How profit from short term investment i.e. investment for under 1 year in equity market can still save lot of tax that may need to be paid otherwise.

Credit Cards Vs Debit Cards

Comparing credit cards over debit cards and help you understand why credit card scores highly over a debit cards and if you can control impulse purchases, how credit cards is one of the best financial instruments.

Why Market Decline Despite Good News?

Why Nifty and Market Tanked On May 16th 2014 and What You should be Doing in the Near Future Future.

FAQ’s about Systematic Investment Plans or SIP

Market is quite high currently but can I start SIP now or should I wait for the dip in the market to getting started with SIP. And I am sure this is a question of many and so let me not only answer this question but also some of the frequently asked questions which I found are being asked very often in most of forums online.

7 Instances When You Should Avoid A Credit Card

If you cannot avoid these 7 Points when using your credit card, you should avoid the credit cards totally.

How Easily We Indians Neglect Emergency Fund?

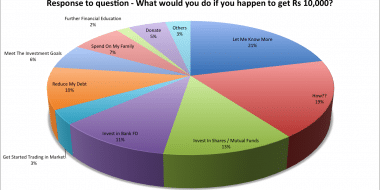

Readers Response to the question What would they do if they happen to get Rs 10,000 as well as answering the most asked question of How to Make that Extra 10,000.

Best Strategy To Save Tax Under Section 80C

The best strategy for saving tax is to invest with minimum locked in period and save maximum tax with minimum possible to zero investment.

Recording of Google hangout QnA Session – 8th Feb 2014

Did you miss the live question and answer session? You can still watch the video and get answer to the questions discussed.

How to Choose the Right Investment Oppurtunities To Building Wealth

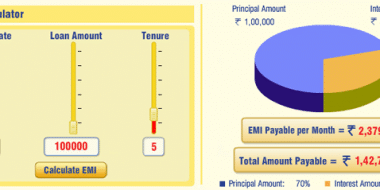

Answer to question – I can make X% in FD and am able to grab a loan at much lower interest rate. Should I Opt for it?

Being Debt Free: The 5 Point Strategy For Every Indian To Getting Out of Debt

Are you concerned about your Debt? If you are, that’s the right thing to be doing but now let me tell you how you can strategically come out of it.

- « Previous Page

- 1

- …

- 33

- 34

- 35

- 36

- 37

- …

- 56

- Next Page »