A government of India owned companies are called a Public Sector Undertaking or a PSU. Government-owned means central government owned, any state government owned, union territorial government-owned or a mix of them. A company to be classified as PSU, the government must be a majority shareholder.

What is a PSU?

A government of India-owned companies are called a Public Sector Undertaking or a PSU—government-owned means central government-owned, state government-owned, union territorial government-owned or a mix of them.

A company to be classified as PSU, the government must be a majority shareholder. Depending on the central or state government as the majority shareholder, the PSU may be classified as a Central Public Sector Enterprise (CPSE), or State Level Public Enterprise (SLPE)

Why do I avoid Investing in a PSU?

Whenever I see a Government as a majority shareholder, I don’t look into any financial data and avoid it for investment.

The stock selection process that I follow has a hidden parameter to avoid a PSU.

- In Investment Checklist, the PSU fails to pass the operational efficiencies parameter.

- In Fundamental Analysis, the parameter for government policies helps me avoid a PSU.

- In Business Checklist, the government regulations part is to avoid a PSU.

PSUs were doing great in the pre-2005 era, but in my history of being in the market for a decade, I am yet to see any significant performance in government-owned companies.

They don’t Operate Efficiently

If you want to compete in the 21st century, you must be very competitive, and PSU companies don’t have a competitive work environment.

When I had invested in Reliance Power IPO (everyone makes mistakes 🙁 ), BSNL was looking to file an IPO. It was supposed to be the largest IPO in Indian history then. Unfortunately, the financial crisis delayed it, and I doubt it is even considering an IPO as of today.

Air India is one more example where. It can’t even hit the news headlines for anything good.

Source: PressReader.

