It is that part of the year where I pick from all the articles I have written in 2018 the one that my readers preferred reading and sharing with their friends the most.

What is Free Cash Flow & Why It is Important for Investor to Consider?

What is free cash flow or FCF? How Free Cash Flow is Different from Operating Profit? What is Ideal Value of Free Cash Flow? What I Prefer in companies cash flow?

Index Funds Vs Mutual Funds – Why It Makes Sense To Invest In An Index Fund?

How Index funds differ from the traditional large-cap fund? Why it makes more sense now after the new SEBI guidelines to invest in an index fund over a large-cap fund?

The 3 Attributes of Stock That Fall the Most in Corrections

The current market correction has taught me some good lesson I like to share with my blog readers. And ask your best investment lesson learned in this correction?

Why I Don’t Trade in Futures, Options or Commodities?

Why I don’t trade in futures, options or even commodities and forex and why I think every retail trader or investor should avoid it for the same reasons

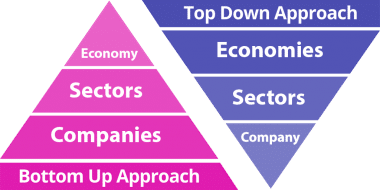

What is Top Down Approach and Bottom Up Approach to Investing?

The top-down approach identifies the broadest option first and drills down to the sectors and companies. With the bottom-up approach, it’s the companies first.

How I Value a Stock For Investing Using Financial Ratios?

One has to identify at what valuation one is comfortable investing and then invest in the right stock at the right price and for the right time to make the most returns from the investment.

What is ROE or Return on Equity?

Answering all ROE questions: What is ROE (Return on Equity)? What is the ROE formula in very simple terms? Why High ROE Isn’t Always Good?

What is OPM – How It Is The Most Vital Ratio To Evaluate a Business?

What is OPM? How to use OPM to invest in the right business? Why OPM is the vital ratio to consider when investing in businesses with a similar product line?

Earnings Yield – A Double Edged Sword

Earnings yield is the ratio of the earnings per share or EPS divided by the current share price. It is inverse of the price to earnings ratio

- « Previous Page

- 1

- …

- 15

- 16

- 17

- 18

- 19

- …

- 56

- Next Page »