How I generate investment ideas in the Indian growth story, what sectors I totally avoid along with the tools I use to find that perfect investment opportunity.

The process I follow to come up with the stock ideas for investment doesn’t use any of the screening software.

Yes, it is so true.

Screening of stocks with ROCE higher than a number or PE less than a certain number doesn’t convince me.

The process I follow to screen stocks is based on my investment philosophy to invest in the India growth story. Being an Indian residing in India makes it a lot simpler.

The best stocks will be the one that you are using in your day to day life. So my stocks are often (not always) based on products or services I use.

Those companies will not be available for cheap in the market but if you use technical analysis, you can buy them at really good levels.

How I Generate Investment Ideas?

I prefer investing in companies product I use. Once I know the company name, I try looking for other companies in the same business or listed companies with the same product line.

Let me share a story about Jubilant Foodworks to understand the process.

Like any other kid, my daughter is very fond of Pizza and anytime you ask her choice of eating out place will be either Dominos or KFC.

KFC and Pizza Hut are operated by Sapphire Foods India Pvt Ltd which is a private limited company and isn’t listed on Indian stock market but Dominos is operated by Jubilant Foodworks and is listed. This is how I stumbled on Jubilant Foodworks stock idea in my open portfolio.

As I checked the peers of Jubilant Foodworks I found that Westlife Development is also a listed company that operates McDonald but it isn’t profitable for a few years now and operates only in 2 regions in India only.

So we have very few choices when it comes to investing in a good food chain business in India.

Similarly when I moved from Kolkata to Surat. The interior work of my newly bought flat in Surat was on. This is when I realized that I had very few good alternative to Fevicol and so Pidilite Industries was added to my list of stocks to invest in.

- Britannia Industries because the choice of creme biscuit in my family is Bourbon.

- Zydus Wellness because there is no alternative to Sugar-free Natura for my mom though she never prefers it.

- Page Industries is because once I moved over to wearing Jockey, I am hooked to it.

- Nestle because of Maggi and the kind of impact it has on my kids. They wanted me to buy out all the banned Maggi noodles.

- V-Guard because when I went to buy a geyser, I found good reviews about V-Guard geysers and their other products.

- Havells because of CrabTree switches that I use and more importantly the kind of innovation they are doing.

- Marico as Saffola and Parachute are part of our daily life.

And the list can go on and on but the idea is, if you prefer to be investing in Indian stocks, opt for the one that you use on a daily basis or you can get good feedback about its products from it’s genuine and unbiased customer.

The process has its own flaw and I may find an awesome company to invest but couldn’t add it to my investment list because either it isn’t available in Indian markets like Parle Biscuits or Amul or if it is available, offers a very high premium like Page Industries or Nestle.

I still prefer looking for companies like this or in a similar business to what we use on a daily basis.

Disclaimer: This is not a recommendation of the stocks discussed but just a process I use to find good Indian consumption story stocks.

After the initial idea of what kind of business I should be investing in, I try to reject companies that aren’t a good fit for my way of investing.

The Rejected Ideas

I prefer investing in companies where they have pricing power either with unique products or with constant innovation and invests in research and development.

I also focus more on companies that directly sell to customer aka B2C (business to consumer) over B2B (business to business) because B2C companies can easily pass on the price hikes to the customer.

So now I trickle down all my stock ideas first through my investment checklist and then through the basic of fundamental analysis.

So with very little effort, I can weed out so many companies.

The checklist at times weeds out some good companies as well but I am fine with it as long as it is full proof.

The best example of the company weeded out is ITC. It is one such company which is part of my family’s daily life in more than one way. Sunfeast biscuits or Aashirwad Atta or Classmate books but I avoid investing in it for more than one reason. It has tobacco business which has too much of a government intervention. Apart from tobacco, I also tend to avoid group companies as I lack the expertise to understand how each business growth is and ITC has so much diversified products from hotels to FMCG that I avoid them.

Sectorial examples of companies that I avoid:

- Aviation stocks are an avoid because there is nothing a company can do retain it’s customer apart from offering them lower price.

- Bharti Airtel is an avoid even though I use them for my mobile and is part of my daily life. Fierce competition in the telecom sector and no pricing power. Pretty much operates like an aviation sector now.

