Stocks and mutual funds added in Nov 2016 to my portfolio and plans for Dec 2016 with detail analysis of why I invested in Ashok Leyland and why auto sector can be the next market leader.

A report I share each month on the progress of my portfolio of stocks and mutual funds with reasons of each and every stock that I own along with contract notes of trades executed in the current month and share plan for the coming month.

Note: This is not my complete portfolio in the market and I may have open trading positions as well as some previous investments prior to Jan 2016 and other riskier small and micro cap investments.

Demonetisation and Donald Trump as US president in November provided awesome investment opportunities. I did invest in Ashok Leyland and as planned did profit booking in L&T.

2017

My view is emerging markets will see an outflow of funds in next couple of quarters because:

- The short term impact of demonetisation’s will prevail in the first half of 2017 and how events pan out is yet to be seen.

- Donald Trump victory can mean US markets will factor in growth which may lead to profit booking in emerging market and funds flowing back to US market.

- With growth forecast in the US, FED rate hikes can lead to more profit booking by FIIs in the emerging market and in India.

Too many triggers for the market to remain sluggish can be once in a lifetime opportunity to build a long-term investment portfolio in 2017.

DSPBR Tax Saver

I have invested 30k in November (Transaction details here) and will keep investing as planned of 30k per month in the ELSS.

As always I select the dividend option so I get full tax saving benefit and get back dividend that I can deploy in stocks.

Pidilite Industries

Pidilite was a safe bet in my portfolio. Ironically it is the top loser now. There are many reasons for it to be a top loser but I am confident it will recover soon.

A recent investment that has significant weight on my portfolio and it is one of those sectors that may have after effect of demonetization.

The biggest lesson learned holding Pidilite is, always keep room to invest more in corrections.

Larsen & Toubro

I had plans to book profit in L&T and did as per the plan though I expected a better price to book profit. The reason I booked profits was:

- The amount invested in this stock was under 25k which is quite low compared to other stocks. It had run-up from my purchase price and I was not very comfortable adding more position at elevated levels. Made no sense in holding this stock in my portfolio if I could not add more quantity.

- L&T is a CapEx business and deals with cash (not black money) like paying wages. In fact, all infrastructure companies pay wages in cash and they can have issues with the demonetization after effect. Though I am not very sure how this will impact in totality but, as my position was very small it made sense to book profits.

- L&T has always been an infrastructure company but as other L&T companies (L&T Tech Services and L&T Infotech) were listed, I realized that it is a group business with a major focus being on the infrastructure sector. I tend to avoid group business (3rd point in investment checklist)

- Last but by no means the least, I sensed better opportunity in the auto sector.

Ashok Leyland

I sense auto sector will be the market leader to lead the next bull run in the coming few years.

In the short run, demonetization will have an impact on the auto industry and in my opinion, this is the best time for investment in the auto sector.

Smartphones made disruptive changes to the telecom industry and companies like Nokia and Blackberry could not keep up the pace with it. I see similar things happening in the auto sector very soon.

Indian auto sector never moved from a liquid (petrol and diesel) to gas based fuels but I am sure it will adopt electric vehicles very early due to benefits in pollution control and cost effectiveness.

Electric cars will eventually weed out diesel, petrol and even CNG vehicles and companies investing in R&D of electric vehicles will have an early mover advantage.

Maruti was available at such a mouth watering level that I was not able to decide on Ashok Leyland. I was in double mind to buy Maruti at 4,850 or Ashok Leyland at 78 and the day Maruti ran up past 5,000, I took a call on Ashok Leyland.

Fundamentals of Ashok Leyland

I follow my fundamental analysis principles for investing in any stock and Ashok Leyland is no different.

- Truck manufacturer cannot ba unique player but they are the largest provider of trucks to the Indian army. In the current scenario (Surgical strikes), defense is a priority for India which can be positive for the company.

- There are no government policies that control the profits of such business.

- Simple business which is to have variety of light commercial vehicles for growing India’s need.

- The company has its operations for decades and don’t see any loss-making year in the past decade.

- The company has good dividend history and in last decade they only missed dividend in 2014.

- Ashok Leyland is part of the Hinduja group which is very experienced management.

- There is some debt in the company but the debt equity ratio is well under 0.5 and it is going down every year.

Apart from those,

- They have introduced electric bus and this is just the beginning of electric vehicles in India.

- Have tie ups with Nissan motors on many front and have even acquired light commercial vehicle division of Nissan motors.

- Have good sales growth, good ROCE, growing EPS, never made a loss and is available at 20PE.

- Promoter stake is above 50% in the company.

Still there are couple of points to consider.

- Not cheap valuations. It is currently available at a PE

multiple of 20+ and 4.5+ times its book value. - The company has delivered really bad numbers in 2014.

- Hinduja brothers’ named surfaced in Bofors scandal but were cleared of all charges in 2005.

