Answering all ROE questions: What is ROE (Return on Equity)? What is the ROE formula in very simple terms? Why High ROE Isn’t Always Good?

What is ROE?

ROE stands for Return on equity. Like ROCE, it is a measure of management’s ability to generate income from the available money i.e. asset minus liabilities (debt and other such liabilities) which is also known as the shareholders’ equity.

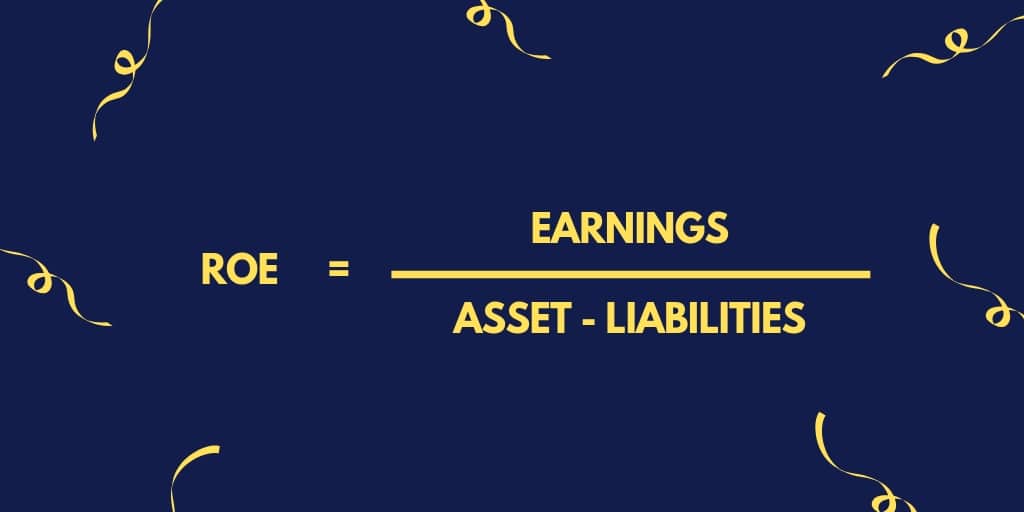

The ROE Formula

The formula for ROE is:

ROE = Earnings / Shareholders Equity

Shareholders’ equity is the company’s assets minus liabilities.

So

ROE = Earnings / (Assets – Liabilities)

Why High ROE Isn’t Always Good?

Higher ROCE is always better but often higher ROE can be achieved not only with an increase in earnings but by also reduction in equity i.e. assets – liabilities or increase in liabilities.

Let us take an example.

Earnings are Rs. 1,000 Crores for a company ABC, has assets of Rs. 200 Crores and liabilities as Rs. 50 Crores.

So ROE is

1000 / (200 – 50) = 6.67 ROE

Now company doubled their debt to Rs. 100 Crore and for the sake of understanding everything else remained the same.

1000 / (200 – 100) = 10 ROE

Clearly, an increase in debt or liabilities for the company can mean a higher ROE. So it is not always better in earnings that can increase the ROE but can also mean an increase in its liabilities.

Final Thoughts

Generally, ROE in the range of 15 to 20% is good. Higher debt can be good for business to a certain point (debt to equity ratio under 0.5) where a company uses debt to expand its business rather than diluting the equity and promoter’s stake in the company.

Apart from that for the financial sector where money is the main commodity, instead of ROCE, ROE is a better estimation, for other sectors, it is always better to remain with the ROCE than using ROE.

Leave a Reply