What is LTCG? What is Grandfathering of taxable LTCG up to 31 January 2018? Does LTCG apply to Mutual Funds? What is the tax percentage and How to calculate the tax?

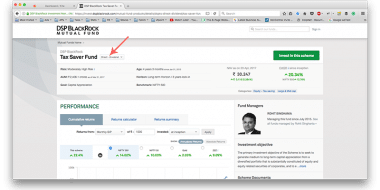

ELSS – Is Investing in ELSS Funds Any Good If One is Not Willing to Save Tax?

ELSS tax saving funds have a lock-in period of 3 years which makes investors remain invested for the long-term. When new investors check the return for the funds, they are positively surprised. But it also makes them feel ELSS funds is the only route to building wealth.

How And Where Indians Should Invest His or Her Salary?

Investment for salaried individuals in India is more important than self-employed or business person because they have a natural tendency of investing in one own’s business.

How to Invest in Direct Mutual Funds – A Step by Step Guide

A step by step guide to investing in direct mutual funds with an example of my investment of Rs. 50,000 along with why Zerodha’s COIN interface is an avoid

What is: Dividend – Everything You Need to Know About Dividends

Dividend is the money paid (typically once a year but some companies pay more than once as interim dividends as well) by a company to its shareholders out of its profits.

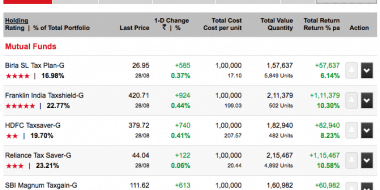

My Wealth Building Portfolio Report And Update – April 2016

Stocks and mutual fund positions added to wealth building portfolio in March 2016 and plans for the upcoming month along with portfolio performance and lessons learned.

7 Investments Gains That Can be Adjusted Against Loss From Stocks To Cut Tax

Profits of debt funds, gold & gold ETFs, real estate and other such investment can be adjusted against short term capital losses for saving tax.

What Happens If I Miss Couple of Monthly SIPs to My ELSS Fund?

Will the invested amount be considered for tax deductions if I miss a couple of monthly SIPs?

Is PPF or Public Provident Fund A Smart Choice of Investment?

NO Public Provident Fund or PPF is not a smart choice of investment option for any investor whatsoever.

How to Save Tax on Profit or Return on Investments – Tax Free Investment Options

Tax is a very significant portion of our total expense. What if your profit or return on your investments can be tax free or significantly lower in tax?

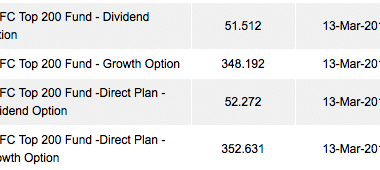

Mutual Fund Plans – Direct Vs Regular Plans

Indian retail Investors are not able to differentiate between regular and direct plan for investing in a mutual fund and so let me explain what it means and when you should be using which one.

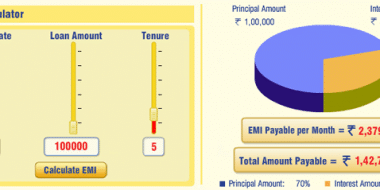

Is Home Loan Right Choice for Saving Tax?

Answer to Question: My gross salary is approximate 12L and my net take home is roughly ~78,000 Rs per month. I think I am paying lot of tax and want to know ways to save tax. Can I save tax with a home loan?

Unknowingly I have been Forcing My Readers to The Biggest Mistake to Managing Personal Finance

The worst investment tend to happen in the month of February and March for saving tax and I realized I have been preaching the same on my blog.

How to Save Tax On Short Term Investment With Profits

How profit from short term investment i.e. investment for under 1 year in equity market can still save lot of tax that may need to be paid otherwise.

How to Choose the Right Investment Oppurtunities To Building Wealth

Answer to question – I can make X% in FD and am able to grab a loan at much lower interest rate. Should I Opt for it?