Intrinsic value is the future value of an asset. Let’s see how Warren Buffett calculates Intrinsic value and use his formula on Indian stocks

You possibly know I follow Warren Buffett closely. So let me explain today how he determines the stock’s intrinsic value.

Then we will use his idea to create a formula to calculate the stock’s intrinsic value. Moreover, then we will apply the method to a few of my favourite shares in the Indian market to understand with a real example.

So let’s now begin.

What is the Intrinsic Value of a Stock?

Intrinsic value is the investor’s perception of the future value of an asset. Everything has an intrinsic value.

Examples of intrinsic value are a company, stock, bond, gold, or real estate.

The intrinsic value bonds are stable and don’t change much with time.

A government bond with an investment of 1Lakh and after a few years to become 1.2Lakh has a future perceived value of 1.2Lakh. So its intrinsic value for the investor after the period is 1.2Lakh.

Similarly, a ₹500 note has an intrinsic value of ₹500 in India. However, for a traveller in a foreign country, the intrinsic value of ₹500 varies depending on the forex rate changes for the Indian Rupees and that country’s currency.

Similarly, finding intrinsic value for gold or real estate is easy.

Warren Buffett’s Concept of Intrinsic Value?

When it comes to stock, the intrinsic value is not so apparent as other asset classes like gold, bond, or, even for that matter, real estate.

So when the stock’s intrinsic value is not so obvious, we have to estimate it correctly before investing.

The best person to define intrinsic value is none other than Warren Buffett. So here is what he has to say about how he finds the intrinsic value of a stock.

You can watch this video to see how Warren Buffett answers a question about what intrinsic value is.

To sum up what he has said:

The intrinsic value of a stock (or any investment) is the ability of the business to generate cash flow in the future discounted at a rate equivalent to a long-term risk-free government bond.

How I Find an Intrinsic Value of a Stock

We have an idea that intrinsic value is—the critical aspect of applying it to stock while investing.

So now, we have to find the cash flow from the business for the tenure we want to remain invested.

Again, the cash flow doesn’t mean the dividend payment, nor can it be the EPS.

I am not using EPS because it includes depreciation as an expense. However, depreciation is the cash that remains with the company, but taxation reduces the profit.

Similarly, EPS and EBITDA also include depreciation and amortization. The closest ratio to watch should be either EBIT or operating profits.

Operating profits are the best match because of the company’s cash from operations. Then it pays interest based on the debt level (which we like to keep to very low levels).

It pays tax accounting for the depreciation and other such expenses on profits.

Calculation of Intrinsic Value

Let us use the operating profit from the business and an estimate of the growth rate to determine how many years the company will take to generate total operating profits equivalent to the current market cap compounded at the current Indian government’s long-term bond rate equal to 6%.

Here is the Google sheet for the same.

Make a copy of the Google sheet and apply the calculation for the stocks you want to hold.

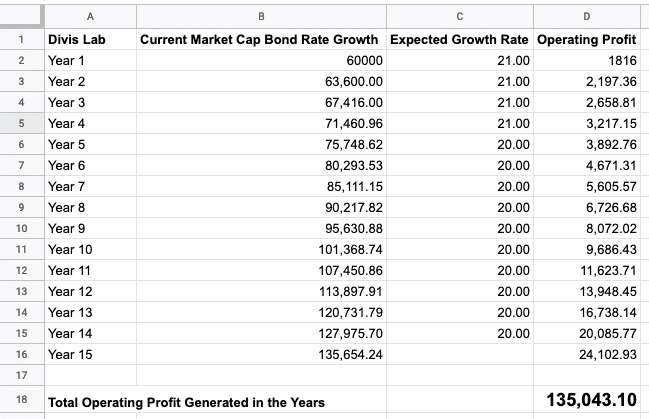

Divis Lab

Let us take Divi’s Lab as our first example. It is expected to be in the high growth phase for the next few years.

Still, the current market cap of 60k Crores will need 15 years of a consistent 20%+ growth rate to generate total profit from operations.

Let’s assume you have 60k Crores. So you want to buy Divi’s Lab.

The profit the business can generate at a CAGR of 20%+ for the next 15 years to make an amount equal to what the government bonds will fetch you in 15 years.

The whole equation has changed considerably because I have invested in the business at even less than 20k Cr market cap.

