Everything to know about Higher Top Higher Bottom Chart Pattern – What it is? Why does it work? Is it Only for Traders? Investment Examples

Higher Top Higher Bottom pattern is one of my favorite chart patterns for investing. I am going to share why I love investing with higher top higher bottom formation patterns in some of my forever good stocks.

So without much ado, let me begin explaining one of my all-time favorite chart patterns.

What is Higher Top Higher Bottom Chart Pattern?

In the market, there are traders, investors, and speculators. Furthermore, there are short-term traders, swing traders, short-term investors, etc.

Each of these participants reacts differently to the news in the market. So the market oscillates between demand and supply.

A shortfall in demand means the stock forms a peak followed by a shortfall in supply means the formation of a trough.

If the high of a peak is higher than the previous high of the last rise and the low of the trough is higher than the previous low of the trough’s, it is called a higher top higher bottom chart pattern.

Why Higher Top Higher Bottom Forms in the Market?

The real reason why I like a higher top higher bottom pattern when investing is that it helps me understand the sentiment of the market participants clearly and concisely.

Let me help you understand the same with an example.

Assume we have only three market participants.

- Swing Traders – Taking a position for a week.

- Positional Traders – Taking a position for a month.

- Investors – Taking a position for a year.

So now we know the demand will be highest in the First week of Jan of every year because each of the market participants will like to take a long position in the market.

The next higher demand will be in the first week of every month because that is when two of our participants will take the long-positions.

The last is every Monday when the swing traders will take a long position.

I know this is a hypothetical scenario, but it will help understand why a higher top higher bottom pattern works.

A stock forms a peak, and this is when investors think the stock is overvalued. So they offload, creating a peak.

Now traders even start shorting it.

Now the new set of investors think the discount from the top is good enough for them to accumulate, forming a higher low.

As investors accumulate short coverings takes the stock even higher than the previous high.

Again, the next set of participants comes in to offload, and the process continues until there is some news, which creates more sellers than buyers.

Is Higher Top Higher Bottom Pattern Only for Traders?

No, I don’t think so. I think it is one of the best patterns for investors who want to invest even for a decade.

The reason I think it is the best pattern is that as you accumulate, the stock price moves higher and so you are always in profits with your investment.

When I am in profits with my investment, I always feel like I am doing good with my buy. The reason is, I still think I am learning to read the annual reports and balance sheets.

So when the stock price moves higher, I feel like the investment is based on the right factors that I am currently looking at.

Moreover, the way I pick and choose stock, they are more likely to be a well-discovered story, and so they will have their fair share of run-up already.

So I prefer to buy-high sell-higher over buy-low sell-high. I like to be investing alongside the trend than invest against the trend and find an undervalued stock.

I like to invest in growth stories, then value picks, and so for me, the higher top higher bottom is a much better choice of a pattern than anything else.

Real Life Samples of Higher Top Higher Bottom Pattern?

