In India, stocks trade in two exchanges – NSE & BSE – It means you can do arbitrage trade by buying in one and selling in another. Article updated in 2021 for Interoperability of Exchanges

Arbitrage is the practice of taking advantage of a price difference between two or more markets or exchanges. In Indian markets, the cash segment stocks trade in the two major exchanges – NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). It means you can take advantage of buying the stock in one exchange and selling it in another and bag the difference as profit can be an arbitrage opportunity.

What is an Arbitrage?

As a quote from Wikipedia

In economics and finance, arbitrage is the practice of taking advantage of a price differential between two or more markets: a combination of matching deals are struck that capitalize upon the imbalance, the profit being the difference between the market prices.

So if

- The same asset does not trade at the same price on all the exchanges

- An asset with a known price in the future does not today trade at its future price.

Then we can take advantage of Arbitrage and sell at a higher-priced exchange and buy at the lower-priced exchange to cash in the profits.

In the Indian market, stocks trade in NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). So one has the option of buying stock in one exchange and sell it in the other one.

Wait… there are things to consider, but I would mention some.

- Do not execute the transactions manually, but it should be an automated process because the situation may not hold for a long time.

- Always check with your broker if they allow interoperability of exchanges. If they don’t, you can’t trade the arbitrage. (We will see what is interoperability of exchanges why you need it)

- Remember to execute it when you have the cost of your broker covered.

So let’s understand the arbitrage now.

1. Check for Interoperability of Exchanges With Your broker

When I first wrote this article in 2012 about arbitrage opportunities with both the exchanges, we were not allowed to buy and sell the same stock in different exchanges on the same day. If you buy stock XYZ today in NSE, you cannot sell stock XYZ in BSE the same day. If you do that, you may have a penalty of short selling in the exchange you sold.

However, so the arbitrage opportunity existed only for those who had the stocks in their DP. So, if you have stock XYZ in your DP, you can sell the same in BSE and buy them in NSE to bag a profit. However, you were not doing intraday trading. So you may be paying the brokerage of delivery to your broker though you are trading on the same day – time-wise.

In 2018, SEBI proposed the idea of Interoperability of exchanges. Interoperability now ensures that one can settle trades made on both NSE and BSE through a single clearing corporation. It means the broker can clear the trades of BSE on NSE or vice versa.

However, still, in 2021, not all brokers support interoperability. I am sure eventually they will, but it is still not the norm. I know and have enquired that both My broker Upstox and Zerodha do support it.

2. Last Traded Price of NSE/BSE is not the Price for Arbitrage

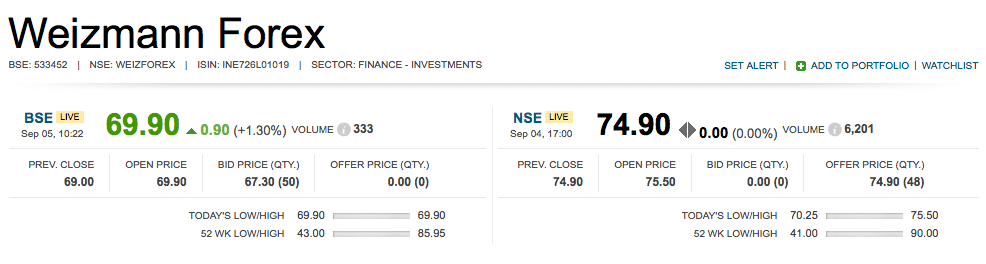

If you see a price difference of few Rupees in both the exchanges does not always mean there is arbitrage. Take the example of Weizmann Forex.

We see the price in BSE as 69.90 and in NSE as 74.90, which one can conclude as an arbitrage opportunity, but there is no arbitrage opportunity. Let me explain to you why.

The big price difference you see is the last traded price which means those price in both the exchange is the traded price and not the amount at which you will be able to trade.

Your price would be either offer price or bid price. Let me explain the offer price, bid price, and last traded price first in simple terms.

- The offer price is the price that others are offering their shares. So you can buy at the offer price.

- The bid price is the price that others are willing to buy shares. So you can sell at the bid price.

- The last traded price is when the offer price and bid price match, and the trade took place.

So if you see the offer price and bid price in both the exchanges, they are

- The offer price in NSE is 74.90 for 48 shares.

- The bid price in BSE is 67.30 for 50 shares.

So if you execute the trade, then your offer price should be 67.30 in BSE and Bid Price in NSE as 74.90, and that would mean you are buying high and selling low, making a loss and not a profitable arbitrage.

So arbitrage only exists if you have a higher bid price and lower offer price in either exchange.

3. Arbitrage Trades shouldn’t be Manual

As a retail investor, we may be able to spot some arbitrage opportunities.

Still, suppose you try to key in those trades manually. In that case, the opportunity may be gone before you can manually execute the trades. The reason being many big traders have automated software running for spotting such arbitrages and execute those trades. If you think you can beat those programs spotting arbitrages, you are wrong.

On top of that, you are trading with the broker in between you and the exchange. The large traders have direct access to the exchange. So they don’t have a broker in between, eating their profits. So they can spot arbitrages much earlier than us. By earlier, I don’t mean time early but price early.

It does not mean that retail investors cannot trade in arbitrage, and circuits are the best opportunities for arbitrage where if you have stock in your DP and if it hits the circuit in both the exchange, you can opt to buy in the circuit where the pricing is low. Once the buy order is executed, you can sell your stock from DP in an exchange where pricing is higher than what you just purchased. I did the same in Fame India here quite some time back.

Final Thoughts

Arbitrage opportunities exist in many forms in the market but trying to take the buying in NSE and selling is BSE is not the right one to take. Avoid spotting arbitrage in low-volume stocks because pair trade execution can be tough in them. If you have any questions about arbitrage, you can ask them in the comments below.