- Real estate sector because of the unaccounted money that customer pays to a company. We may argue it isn’t but we need to argue is enough for me to avoid the sector as a whole.

- Power generation companies even when CESC was part of my daily life in Kolkata because they have to sell their product (power generated) at a pre-determine price set by the Government.

- Oil sector again for similar reason of no pricing power and has to be sold at a pre-determined rate and heavily taxed.

So once I get the stock idea, it passes through my first few mental checkpoints. Once I am convinced, I move over to tools to analyze numbers real quick.

Tools I Use

I prefer the following sites in the following order to speed up the process of rejecting a stock.

Screener.in

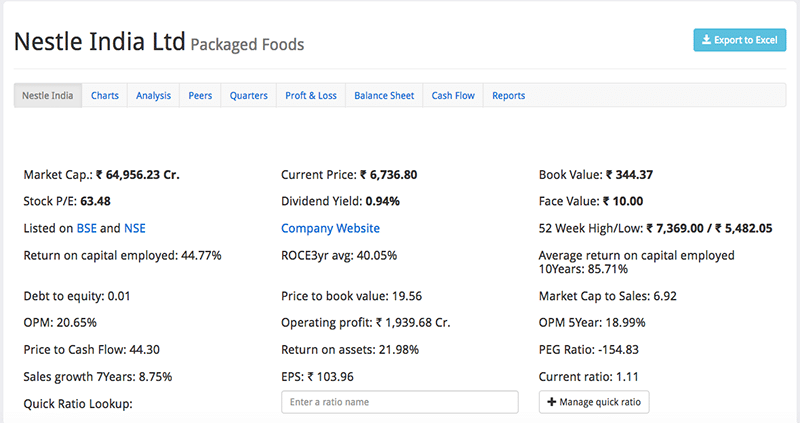

I use screener.in to get some of the quick parameters about the companies that I look for. Here are some of them I have them right in front of my screen.

If you are a member, you can customize to what ratio you want to be seen right away.

Any company that has high debt, or bad ROCE, or very low-profit margins is an avoid for me right at this point.

- Welspun India when it fell from 100 to 50, I was tempted but avoided because of its high debt.

- Aditya Birla Fashion at the time of DMart IPO was weeded out because of high debt and very low-profit margin right away.

Company Website

I head over to the official company website to see what kind of products they make and how well they are able to price those products in the market.

Profit margin gives me an estimate of what kind of product pricing power a company has but the website will provide product information so I can analyze who all are their competitors and how a company can price the product better than others.

Once I look at the companies website, I can also learn about the management, their business history, awards and how long they have been in the same business.

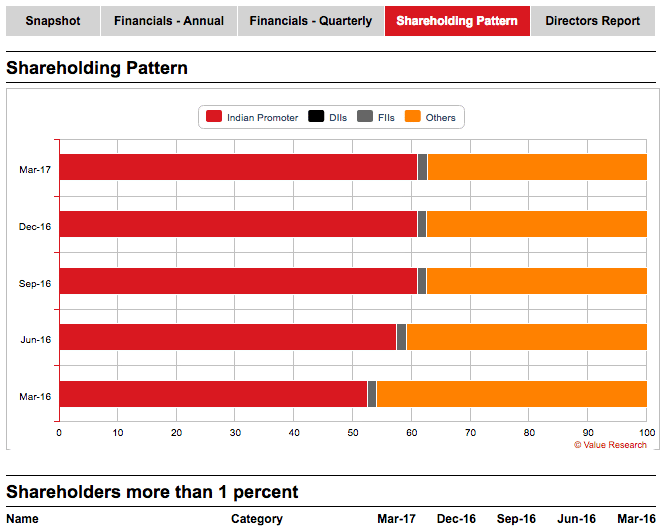

ValueResearchOnline

Once they pass the screener test, I move over to ValueResearchOnline to see the shareholding pattern. Are promoters holding good chunk of the company or not.

Normally I tend to avoid companies where we have very low promoter holding.

There is no general rule like I avoid companies with promoter holding of under 50% but if I see promoters holding decreasing over time, or if promoters have very high number of shares pledged I tend to remain cautious about it.