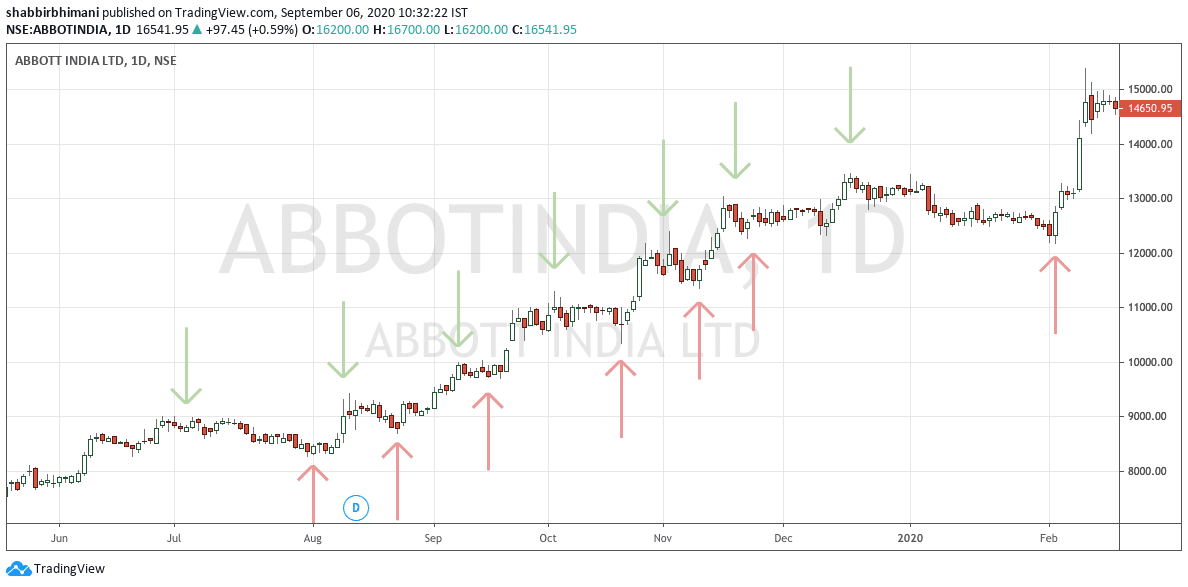

Here is the Daily chart of Abbott India.

Investment at any point in time in 2019, and you know it is a matter of a few months when the stock will have some good news coming and will rally part the previous peak.

Some product launch, good results, etc. are some of the triggers that will help stock surge past your buying price in the next few months.

You are always in profits with your investment, and as the company has stable growth of earnings and EPS, you are bound to make a decent amount of money investing in it.

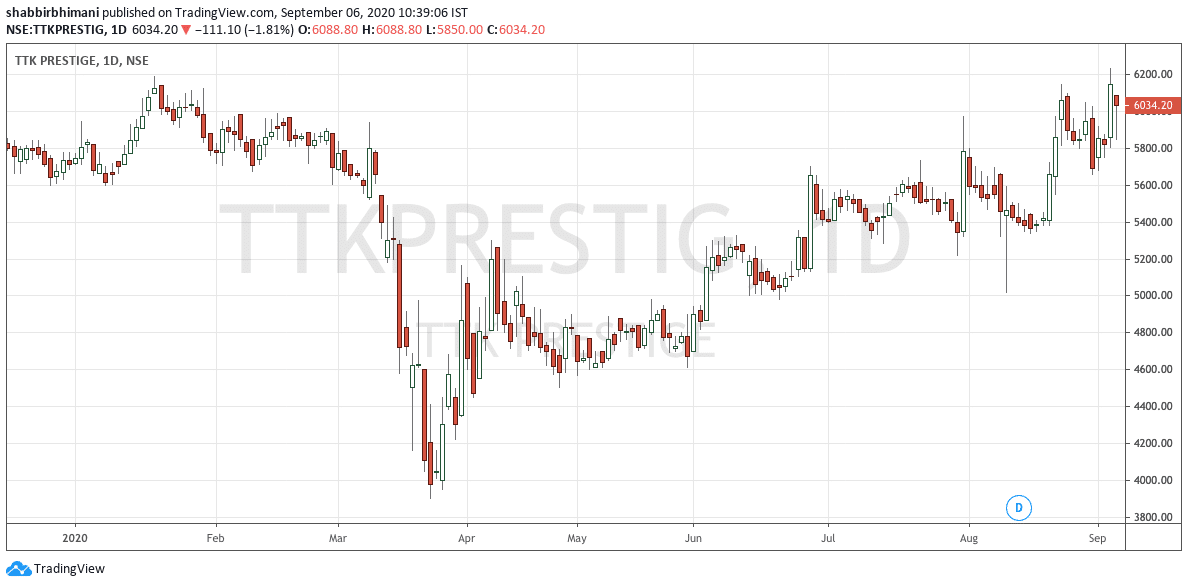

Similarly, In TTK Prestige, after the market fall in March, there was a concrete base formation between ₹4600 and ₹5000, followed by a higher top higher bottom.

Final Thoughts

When you see a higher top higher bottom pattern, the best way to invest in the market is to split the amount of the investment in 3 to 4 tranches and accumulate in the dips.

For traders, as the low moves higher, the stop loss keeps trailing higher.

Often, for my style of investment, I prefer to average up vs. average down, and so higher top higher bottom is a much better choice of investing at the right price.

However, as a general note, the stocks discussed in the article aren’t a recommendation but are for understanding the chart patterns with real examples.

does this line means you trade in options “When I am in the money with my investment”

Lastly currently how many whatsapp group you have two or one. the buyers of your ebook do they get added in any premium whatsapp group or telegram group or google FB group.

Thanks for the Article.

The WhatsApp groups I am part of aren’t because of eBook. The eBook / book buyers become part of the DIY Community. We have outgrown the WhatsApp group max people limit. It was started sometime back but not that active anymore.

about dis ..does this line means you trade in options “When I am in the money with my investment”

No I don’t . In the money means in profit.

I have edited the article to avoid confusion.