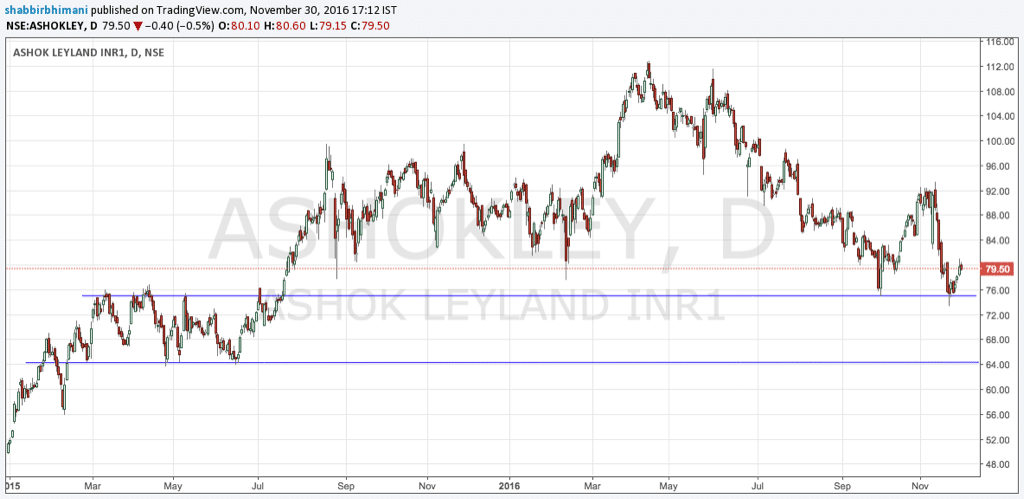

Technicals of Ashok Leyland

In March 2015, 70+ was a resistance for the stock and in the current correction of 110ish, it has bounced twice from 72 (top blue line) which will act as an intermediate support.

The best buying range will eventually be between 64 and 72 and with so much negative news waiting for the auto sector, I think it can slide down in between the blue lines.

Once it slides below 72 and touches 64, will accumulate more once I see 64 as bottom being tested and not breached.

I have added 1000 shares of Ashok Leyland to my portfolio at Rs 79.15. Contract notes here.

A side note:- I have moved away from ShareKhan and into Zerodha for all my investment. You can read about my Zerodha review here

Portfolio Update

Increase in investment from ₹13,83,094 to ₹14,63,886. An increase of ₹80,792 in the month of November. The performance of the portfolio built so far is as follows:

Profits Realized

- Infosys: 780 (60)

- Average Buy: 1165

- Average Sold: 1178

- Tata Steel: 9,200 (400)

- Average Buy: 280

- Average Sold: 303

- Larsen & Toubro: 2,080 (20)

- Average Buy: 1241

- Average Sold: 1345

Total Profit Realized: 12,060

Dividends

- Zydus Wellness: 325

- Larsen & Toubro: 365

- Jubilant FoodWorks: 250

- Britannia Inds.: 900

- Birla SL Tax Plan: 8,581

- DSPBR Tax Saver: 1,460

Total Dividend Received: 11,881

Stocks

Stocks I am holding in my portfolio along with the link to why I have invested in them.

- Ashok Leyland 79,500 (1000)

- Invested: 79,245

- Profit: +255

- Britannia Inds. 1,49,206 (45) [Why]

- Invested: 1,18,731

- Profit+Dividend: +18,650

- Jubilant FoodWorks 92,040 (100) [Why]

- Invested: 1,09,503

- Loss+Dividends: -17,213

- Jubilant Life Sciences 2,11,395 (300) [Why]

- Invested: 1,34,636

- Profit: +76,759

- Pidilite Industries 6,40,400 (1000) [Why]

- Invested: 7,18,864

- Loss: -78,464

- Zydus Wellness 1,72,980 (200) [Why]

- Invested: 1,61,847

- Profit+Dividends: +11,458

- Total Stocks: 13,32,796

- Invested: 13,22,827

- Profit: +11,444

Mutual Funds

- Birla SL Tax Plan-D: 1,06,331

- Invested: 1,05,000

- Profit+Dividend: +9,813

- DSPBR Tax Saver-D: 54,667

- Invested: 60,000

- Loss+Dividend:-3,873

- Total Mutual Funds: 1,60,998

- Invested: 1,65,000

- Profit+Dividend: +5,939

Overall

- Portfolio: 14,93,794

- Capital Invested: 14,63,886

- Unrealized Profit: +5,967

- Dividend: +11,881

- Realized Profit: +12,060

Plans Ahead

I would like to keep cash ready to be deployed in Ashok Leyland as and when I get an opportunity in the midst of low November sales volume numbers of Maruti, Hero Moto or even bad November GDP number.

Apart from Ashok Leyland, I will continue investing in my DSPBR ELSS fund as planned.

Over to you

If you have any questions or comments share them in comments below and I love to respond to them.

shabbir i have invested in ashok leyland around 1lakh at CMP of 95 . since last one year there is no profit . I cab be invested for next 2 or 3 years if the stock has any scope of profit for investor in future plz give your coments.