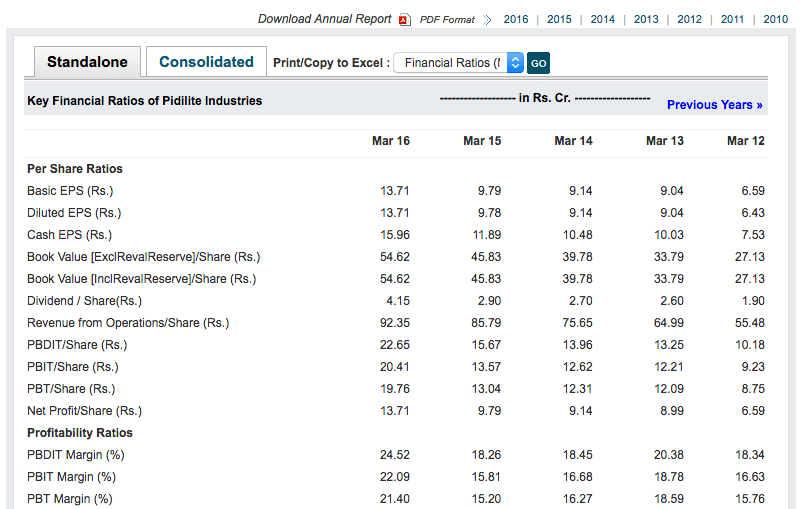

MoneyControl

Then I move over to MoneyControl to check up some of the ratios over time.

Screener only gives us that ratio for the current year but I prefer to see how was company debt or ROCE was in last few years. If it is higher now, is it reducing? Is profit margin getting better or worsening. How has the ROCE been for the company in the past few years? Is it getting better or not?

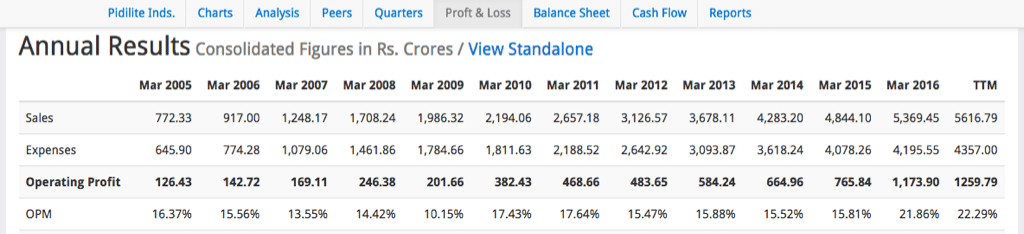

Screener and Excel

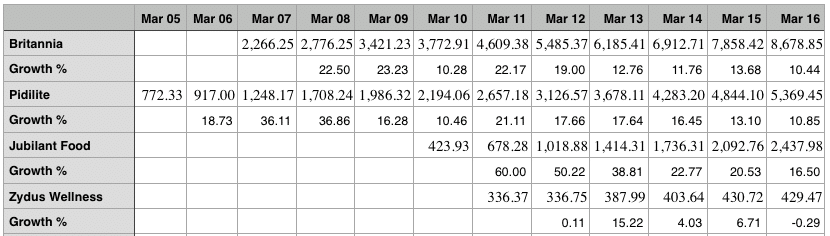

Once I am convinced, I do one more check of Screener to see the sales numbers and growth.

I copy the elements and put them in Excel to see what kind of Growth Numbers they managed for over the years.

From the above growth numbers, we can clearly infer why Britannia and Pidilite are doing so good (growing sales) whereas Zydus Wellness is kind of steady (steady sales) and Jubilant Foodworks (market expects very high growth rate) is weak.

Peer comparison

Everything may be very good about the company but if there is more than one company in the same sector or niche or if you have more than one company in your list to invest, a comparison is inevitable.

I often use price to earnings ratio or PE and how many times the book value the company is available for.

I remember in June 2016 on the BREXIT day I purchased Britannia Industries. Nestle was on my investment list as well and it was around 6000 but was still trading close to 100 PE majorly because of Maggi issue and not because of the crash in the market due to BREXIT. So I wasn’t convinced to buy Nestle at such high PE multiple.