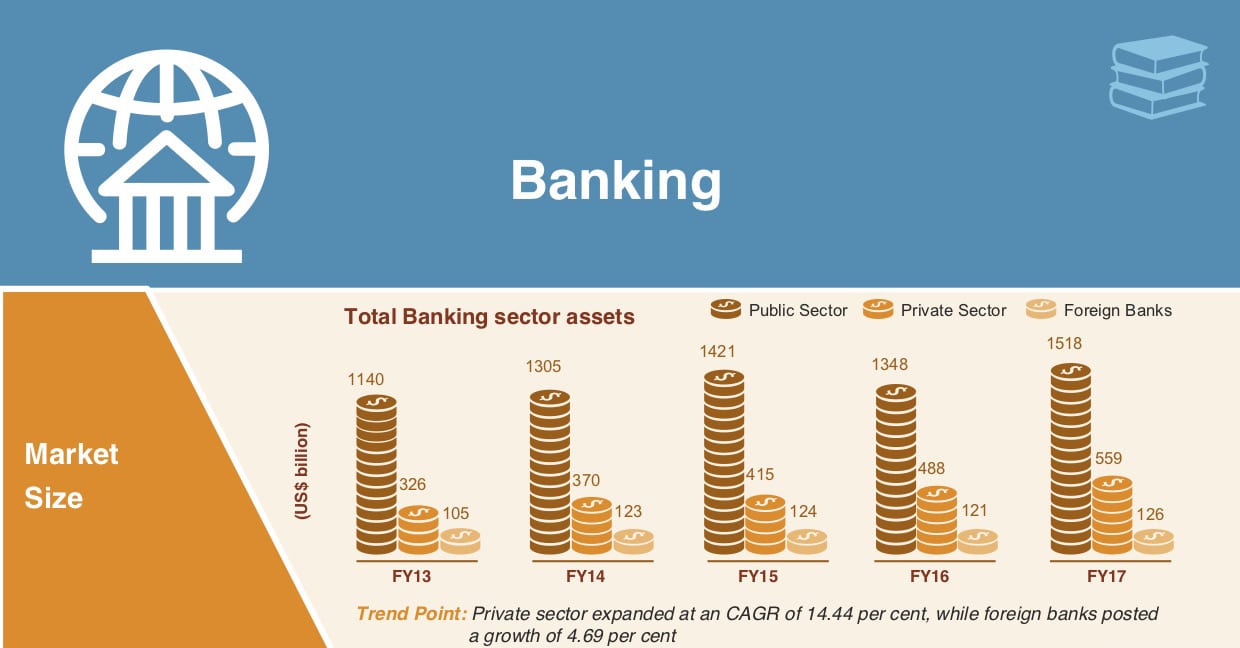

The PSU banks are constantly losing their market share to private banks. Like MTNL and BSNL, it is only a matter of time before they have given up all the market share to private banks.

Source: IBEF Report on Banking sector.

I have chosen the banking sector for a reason.

Banking is one sector where to date, in the history of the past 100 years across any leading market of the world, there has never been a single bank that has gone out of business for its lack of operational efficiencies. It is always because of a bad loan or no loan recovery.

Despite such an advantage for a sector as a whole, the PSU banks aren’t able to participate in the Indian growth story.

In 2018 business needs to re-invent itself with efficient operations with an urgency to grab market share. Unfortunately, I see every PSU lacks the eagerness and willingness to perform.

ROCE is not High Enough

Pick any PSU company, and you will not see the company being able to generate a ROCE of 20% or more consistently for a very long time.

Low Sales and Profit Growth

Compounded Profit Growth For 10 Years, 5 Years, and 3 Years not in the range of 20%.

The only exception is IRCTC, but the valuation of IRCTC is again like any other FMCG company.

And I am unsure if it can double its PE ratio in the future as it is a PSU.

