Compound annual growth rate or CAGR – is the annually compounded rate of return. The rate at which investment should grow to reach an ending balance.

The Right Approach to Stock Market Investing

Want to invest, but don’t know how and where to start? Trade wars, GDP, Auto Sector, RBI Policies are overwhelming? Let me help you approach the market right.

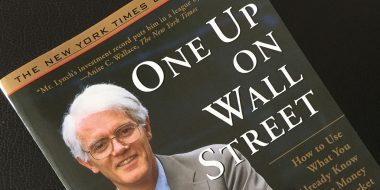

One Up on Wall Street – How to Use What You Already Know to Make Money in the Market

One Up on Wall Street is a must-follow book for every investor. My portfolio aligns with the stock-picking ideas from the book to keep it in the green in such a brutal fall of 2019

What is STP Or Systematic Transfer Plan & Who Should go for STP

STP is a Systematic Transfer Plan, but what I share today is more critical for an investor looking to invest in the market – who should opt for STP and when?

When is the Right Time to Exit a Stock?

When is the Right Time to Exit a Stock? 1. When Management takes Rash Decision. 2. When Business Environment isn’t Stable. 3. Other Better Investment Opportunity +3 more

What Happens to Fund Which are Closed and Don’t Accept New Investments?

What happens to the invested amount in a fund that isn’t accepting new investments? What an intelligent investor should do about it?

What is Free Cash Flow & Why It is Important for Investor to Consider?

What is free cash flow or FCF? How Free Cash Flow is Different from Operating Profit? What is Ideal Value of Free Cash Flow? What I Prefer in companies cash flow?

How to Read Critical Information in the Annual Reports Faster?

What critical information to look in the annual reports before investing in any company and how to judge the management and the future outlook of the company.

ROCE – Understand Financial Efficiency of Management

ROCE stands for return on capital employed, which helps us understand the financial efficiency of the business and the management.

The Type of Stocks I Avoid Investing Now and Why?

Understanding the current market correction, the stocks and sectors to avoid now but more importantly where to look for next market leaders and multi-baggers

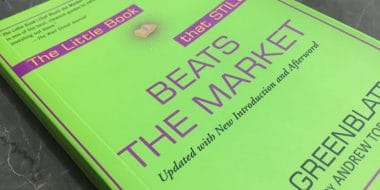

The Little Book That Still Beats the Market

The screener query to the Joel Greenblatt’s magical formula from the book “The Little Book That Still Beats the Market” along with my view on the magical formula.

Investment Return Vs Investor Return – Why Investors Earn Below Average Returns?

The average retail investor isn’t able to create wealth in the market despite markets doing so well. Why there is so much gap between investment return and investor return?

How to Know if A Stock is Overvalued or Undervalued?

Is there any process to judge if the company is overvalued or undervalued? The answer is yes. I share my complete process to find out if the company is overvalued or undervalued.

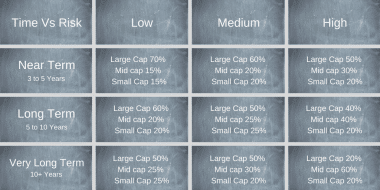

What is Ideal Asset Allocation (Market Cap Wise) For Buy and Hold Investor?

This article is not about the asset allocation into debt and equity but it is about the right mix of market cap allocation to your equity part of the investment based on your risk appetite and the time horizon for your investment.

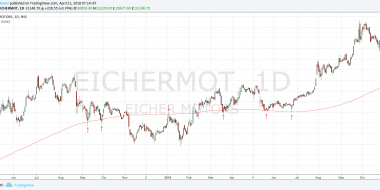

200 Day Moving Average – It’s Importance and the Magic That Keeps Happening

The 200-day moving average commonly expressed as 200DMA is a very popular and widely accepted technical indicator among traders to analyze the underlying trend.

- 1

- 2

- 3

- …

- 6

- Next Page »