Similarly, when I purchased Pidilite, I had Marico and Page Industries in my investment list but their PE was much higher than Pidilite.

We have to deal with the fact that so many investment opportunities and so little money. One can argue comparing PE of companies in different sectors may be wrong but it works for me.

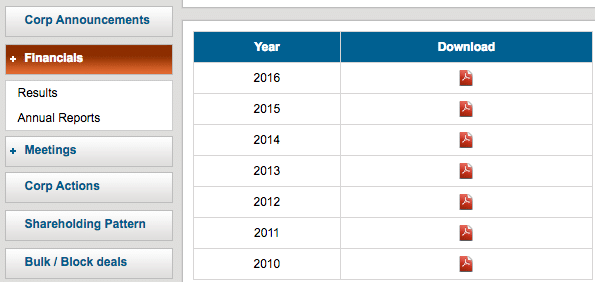

BSEIndia for Annual Reports

Once a company passes all the parameters, I head over to BSE and check out previous annual reports to see what company predicted 4 to 5 years back and how well they manage to accomplish them.

This is the most important part of my analysis where I analyze the company in lot more details. This check will make sure if I invest in the company at all or not. I look at many things like:

- What company promised in the past and how they managed to deliver it.

- What company did in the not so good times or when the share prices kept falling or sales were down.

- How transparent they were when things were bad and what kind of interview was published on moneycontrol.com.

- What measures it took to come out of the bad phase.

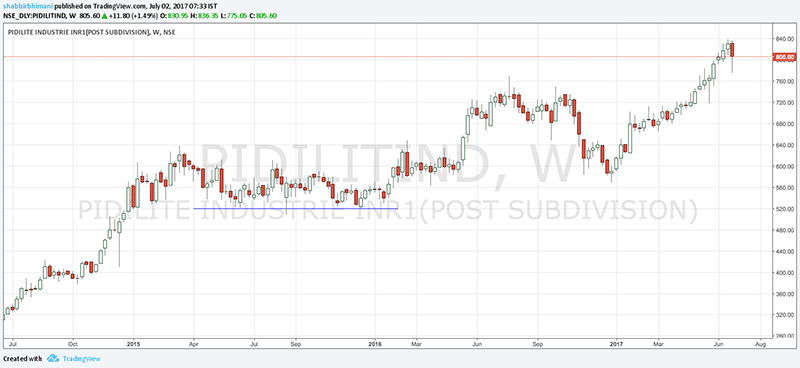

Technical Analysis

When I pick good stocks, I have to make sure I buy them at the good support level of the market and this is when I use technical analysis and price action indicators to buy the stock at the price that makes me comfortable.

I have stop losses for this investment as well but those stop losses are deep and I am yet to see any company in my list execute that.

- Nestle because of Maggi saga never breached 5000 though I was hoping it will retest its support of 4600 which was kind of my stop loss levels at that time.

- Jubilant Foodworks is very close to the stop loss of 700 and 500 and I don’t see it breaching levels unless there is an issue with the business going forward.

Final Thoughts

Any stock discussed is not a recommendation for investment but the process of identifying good stock is. Build your own process so you can identify good stocks to invest in.

If you drive a Maruti car, add it to the list of stocks to invest or if you prefer driving bullet and know about Eicher Motors, add the stock to your investment list.

Keep your eyes open and you will find investment opportunites everywhere. Don’t just look for them from stock tippers.

great….may I check how to find 52 week high/low ‘P/E’ ratios of companies….so that we can find which are the top 5 companies trading at lowst 52 weeks level

Sure why not.

Thanks Shabbir…could you share the relevant website where we can find the same- 52 week high low ‘p/e ratio (not price per share)…looking fwd.

I am yet to find a site that shows that data.

Wonderful article Shabbir. I was just thinking that some people have still kept aside 20% cash aside. Can we do this exercise for the markets now to find out example of stocks.

This is always doable. Just invest in stocks where you are one of the customer and you will always know how you see them.

Excellent ideas. Thank you.

Shabbir ji – you have explained the stock selection process step by step in great detail. It looks quite simple but I think most, if not all, of retail investors will not be able to follow this in practice.