Pay Higher Dividend

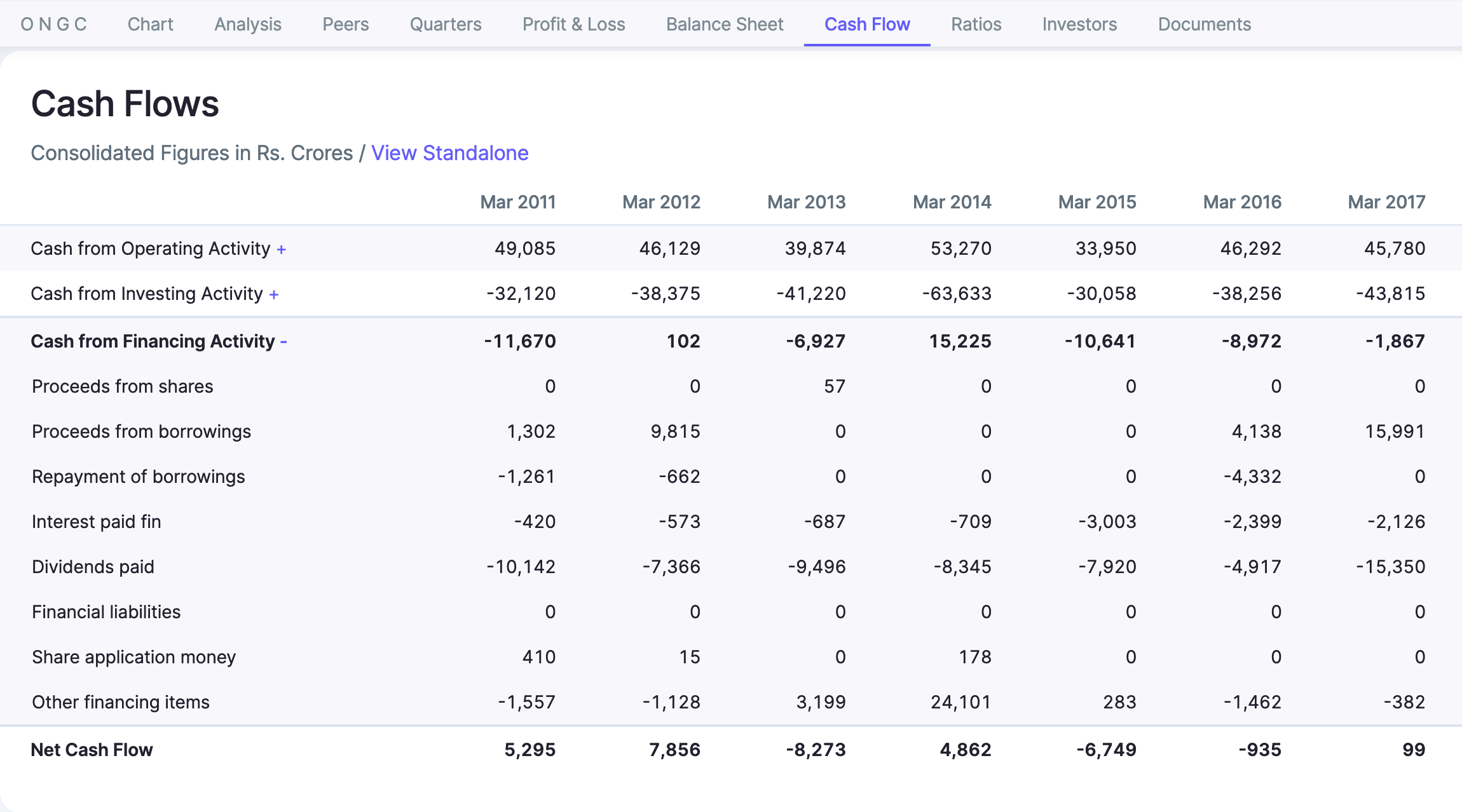

Promoter (GOI) wants dividends from the company, and rightly so.

Moreover, there are instances when the company has taken a loan to pay the dividend. See the screenshot of the Cash flow of ONGC for the year 2017. They took a loan of 15k Cr to pay the dividend.

The dividend yield is not my factor to consider investing. I may have to consider it in the future, but it is not a factor for considering an investment, and I think it is working well for me.

Stock Price CAGR not Adequate

Some may argue they will do well, but then if they have not done for the past 10 years, I am not sure why they will start performing after I invest in it.

I am okay with being bad and missing it.

Not Available at Fair Price

You may be wondering company available at under 5 PE is not at a fair price and how can the company at 50PE be at a reasonable price.

I suggest you read the article How to Calculate Fair Price of Stocks and then apply the same to ONGCs earnings. Even if you expect the PE expansion for the company and if it can be sold at a PE multiple of 20, the current price is still not fair.

More important is the expected future growth for the next decade and the expected PE ratio at which one can sell the stock.

Volatility and Policy Changes

Some policy changes, and the stock price becomes too volatile for me to be able to handle it.

Moreover, GOI always has a volatility factor, making it private. When there is news, the share price jumps but returns to normal as it subsides.

To add more volatility, railway-related news and those stocks are on fire, and if there is oil-related news, they are on the boil.

In short, companies are doing too much price movement for the news than for the earnings.

The Sad Performance of PSUs

Here are the charts of some popular PSUs that are part of Nifty and haven’t performed in the last decade.