Pidilite Industries

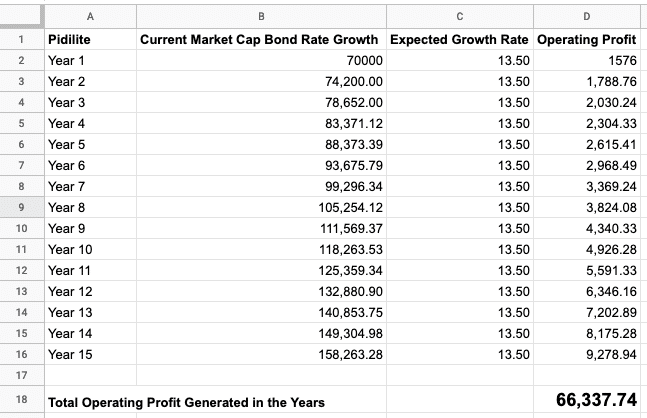

No evaluation is complete without my all-time favourite stock, Pidilite, which is overvalued. So now let us see how based on the above method as well.

Its average growth rate of 13.5% will require more than 15 years to surpass the total operating profits equivalent to the current market cap.

Forget about the compounding of the market cap at the government bond rates of 6%.

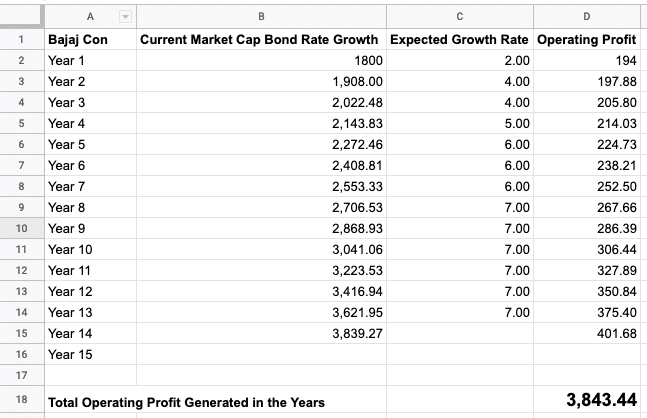

Bajaj Consumers

Let me also share an example of a stock that isn’t in a high-growth phase. The stock is Bajaj Consumers and sees what happens in the above method.

The company is generating good profits but lacks high growth.

So, it only manages a meagre growth of 4 to 7% in the next 10 to 12 years. Still, the company can generate more total operating profits than the current market cap one is willing to pay.

However, the above sheet and calculation were done before the company announced the results on 16 Jul 2020. After that, the company has run up 20%+. So the current market cap is much higher than in my Google Sheet.

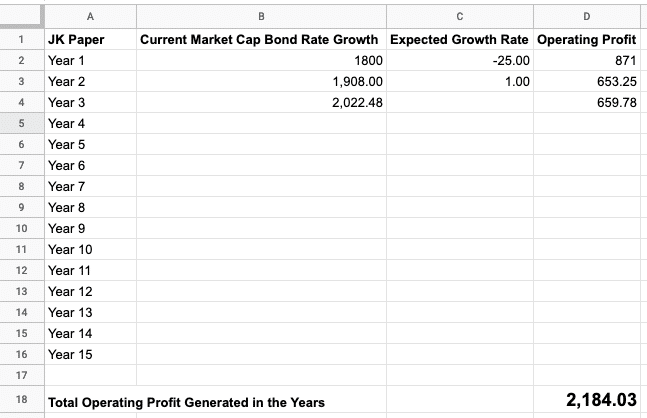

JK Paper

The last example I like to share is a company that is a very neglected sector and has been impacted by Covid-19. The stock is JK Paper.

Schools and colleges are closed. Offices aren’t working at full capacity. So it is expected the demand for paper will reduce drastically.

However, the paper packaging material demand will increase as more and more people will order online.

On top of that, using paper is considered unfriendly for the environment.

So I assume a 25% de-growth in earnings in FY21 and then flat growth even on top of the low base after the de-growth year.

Still, the company generates more profit than the current market cap in the third year.

Modifying the Formula as Convenient

According to Warren Buffet, if the total cash generated by a business is higher than the long-term risk-free government bond return amount at a future date, one should invest in the company.

In the Google sheet, I have used market cap and operating profit.

Feel free to use price and EPS or price and book value.

