What is Portfolio Churning and Why I Churned My Portfolio in 2021 and what is one key Lesson I Learned when churning my portfolio?

What is Portfolio Churning?

Portfolio churning refers to the changes investors make to their portfolio, keeping in view the market conditions. It includes buying and selling the holdings and deciding to keep holding the investment to give a better yield.

The churn mainly depends on the market’s view as a whole or view of the underlying business shortly and for the long-term.

As an investor, you invest in a company with a specific view of the market. We are assuming all the companies we invest in pass the investment checklist, business checklist, and fundamental analysis.

Still, you will want to move your investment based on your future outlook.

Page Vs Marico Example

Let me share the example to make things more straightforward. Again, this helps you understand the churning process in the market, and neither of the stock is a recommendation.

Pages Industries and Marico both will pass all the checklist for investment. Valuation wise both will be overpriced, but we cannot put the price into it for our sake of understanding.

When both companies are great companies to invest in, I decided to invest in Marico over Page Industries amid the Corona pandemic. My understanding of the situation was that people would consume more cooking oil than innerwear or swimwear.

Now the lockdown is opening up, and things are changing. People in the lockdown have been wearing their pyjamas more, so they buy more of Jockey than Saffola.

So when my worldview towards these business has changed, I may churn my investment towards such companies. Again, I am not adding more to Page Industries, but this is just an example to help you understand Portfolio Churn.

Amara Raja

The day Tesla entered India, I was sure to move out of my investment in Amara Raja Batteries.

I always believed every car requires a lead-acid battery because the battery pack in the electric vehicles will replace the fuel tank. So, to start the vehicle, they will still need a lead-acid battery.

Still, each Tesla car has a lead-acid battery. However, they are working on replacing the lead-acid batteries as well.

Now my view has changed, and I like to avoid companies and sectors that will be disrupted if they don’t reinvent themselves.

Portfolio Turnover Vs Portfolio Churning

Portfolio turnover is for the mutual funds, whereas individual investors turnover in the portfolio is termed as portfolio churning.

However, both mean the same.

Portfolio turnover is represented in the percentage term, the frequency at which a fund’s holding is either bought or sold. The turnover percentage is the total asset under management that has been purchased or sold in the past year.

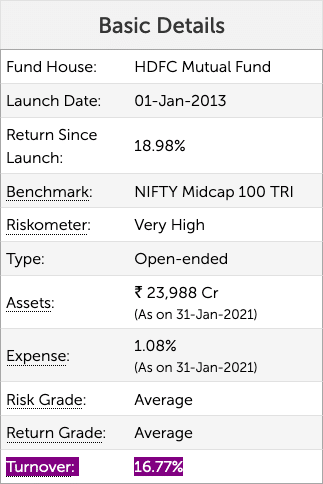

As per ValueResearchOnline, the HDFC Mid-Cap Opportunities Fund has a turnover of ~16%, which means they have bought and/or sold 16% of the total asset in the past year.

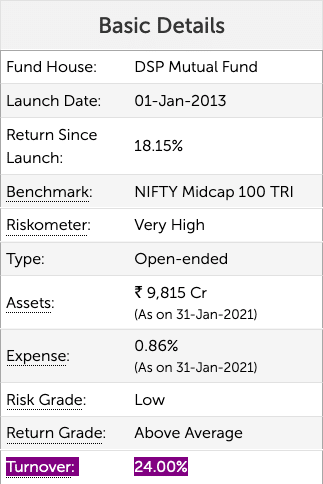

Similarly, the DSP Midcap Fund has a turnover ratio of 24%.

The turnover rate is essential for potential investors to consider, as funds with a high rate will also have higher fees to reflect the turnover costs. However, if the turnover is high, it also means the fund is active in moving to higher performing sectors and stocks.

Portfolio Churn Can Mean Short-Term Thinking

If you start to churn your portfolio, you can fall into the trap of short-term thinking.

In the first 60 days of 2021, I had one of my most significant churn to my portfolio. The worst part of it is to fall into the trap of thinking in terms of months and quarters, not years and decades.

Assuming Marico and Page both are great companies and will do well in the next decade, but one may do well in some years, and others will do well in others.

However, it doesn’t mean I have been thinking short-term only. I also thought that a company where I am invested might be subject to being disrupted as well. Time will tell how the company re-invents itself, but I will prefer not to take the risk of assuming they will make the right choices in the future.

But, if you are churning the portfolio a little too much, beware. Are you thinking a little too much for the next few quarters than the next few years?

If you follow any business news channel, you will be tempted to invest in the metal and cement sector for sure, and if you churn the portfolio based on the news channel, you are thinking short term for sure.

Final Thoughts

Buy and sell when you think you need to based on your view of the market, sector, and the company’s underlying business.

Avoid unnecessary churn because it can mean you end up paying a lot of transaction fees and taxes.

Avoid short-term view and be in the market with a long-term perspective for the business. Let the team you have invested in build wealth for you.

The input on portfolio churning in Stocks is very relevant. However, tracking portfolio turnover in MFs is, in my opinion, overthinking the problem. Once you have selecetd an AMC and from that you have selected a theme, (LC, MLC, SC DAA) etc, its prudent to just track the Net returns generated. These returns are post Expense ratio and the higher one is more beneficial to the investor. If a manager/ fund house can generate higher return for you by following a higher churn, then i say – more power to him. Its his investing style (momentum based?) and i am happy to benefit from it

Exactly but one should also know that if there is no turnover in the fund, chances are the performance may not continue and that is the whole point in understanding the process.