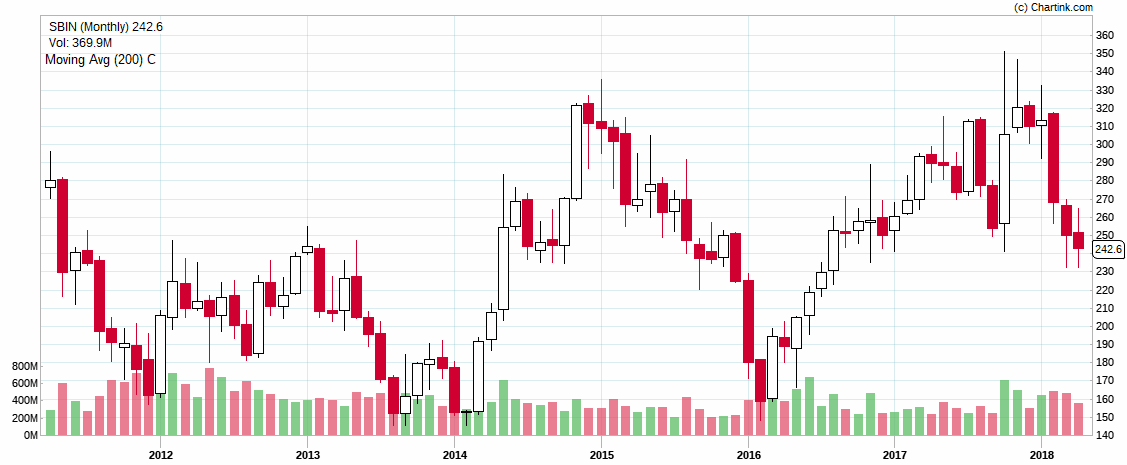

SBI

The performance of SBI in the past eight years.

It is at a time when the Indian banking sector has been growing steadily and is possibly one of the best-performing sectors in the market. As a result, the market caps of private banks have exploded at the same time.

Any SBI branch will have a lot of customers around, but still, it doesn’t drill down into the share price.

An FD in SBI would have given better returns than an investment in SBI for the past 8 years.

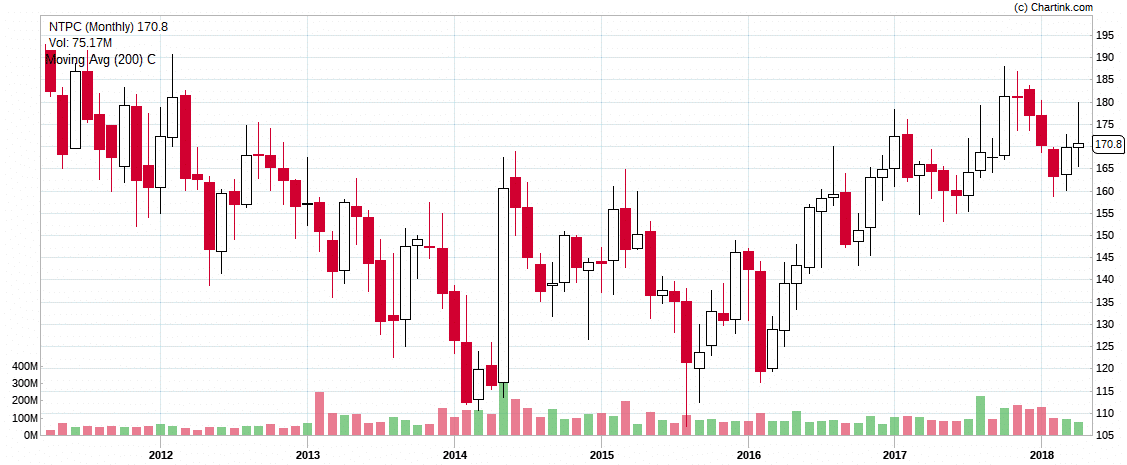

NTPC

A maharatna company is the company’s performance for its investors in the past eight years.

Coal India

The only coal player in India is a maharatna company, yet this is the chart of Coal India.

Charts by ChartInk.com

The performing PSUs

From time to time, some PSU may perform. Those are more for traders than long-term investors or buy-and-hold investors.

The best-performing PSU in the past few years have been HPCL, BPCL & IOC. However, the reason for the performance is best known to everybody. In the last few years, oil prices have seen rock bottom, and the prices of petrol and diesel aren’t controlled by the government, leading them to perform.

The question is can they continue generating a similar return for its investor? Unfortunately, I don’t think they can.

Final Thoughts

I can go on and on with examples of PSU underperformance. But, as an investor, the certainty of non-performance from PSU has made it easy for me to avoid it. Do you invest in PSUs?

correction “the old prices have ” i think it would be Oil.

Yes true. Thanks for pointing it out and has fixed it now.