Anything you consider as a close approximation of the cash generated in the business is the right choice. However, the free cash flow may not be ideal because the FCF will reduce if the company invests the money.

Final Thoughts

The idea is if you have the amount of money equal to 1 share of a company. Should you buy the long-term risk-free government bond or invest in the company and hold it for the same time?

Consider the impact of COVID-19 for the next year or so for growth. I have kept the growth for each year as a variable in the Google sheet. Input value that you consider a reasonable estimate of the company’s growth in the coming years.

The four stocks discussed are only for educational purposes to understand the process Mr Warren Buffett has explained in the video for the intrinsic value and are in no way any recommendation to invest in them.

Dear Shabbir,

It’s a great article.. you explained Intrinsic value with example

in a understandable way.. Great. And Thank you

1)It means for Divi’s lab I need to wait 15 years to get back my money at current market Cap?

And for Pidilite too (with out discount rate) so

here better to invest in Divis lab based on intrinsic value calculation.

2)JK paper Market cap is less so it can cover investment money by two years

My question

A) Does it mean that I should invest only in JK paper if I have only less than 5 years investment time period?

B)You invested in Divis lab 20k Market cap so you got the stock at less price – can we try to make one estimated buy price (entry level) based on intrinsic value calculation so that Ican wait price to correct and buy only once my price level reached

In this way we can make some price level to Entry/Buy price

JK Paper market cap is low and that is not the reason it will recover money faster. The past growth rate and current fall in the market makes sure the valuation of the company is cheap as compared to the profits it is generating.

The total cash that a company can generate in the next coming years is what we ar concerned.

So now assume there is no growth rate in JK Paper and it is at EPS of 27 Rs. Let’s assume it only generates 26Rs. as EPS for next 4 years and still it has generated a total cash of what you are paying now.

Now consider Pidilite, which has an EPS of 22 Rs. So to generate 1400 Rs as total earnings per share it will need a lot more time.

Again, you can’t just do a 4 stock calculation to learn everything about intrinsic value. I have done the same for all the stocks I have invested as well as all the stocks I am tracking.

It helps. So first do that and you will see that many companies have high growth rate and so they can generate cash much faster than some so well known high PE stock. Big example is HUL.

Thank you, what growth rate you expect for HUL ?

The management of the company expect single digit volume growth.

Dear Shabir,

Based on your calculation i can’t find at present share prices is undervalued or overvalued so i made little change based on information provided Zeroda varsity please find bellow that calculation;

this calculation shows Divis lab price still undervalue by 8800/- so we can still buy at higher level..

this only a example so i would like you to check please

https://uploads.disquscdn.com/images/b9bd70601ba073bc9624367eafd80a6c1c2b975c941ebb1e5ed7e7788361deb5.png

If you expect a 20% growth rate for the next so many years, it can be a disappointing story because companies can’t keep on growing at that rate for that long.

20% growth only for ten years.. rest of the year 4% growth only considered. that is terminal value

you did not consider terminal value

Terminal value shouldn’t be as high as 20%. I am considering a point when the total invested value of a rupee is more than the amount generated by the business.

Again

For terminal value calculation, I took growth rate as 4% not 20% (terminal value calculation –10 th year operating profit 9,686.43

discount rate used 6% growth rate 4%) you can see calculation..First 10 years only took 20% growth rate

https://zerodha.com/varsity/chapter/equity-research-part-2/

Shabbir, I have changed again, because

first time we only considered cash flow… now took average capital Expenditure too..

We can buy share price around 3000

range. Calculation attached.

kindly have look on it..

https://uploads.disquscdn.com/images/7af093c57936d2ffa702fa3da1754d931d0a133dc59160a60ebc4739cfd70cdc.png

1) Took cash from operating

activity from cash flow statement and deduct Avg. fixed asset purchases (to get avg. free cash flow)

2)First 5 year took 20%growth rate

3)second 5 years took 15%growth rate

4)Rest of the year 4% growth rate

Looks much realistic now.

Again..

First 10 year only growth rate took 20%

Rest of the time growth rate took as 4%

i mean for Terminal value calculation growth rate used 4% only.. you may calculate it if required

Taking 20% for 10 years is a being over optimistic. Companies have done it but only a handful of them. So I prefer to take the growth slower of around mid teens or even low teens when doing the investing.