What is market capitalization or market cap of a company? What is enterprise value or EV? Why, as an investor, we shouldn’t focus on enterprise value or EV?

Before we can deal with understand Enterprise value (EV), let us know market capitalization or market cap.

What is Market Capitalization?

Market capitalization or market cap as it is commonly known as is the total number of shares multiplied by the price of each at any given point in time.

So let us see the market cap of Page Industries.

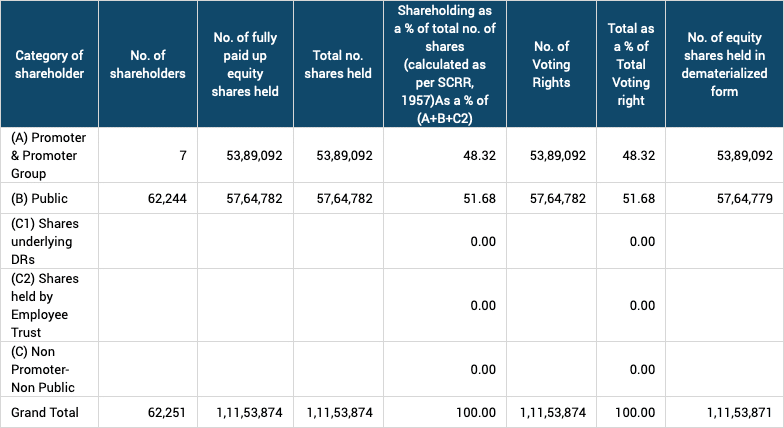

On the website of BSE under Shareholding, one can see the total number of shares of a company.

We see the total number of shares for the company as 1,11,53,874. The price of each as on 19th May 2019 is ₹22,764.

So market cap of the company becomes

= ₹22,764 x 1,11,53,874

= ₹2,53,90,67,87,736

= ₹25,390 Crores

Which is the market cap of Page Industries as on 19May2019.

What is Enterprise value (EV)?

Market cap has a straightforward calculation, but then it neither take into account the current cash or cash equivalent in the books nor the debt.

Enterprise value (EV) is more for measuring for a take over of the company. I will explain that in a bit but first let us understand the formula of Enterprise value (EV).

Enterprise value (EV) = Total Market cap + Overall Debt − Cash

Let us understand EV with a hypothetical example.

So if anyone wants to take over Page Industries, they need to buy every share from the market, pay off the debt and can use the cash in the books of the company once they are in control.

The above formula represents the same.

So EV is the amount of money needed to take-over a company.

EV includes in its calculation the market capitalization of a company but also all forms of debt (short-term and long-term debt) as well as any cash in the company’s balance sheet.

EV differs significantly from simple market capitalization in several ways, and many consider it to be a more accurate representation of a firm’s value and in theory, is the total price of buying a company.

Investors take Enterprise value (EV) with a Pinch of Salt

More debt in the company increases the EV but … companies with more debt are an avoid.

So it is essential to consider how the company’s management is utilizing the debt.

Is debt to foster growth or it is because of the current expansion plans? We are an investor and not willing to take over, and so our concern is – How can the company pay off the debt?

Your article is very helpful. I would also request you to have a look at https://stockarchitect.com it helps in getting real time notification about the stocks we own.. need your opinion about the same..

I don’t track that site and so won’t be able to comment much about it.