As per recent regulatory developments, from January 1, 2011, KYC (Know Your Client) is mandatory for investors wanting to transact in Mutual Funds, regardless of the transaction amount. This means you will not be able to process any fresh MF purchases post January 1, 2011, unless you are MF KYC compliant as per CDSL Ventures Limited (CVL) norms.

As per recent regulatory developments, from January 1, 2011, KYC (Know Your Client) is mandatory for investors wanting to transact in Mutual Funds, regardless of the transaction amount. This means you will not be able to process any fresh MF purchases post January 1, 2011, unless you are MF KYC compliant as per CDSL Ventures Limited (CVL) norms.

So you can always ask your broker’s to get you forms and submit them for your KYC but as there are no mutual funds fees they may not be very helpful at times and so it is better you also know how you can get your KYC done yourself. The process is really very simple.

1. Get the Form

The KYC application form is available at the investor service centres of the Fund and CAMS or at any designated ‘Points of Service’ (POS) of CDSL Ventures Ltd. or can be downloaded from your broker, Advisor or AMC. I have uploaded them here for you to download. (KYC Form Individual / KYC Form-Non-Individual).

2. Documents

Documents required to be submitted along with the KYC application form are:

- A recent passport size photograph

- PAN card copy

- Address proof (Recent bank statement will work but if you have get your bank statement in email you need to visit your bank branch to get an original one.)

Once you have the documents ready submit at CAMS Online office in your city. You can find the address of your CAMS Office here. Make sure you carry the originals along with a xerox copy of the documents because at times they want to check with the originals.

3. Verification

After verification of the KYC application form and accompanying documents, investors will receive a letter certifying their KYC compliance. They normally give you the letter in few hours to a max of 24 hours and there is no charge for this verification.

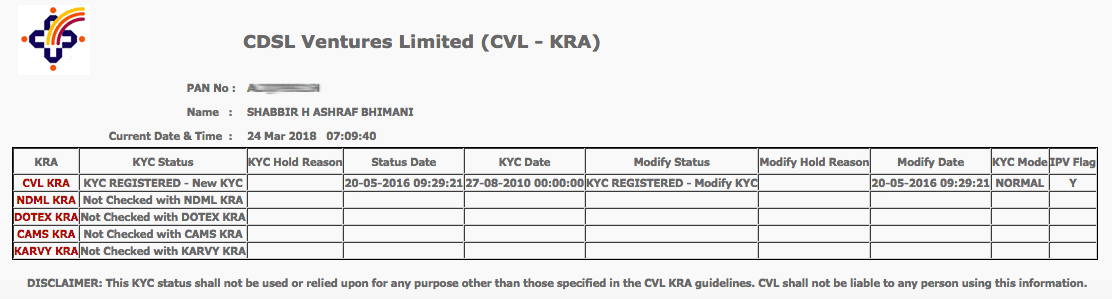

You can verify your KYC status online here. The day you submit your form your status should be processing and once it is processed your status should become VERIFIED.

Actually KYC need not be done at your broker’s end but some online system does not accept order if they don’t have the data in their own system and so it is better to get that done as well. Once you have the letter you can send that letter’s copy to your broker to update. For ShareKhan you have to Fax the verification letter to 022-24982626 (Details here).

I hope this helps my fellow investors. Share your feedback in comments below.

Update: Links and other details updated 24th Mar 2018.

Paytm kyc online apply

No

I have registered for CKYC and received the KYC ID number suggesting that KYC updated, but when i check with my PAN numer it says KYC is incomplete

verification link is changed now. Please update the article with the below https://www.cvlkra.com/kycpaninquiry.aspx

Thanks for letting me know and the link has been updated.

I want to register for zerodha commodity account but they are demanding that your kyc registration is mandatory. But i dont want to open mutual fund account.

Myself Thomas P M from bangalore.

In my pan card database record my name states as Pulavelil Mathew Thomas(initials are expanded ).

But actually in all documents like pancard hard copy,sslc,voter id and all it is

THOMAS P M which is correct.

During kyc registration can i provide driving license for person of identity for name?

The name in pancard database is in expanded form and name in pancard hard copy is

in correct form.

I got to know the name is in expanded form in pan databse when i done pancard data search online.but in physical copy it is correct.Will it make any problem for KYC registration?

I dont have any issues to submit pancard.But name should be taken from physical copy of pancard or drving license.I am struggling with difficulty

Please help me with neccessary details..

Awaiting your precious reply.

Thomas, this blog is not the right place and I am not the right person to be able to help with the exact issue and if the short or the long form of the name may be used. Even you may need to be doing some affidavit.

Understand that KYC is for a PAN number and the details submitted in KYC is not used directly from what you have submitted. Once the PAN number is KYC complaince, all should be good for you to invest in mutual funds.

So you should be fine with the short or long form of the name and when you use the KYC to open account with broker, you can use the right spelling of your name.

Still this is just my assumption and please be certain with the people who are taking up your documents and don’t consider this as the final advice.

I have demat account from ICICI . Am I KYC compliant as I want to buy direct MF online.

Not sure because if you opened your account recently then yes you could be KYC compliance.

yes.. I opened it recently (a month ago)..

Should be ok then but better to confirm with the broker if they have submitted everything needed for MF KYC investment.

Once you have everything, do the investment directly instead of using the broker. Read https://shabbir.in/mutual-funds-direct-plan/

Thanks for the help

The pleasure is all mine.