In 2009 I shared Best Tax Saving Funds and though the idea of finding the best tax saving ELSS fund is still valid, it makes sense to be sharing some new insights as well as the look into better option to save tax in 2013.

Do I need to file my IT returns when I have loss or no Profit?

In the last quarter of fiscal when we approach the month of March, questions related to taxation hit my inbox quite often and one of the very common question is – Do I need to file my IT returns when I am in loss for my portfolio?

Why You Should Invest in Mutual Funds?

An article by Vinay Kumar for making his friends understand why it is important to invest in mutual funds and how mutual funds delivers inflation beating returns that not only saves tax under 80C but returns are tax free as well.

Impact of DTC on ELSS Funds

ELSS will not be an option once DTC is enforced. Till we have the option I am definitely going to use it to get Full tax saving without investing one lac into the Best dividend paying Tax Saving Funds.

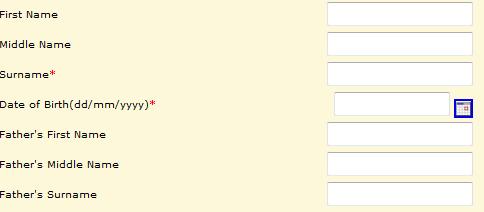

How Unsafe Is Income Tax India e-filling

December 15 is the last date for quarter’s Advance Tax Filling and this time I thought of registering myself at Income Tax India e-filling to view my fillings online. When you click on the register link it asks for a PAN Number. Once you provide a valid PAN number you can proceed further. The shock […]

New Direct Tax Code

New taxation rule is in talk once again and so I would like to point you to one of my article where I shared How New tax Code can Impact us?

Taxation for Non-ELSS Mutual Funds

There is lot of confusion among many of us about Taxation for Non-ELSS Mutual Funds. Let us try to answer this question with very simple examples.

How New tax Code can Impact us?

After my post on Better Way to Save Tax there were lots of emails where I am asked about the new tax code proposal and my view on it and so today I thought I will clarify it for once and for all.

Better Way to Save Tax

It’s that part of the year when everyone is looking for ‘tax saving’. Normally we look at sections like 80C and 80D, figure out what qualifies for deductions and proceed to make those savings and investments. But have you ever asked if there is any better way to Save your Tax? I will discuss few of the ways and see if you can better your way of saving Tax.

4 Tax Tips – Best of 2009 at shabbir.in

This is the second post of the best series of 2009. First was on Investment and second on Tax

Dividend or Return on Tax Saving Funds

After suggesting Best Tax Saver Funds on the basis of dividend the question of many readers of the blog is. What they should choose, Dividend or Return?

Why you should File your Tax Returns?

Paying tax is not your only duty but even filing tax returns. I would list some benefits of filing your tax returns and why you should File your Tax Returns?

Best Tax Saving Funds

List of some of the best Tax Saving mutual funds. The list of funds selected are based on criteria of consistent dividend for a long period of time.

80C Tax Saving Mutual Funds

Its high time when every one of us start looking for saving tax and so I thought would make a post here where you can find all the funds where you can invest to save your Tax. This are all Equity based ELSS Funds.

How to Avail Full Tax Saving Benefit Under Section 80C Without Full Investment

Did you know that you can save taxes on the Rs 1 lac limit (the limit under Section 80C) yet invest much less than that? Sounds impossible, doesn’t it? I have done the same last year and will be doing the same this year.