The 200-day moving average commonly expressed as 200DMA is a very popular and widely accepted technical indicator among traders to analyze the underlying trend.

What is 200-Day Moving Average?

The 200-day moving average commonly expressed as 200DMA is a very popular technical indicator among traders but more among investors to analyze the underlying trend.

It is an arithmetic average of the last 200 days closing price. Some prefer open, high or low prices but most widely used is the closing price.

The 200DMA can be calculated by taking the price of a stock or index for the past 200 days and apply the formula:

[(Day1 + Day2 + Day3 + … + Day199 + Day200)/200]

It is termed as moving average because as one more day close price is available, the new close is added to the calculation and the first close in the calculation is removed. Making it a constantly updated value for each day.

The 200-Day Moving Average Magic?

We aren’t too bothered about the formula because every charting software has an option to apply 200DMA. What is more important is its application and hype.

Let me first show you some magic about the 200-DMA. All these can’t be a coincidence.

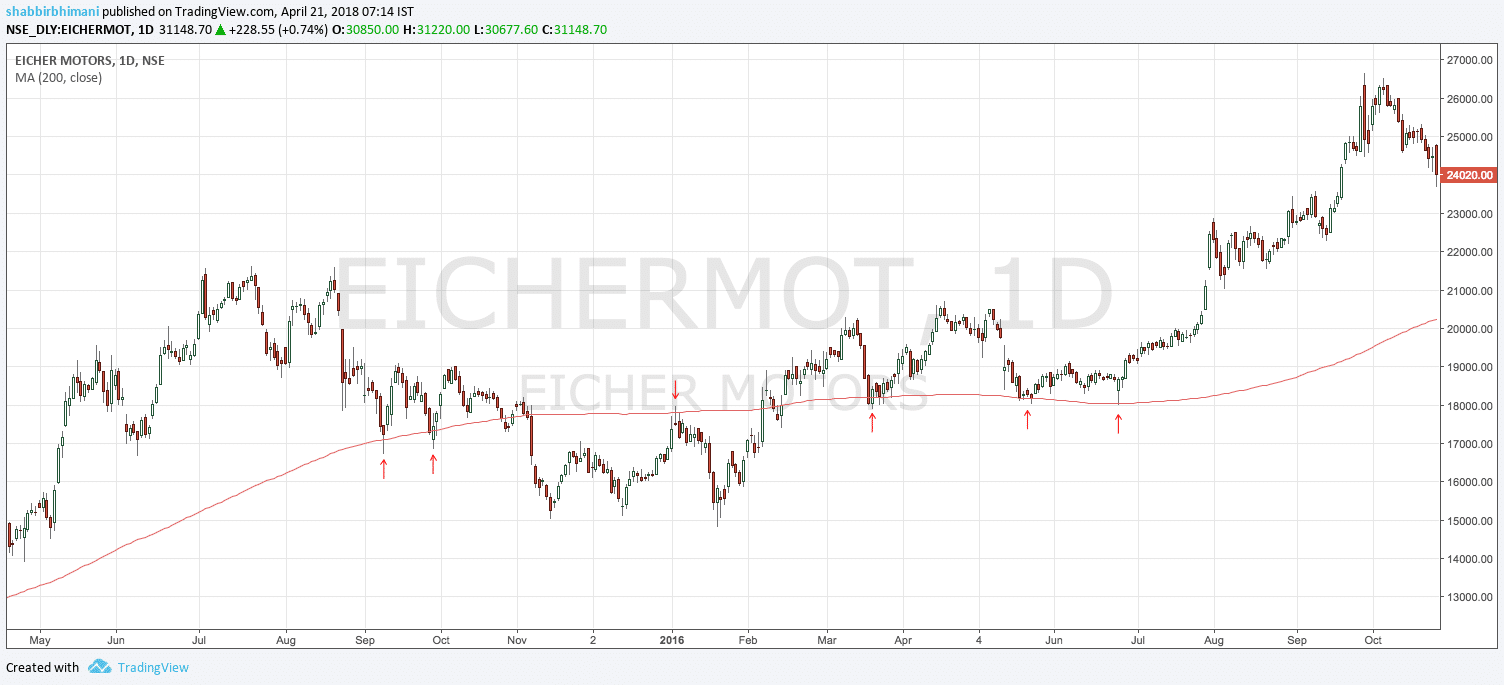

Here is the daily chart of Eicher Motors.

The red line represents the 200DMA for the close price. The red arrows indicate the stock price bounces after touching the red line. In a correction, the 200DMA acts as a support from where we see a reversal. Similarly in an upswing, when the price is below 200DMA, it acts as a resistance.