95 is the wrong price you have purchased this stock and it is value under 80. Stock looks promising and that is why I am holding this stock for sure and your timeline is good enough for it to be profitable in this but again your purchase price isn’t right.

i am Dinesh,i am a new comer to stock market. i am interested in learning stock market. please let me know where can i learn.

You can start from my blog’s start here page – https://shabbir.in/start-here/

I have checked your contract notes and brokerage is 0.3% I use the same sharekhan and they offer me 0.2% get back to your broker and ask him to reduce it.

How do you cope with losses… 1 lakh eroded in 1 month ?

Are your investments based on CANSLIM I see this cup pattern in your trades?

Nice blog though… keep going

Hi Subbu, glad you like my blog and you are right about the brokerage and it was low back then when i used to be trading in Sharekhan only but as I have moved trading to Zerodha and when I moved from kolkata to Surat ( http://imtips.co/kolkata-surat.html ) they moved my brokerage back to high rates but as I am not trading in Sharekhan and has moved investment also in Zerodha I am not too bothered from now on. Thanks or referring it.

Yes you are right about erosion of 1L but when you look at the portfolio size of 15L, it is not very high amount. Also compare that to the erosion being mainly in Pidilite only which was added 10 times I wished to add in my portfolio and then thought of keeping that in my portfolio as well. (Details here – http://shabbir.in/portfolio-oct-2016/ ).

About the pattern that you notice, yes I prefer investing in the leg up in the formation of bottom and it is more like cup trades.

Thanks shabbir for your suggestions. I will do the same .

Pls keep sending us valuable thoughts about Wealth creation

It is nice shabbir.

I am regular following your blog it was very nice.

Your approach was very nice the way you are narrating about market is wonder and technical analysis was amazing.

And your showing whatever you did monthly with proofs contract notes and all. your such a honest person shabbir really hats off to you.I ever seen this kind honest blog really

When I saw few months back you are having share khan ac,I was wonder.Now you have moved to zerodha good. Even i have opened with them it was nice.

Earlier I am also paying lot of money to ICICIDIRECT peoples for 11 years.Since 1991 I am in to this market When I was 10th due to study higher education I did not invested much money and time in market but now a days I am very serious about this equity market. This is the best market to create wealth in long run.

Here my question is I have 2 accounts one my name and another one is my wife name

In my account I am doing for long term ,my wife account for short term purpose is it right? I am doing

I dont want mix long term and short term in one account and dont want to give confutation to It dept

can I close my old ICICIDIRECT AC?

Thanks shabbir

I am waiting for your reply

is it right time to enter pidilite ? wait for some more correction ?

Please suggest.

If you are a long term investor, this is good time to accumulate but best time was around 580 to 620 range.

What is % change in networth from Oct to Nov ?

Almost -8%

Kotak Select mutual fund is safe to buy as SIP?

Ankit, can you define what you mean by safe? Do you mean it would not come down when market is down or you mean there is some one who will run away with your money?

Nice answer

It is nice shabbir.

I am regular following your blog it was very nice.

Your approach was very nice the way you are narrating about market is wonder and technical analysis was amazing.

And your showing whatever you did monthly with proofs contract notes and all. your such a honest person shabbir really hats off to you.I ever seen this kind honest blog really

When I saw few months back you are having share khan ac,I was wonder.Now you have moved to zerodha good. Even i have opened with them it was nice.

Earlier I am also paying lot of money to ICICIDIRECT peoples for 11 years.Since 1991 I am in to this market When I was 10th due to study higher education I did not invested much money and time in market but now a days I am very serious about this equity market. This is the best market to create wealth in long run.

Here my question is I have 2 accounts one my name and another one is my wife name

In my account I am doing for long term ,my wife account for short term purpose is it right? I am doing

I dont want mix long term and short term in one account and dont want to give confutation to It dept

can I close my old ICICIDIRECT AC?

Thanks shabbir

I am waiting for your reply.

Dear Ramana,

Sorry to intervene.

Though Shabbir bhai would better answer your question But As you have mentioned about IT dept. please read “Clubbing of Income” (I have learned it very recently) before you book short term gains on Wife’s account.

Regards,

Kedar

https://cleartax.in/Guide/clubbing-of-family-income-under-income-tax-act

Clubbing of income is something new to me as well and will ask my CA. Thanks for sharing that.

Thanks Kedar for your suggestion

Please send me “Clubbing of Income” url I am not able to find out same one.if you have pls share me.

thanks kedar i got it

https://cleartax.in/Guide/clubbing-of-family-income-under-income-tax-act

is it one your refering.??

Glad you like my blog and I hope you will share it with your friends on social media.

Yes I have moved away from ShareKhan because on 15th of Nov 2016, they had their complete system down and out and I could not place a trade for the complete day. So after paying such high brokerage if I have such full days, why not opt for Zerodha.

Regarding your long term and short term thing, it is correct what you are doing to save tax but my suggestion will be to consult a tax expert or CA for that matter and show him the exact scenario of yours.

Yes you should close your ICICIDirect account and I have closed mine almost a year back.