Can you analyse and recommend various pms schemes being offered by several investment houses. Do you have any comments about Demetre debt pms from Karvy. Thank you – Baldev Sood

PMS generally is a service that works for your broker and not for customer. Read https://shabbir.in/sharekhan-pms-review/

Shabbir… as usual… you are brilliant and this article is another feather to your cap… your strategy is very result oriented but we just try to miss this and follow someone else for our investment decisions… this strategy tells us that patience and picking right stocks can really help us build wealth and other instruments like intraday, F&O are real avoid because of the uncertainty and insecurity… many heartfelt thanks for sharing this!!!

Glad you like it and completely agree with you on avoiding F&O and intraday. I don’t trade in F&O or intraday and being a blogger, I often get queries surrounding them where my answer is always that I avoid them.

Dear Shabbir Jee,

Your article is very helpful. But due to lack of time i am unable to do such type of research. So i am looking for a stock adviser who can guide me regarding stock picking, providing regular feedback & exit timings. Can u please suggest some advisers & the fees they charging for medium to long term stock suggestions.

No I don’t suggest any stock advisory services Prabhat Jee.

Fantabolus Article .Very Lucid.

What about Maruti ?

Cheers! Shabbir Bhai

Maruti is in my list of stocks to invest but I often miss an opportunity to get in Maruti. I had plans to enter at around 4800 but decided against it in hope I will get at 4200 but even 4750 never came.

great article…will read in depth soon.

Thank you.

B2C companies can easily pass on the price hikes to the customer.

Great Article Shabbir.. Very simple and easy to understand … Appreciate you being so open with your strategy …

The pleasure is all mine Sathish

Thanks a Lot Shabbir bhai for sharing your wisdom with all.

It’s a wonderful combined strategy having Technical & Fundamental analysis & probability of winning is very high.

Yes very very high. Almost 100%. I am yet to see any hiccups to it.

Hi Shabir,

What is your opinion about PMS Provider like ASK? Can they give better return than the stock market or MF?

I am yet to see any PMS services that can give you better returns than mutual funds. PMS are mainly focused on generating brokerage for the broking firm more than making you money. Read https://shabbir.in/sharekhan-pms-review/

Hi Shabir,

This is an excellent article. There is so much to learn from you and also from the internet. As an investor I do not have the time to search various companies and compare them. Moreover how we are going to determine the future growth of the company. These future projections have to be made on the basis of certain assumptions. We do not have information about company growth plans etc. So what is wrong if we take advice of some good stock advisory firms like EquityMaster, or Sarlgyan etc. I subscribe to some of them and their strike rate is about 70-80%. I dont take their recommendation blindly. I do my own bit research if you can call them as research. When you go by the well known brands, how do you identify multibagger?

There is no harm in going with stock advisors and doing your due diligence and I also do the same. It’s just when you take them as tips and go with them blindly will be the cause of concern.

About multi baggers, we assume that what has gone up will not go up faster and let me share you some numbers.

Eicher motors has gone 10 times in each of the 5 years period in the last 15 years. (give and take some time here and there) and so even after first or second 5 year period, if you had invested in it, your portfolio would have been 10 times in value now.

Let us take one more example of V-Guard, I identified at 200 Levels in 2012 and had shared it with the community. Check the thread here https://www.diytechnicalanalysis.com/community/threads/v-guard-can-be-a-good-play.98/ and it was good play technically as well as fundamentally and it has done a 10 to 1 split and so it is almost 10 baggers now. Need more than that? Again the question is if you assume it will be few times more, you should consider it but not otherwise. What I am saying is such opportunity exists. It just that we tend to focus on companies that are too small and they can only become multibaggers. I don’t say that I have ability to identify multibaggers and one small stock in 2011, I identified at 100 odd levels and it has only doubled since then. https://shabbir.in/hitech-plast-yet-another-multibagger-stock/

But if you have a process that works and more importantly never fails, it can always give you those 15+ returns for a very long time and that is good enough than those high flying stocks for few days or few weeks.

brilliant article.

Thanks for the feedback Souresh.

This is an eye opening article for me Shabbir. I never thought about stocks from such a view point and it can’t be more right time than this for me when I am looking for investment opportunity.

Just one question why don’t you consider Maruti – Just because you drive a different brand?

Glad you like it Rahul.