What is Moratorium? All you need to know to understand with an example. More importantly, answer to the question should you opt for it or not?

RBI has announced anyone having a loan can opt for Moratorium, but whatever I read was not very easy for a common man to understand. So let me break down Moratorium for you and get some use cases where what one should be doing in the situation.

What is Moratorium?

First thing first. Let us understand what does Moratorium means. In English, Moratorium means a legal authorization given to people who have taken up a loan and paying the EMI that they can postpone the payment.

So when one reads it, it sounds like I can postpone the payment of my loan dues for three months and pay it later. However, when you know the details, you will find it is not as simple as that.

Let me explain in simple terms.

The Moratorium allows you for a temporary postponement of loan payment. However, under the Moratorium, only late fee charges will be waived. Interest and other applicable charges will continue to accrue during the moratorium period.

Let’s understand Moratorium with an example.

Moratorium Example

Let’s say you have taken a loan from a bank. Pre-moratorium, you have been paying the EMIs regularly.

Each EMI consists of principal and interest amounts. So after each EMI, you have a residual principal amount that you have to pay the bank.

For the sake of calculation, after the last EMI, the total principal outstanding is 10L with a rate of interest as 12%, and tenure remaining for the loan payment is 15 years.

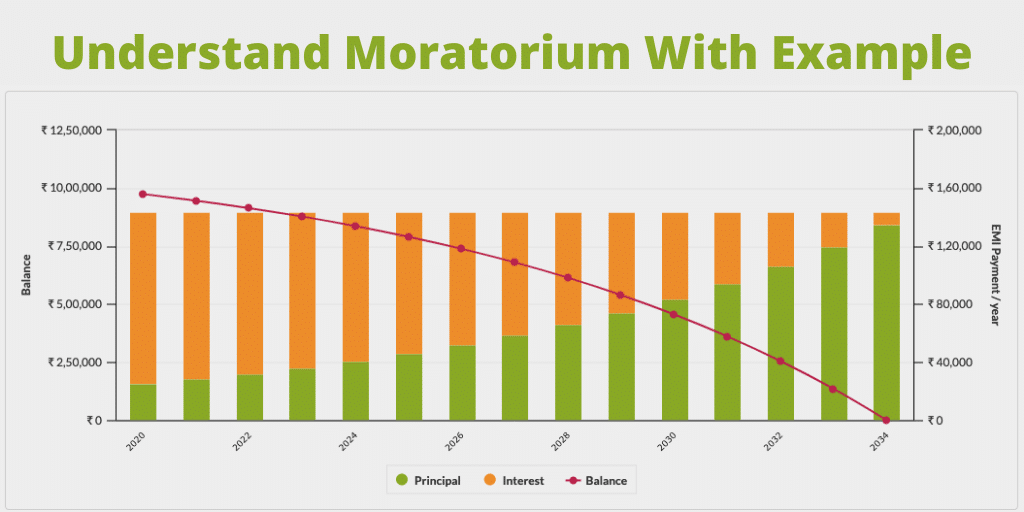

Here is the EMI Calculation from EMICalculator.net. The green portion is the principal one is paying, and orange is the interest within the EMI for the year. As one approaches the end of the tenure, the principal being paid is higher.

So the EMI is ₹12,002 whereas ₹2002 is the principal amount, and ₹10,000 is the interest for the next month. We assume the same for the next three months for the sake of a more straightforward calculation. However, the interest decreases slightly with each passing EMI.

If you opt for the Moratorium, the interest will be added to your principal amount. In our example, the outstanding principal amount of ₹10L will become ₹10.3L

As your principal amount increases, you have to pay more EMI. However, you have been given a moratorium, so your EMI will remain the same. So the only option is to increase the tenure.

Earlier, 10L as loan amount and 180 months of EMI of ₹12,000 were to be paid.

Now with 10.3L as loan amount, one has to pay 196 months off EMI for ₹12,000.

So for relief for three months, one has to pay 16 months of extra EMI amount.

Even if one opts to increase the EMI, the amount increases by ₹360 per month. Thus one has to pay the higher EMI for the next 180 months, which is ₹64800 extra.

Is the Moratorium Good or bad?

It is bad for the borrower who has a higher interest part in their EMI. So if you are getting paid by your employer or if you have a corpus amount, it is a better choice to keep paying the EMI.

However, if the interest of your EMI is low, it may not be a bad idea to opt for a moratorium.

Still, I will suggest you do the calculation for your loan amount and tenure. What is the principal amount that will be added? How much extra will you pay?

However, keep one point in mind, as the loan amount increases, the Moratorium is a profitable choice for banks. So it may not be a cost-effective option for the borrower.

Final Catch of Moratorium

Some banks have, by default, have a moratorium opt-in mechanism where they will opt you in as default, and you have to opt-out of it. Whereas other banks have by default opt-out of a moratorium.

Login to your loan account online or call customer care and find out what your bank has done to your loan. See if you agree to it and, if not, make an informed choice that helps you manage your loans better.

Finally, as and when possible, avoid taking loans or pay it up as soon as financially feasible. Always invest in your loan.

Leave a Reply