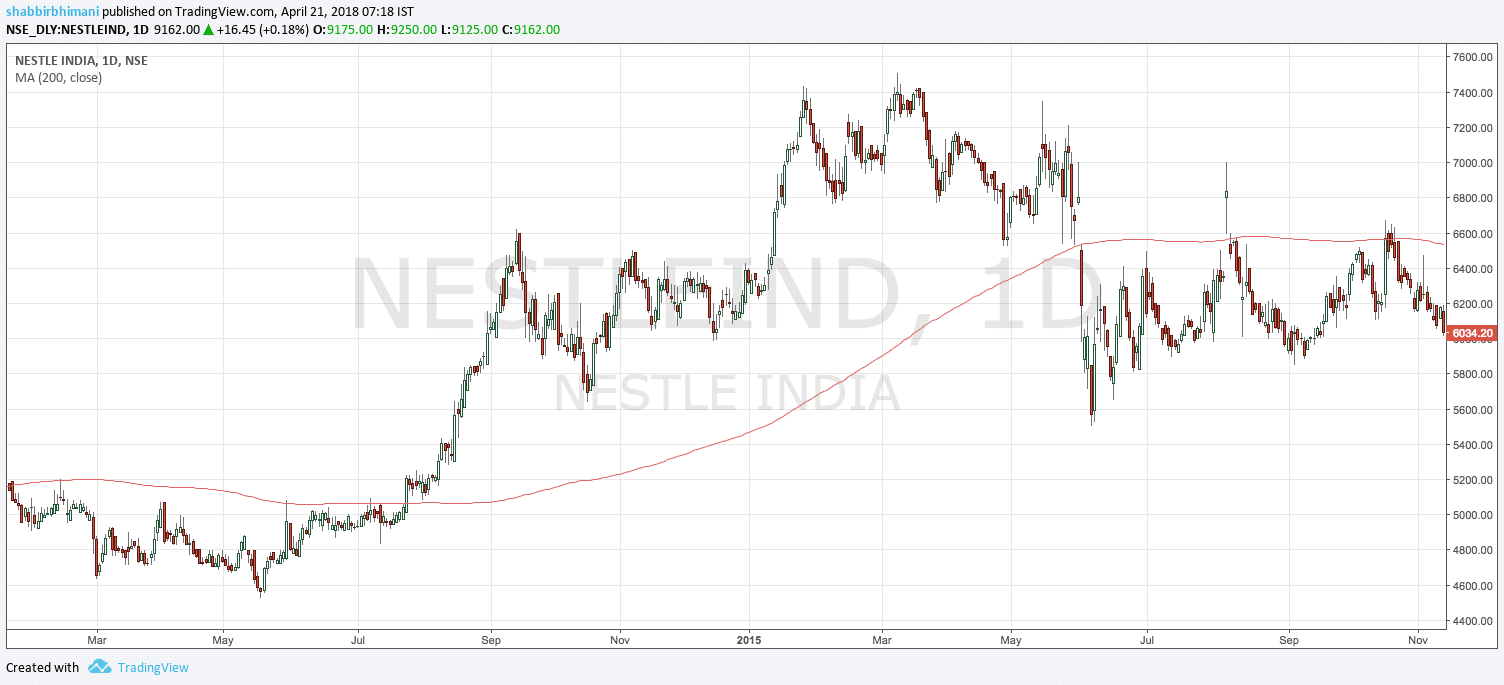

The similar price action is seen in Nestle India.

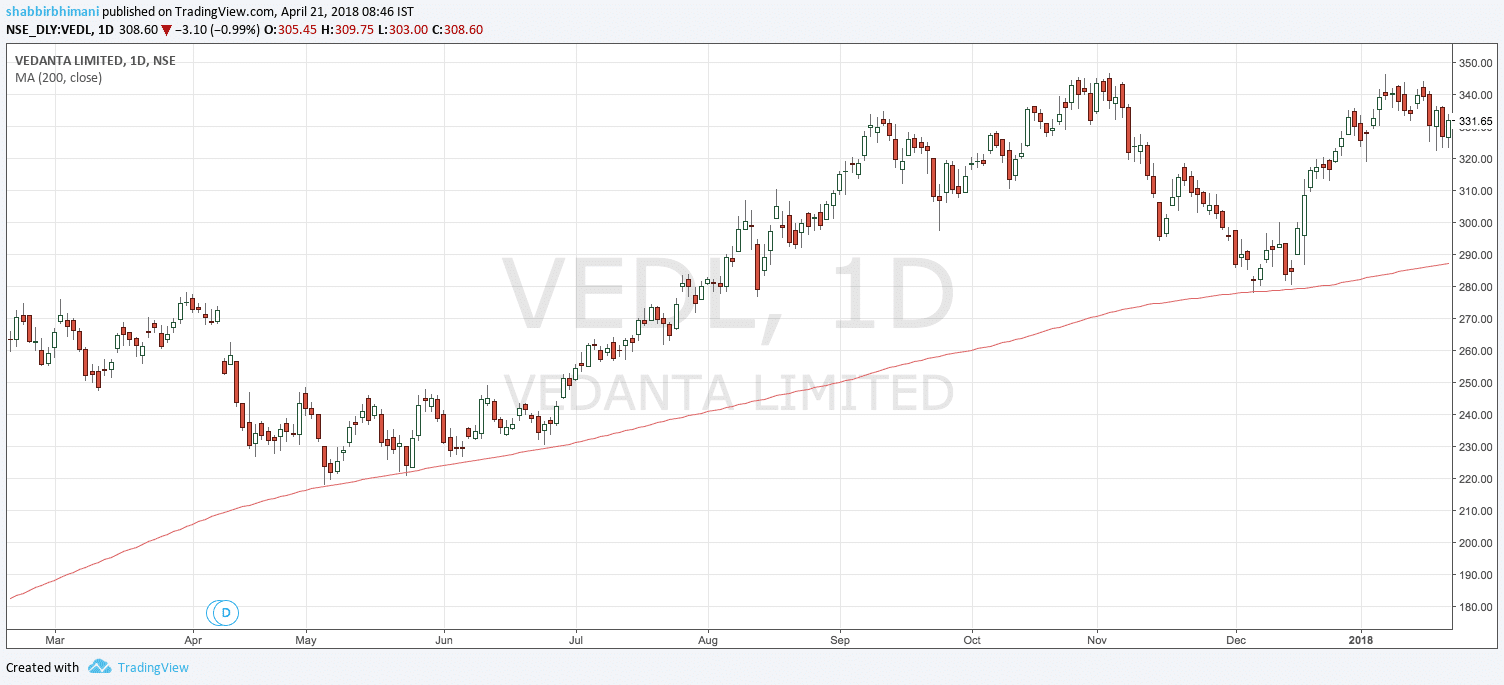

Or in Vedanta Ltd.

Pick any random company’s daily chart and apply the 200DMA, you will find the stock is seen to touch 200DMA and reverse on multiple occasions. Pretty much like a magic.

Why the 200-Day Moving Average Magic?

The 200DMA magic happens but the question is why. As a trader and investor, we need an explanation for it. We can’t just accept it as a magical phenomenon.

So let me try to answer it:

- Widely followed – 200DMA is so widely used that a stock or index when it touches 200DMA, the bears start covering their short positions or bulls starts accumulating. It provides the much-needed change in demand-supply change for a reversal.

- Clubs well with other averages – 200DMA is a laggard trend identifier. It means the change in trend can take anywhere between 50 to 100 days depending on the volatility in price movement to signal a trend reversal. But when clubbed with smaller time moving averages like 50DMA or 100DMA, they provide a better understanding of the trend much earlier.

- Very Simple and Easy to Understand – The 200DMA is one of the simplest forms of trend analysis. It is very easy for any new market participant to understand and apply. By simplicity I mean, 200 DMA has no extra parameters to the pattern like RSI or MACD or any other mathematical study for that matter.

So it’s simplicity and widely accepted creates the magic.

How Can Investors Use 200-Day Moving Averages?

The most important question of all, how can the 200-Day moving average be used by long-term investors.

200DMA is a laggard indicator and so often it can take up a long time for a trend reversal signal for traders but it is best applied to a stay-put type long-term investor.

If you are investing in a mutual fund, start SIP to create investment habit. Over time you will have additional lump sum amount to invest. Do the lumpsum investment when the underlying index is very close to its 200DMA.

As an example, if you want to invest in the best midcap fund, invest when the CNX MIDCAP index is around its 200DMA or if you prefer a small-cap fund, look for the CNX SMALLCAP index.

For stocks, the process isn’t this simple. The first step is to know the right stocks and you can do that with an investment checklist and fundamental analysis. Once the stock qualifies for the right stock analyze the business. Then we have to apply the price action technical analysis to invest in the right price.

So here in vedanta chart the 200 day moving avg which I have put is it right or wrong like it must be simple or expontential. Second thing since the stock price is below 200 moving avg so is it noow a buy signal or not.

https://uploads.disquscdn.com/images/296df4a699293e20ae6ad92a003a17dd887378ee92299851816f9de215c6e99d.jpg

200DMA is simple moving average. Moreover, moving averages are never good at getting a trading signal for buy and sell. They are laggard in nature. You can read about its laggard nature in my book.

So 200DMA is mainly used as indicator to identify trend in a very loose way.

I checked some of the my stocks as well and the magic is amazing. Thanks for sharing.

Yes it is quite Interesting.