Hello shabbir first of all this is very informative however unintentionally I did the arbitrage so I m not able to understand how to resolve and what would be the penalty for it… so please let me know

More likely it will be 20% but your broker will be able to tell you the exact amount.

Hello sir,

kya aap mujhe arbitrage ke bare me smajha ya bata sakte he esme work kese hota he or ye kam kese karrta he

nse & bse

That is what I have explained in the article. What more you want to know.

Hi Shabbir,

Can I do the arbitrage if i catch the price difference in SPOT and Far Future of F&O stock.

Today i spoted 4% gap in STAR (strides Sasun). Is this feasible.

I got it from moneycontrol site.

Regards,

I don’t think so because humans can notice such variations but the time needed to execute the trades can’t be faster than a computer.

Dear sir ,

If i buy x share in NSE for 100 Rs and My brother Sell share same in BSE for 101 Rs (Considering 1 Rs price difference) from our personal DP and if we both cleared our position when difference is less than 1 rs. and done this thing No of times per day. is it okay?? can we make this type of arbitraging? does we face any penalty??

You can’t do that. Even if it isn’t your brother and you do it in the same account, you will be have to pay the brokerage and so more than 1Re difference will be paid to the brokers only.

On top of that, your brothers account where you sold may have a short sell penalty as well.

Sir, I found the above article very informative. Thanks for sharing.

The pleasure is all mine Giridhar

Hi Shabbir,

Thx for your article. I am very interested in arbitrage of the stock and the software you mentioned in the article. Do you have software or platform that can introduce so i can do the arbitrage.

Thx!

Happy

I don’t trade in arbitrage and so can’t suggest you a software for it.

Thanks for detailed explanation.

intraday arbitrage not allowed.? short in bse and buy in nse.

No you can’t do that.

hello sir, one question. i m fresher in stock exchange.

i am holding 100 reliance industries in my DP and first step i sold it on NSE at 1565. Now i want to purchase on BSE where it is trading at 1560. is it possible to make both deals as new & fresh deal. Brokerage apply as both delivery brokerage (no issue for brokerage). is it possible. pls reply

Yes it is possible.

Can I sell a share in my dp that i purchased from NSE, to BSE ?

Yes you can

anybody can contact me on my facebook id callput1299

What if i use two DMAT acccount and trade separately on NSE and BSE and try to take advantage of price difference and then equally the trade at equal price. Do you think it is feasible?

Not at all. Same DEMAT or different but you will not be able to deliver the shares from one exchange to other.

What if I maintain separate position in both the accounts and close it by the end of the day when the difference between the exchange is lesser.

If you are closing each of the positions, you are actually trading in the same script rather than doing an arbitrage.

Iam a student just ready to join my research course . I am intrested in Arbitrage and wanted to conduct my research in arbitrage but iam not geting what to research inside arbitrage can you help me out plzz…

I am not sure I can help about what you should be researching in Arbitrage because you are an expert doing the research,

hahaha

(Y)

It is wrong because it has to be BID and ASK price on each of those exchanges.

So basically, always the arbitrage opportunity math involved offer and bid price comparison? Then how come links like these http://profit.ndtv.com/market/arbitrage-opportunity have a single value in NSE and BSE tables?

You are not allowed to buy and sell the same stock in different exchanges on the same day. This means if you buy stock XYZ today in NSE, then you are not allowed to sell stock XYZ in BSE the same day. If you do that, you may have penalty of short selling in the exchange you sold. How?????????????

That’s how it is. Both are different exchanges.

I have stock in xyz 100 shares, bought @ Rs. 90/- shares in DP. I want to do arbitrage. I sale 100 share in NSE @ Rs. 100 & buy in BSE @ Rs. 95/-.

As such I make Rs. 5/- *100 = Rs. 500/- profit.

Now, question is from taxation view.

Profit I have made will be treated as:

a)Rs. 500 intra-day profit OR

b) as short term capital gain i.e. sale price 100 – holding price of stock 90 = rs. 10/- short term capital gain per share ?

As you know taxation is different for both cases. Pl advise your opinion.

Thanks.

The tax calculations is based on your holding of 100 shares prior to arbitrage. As this is not day trading but sell from DP and buy it back, so if your calculation is based on FIFO (aka First in first out) then you will be taxed for selling your 100 units based on when you purchased and then you have 100 units back in your DP.

Still I will suggest don’t take my words for taxation and consult a tax expert on this.

Thank you sir for your prompt reply.

The pleasure is all mine.

hi I am Having a team of more than 20 dealers, all having experience of more than 10 years, we have already worked with JM Finance, Religare, Active finstock, Quant, Etc,

We are dealing in Cash-Fo and Cash-to-Cash on Fund and Stock basis respectively.

contact me if you have any Business for me and my team as we are interested in Algo trading (GREEK) on CO-LO or TBT.

regards,

Prem

09887464369

Thanks sir for your answer

I want to ask one more thing – if I had 100 shares of

reliance in my dp account then can I buy and sell from one exchange to another

more that 100 shares (say 1000 or more) in intraday trading??

Or

Simply I want to ask that is arbitrage trading is available

with margin?????????

Is this possible and legal??????

No you cannot do more than 100 but then if you buy and sell in the same exchange some quantity, that is allowed.

So if you buy 500 in NSE and sell 400 in NSE

and buy 400 in BSE and sell 500 in BSE

Then it can be but then the difference at the end of the day cannot be more than 100 in any exchanges.

thanks sir,

that is no. of shares in dp account= no of shares can be buy and sell in one excange to other???????

Exactly.

sir,

if i make large no. of buying and selling of a particular stock with margin from one exchange to another, then would happen??????????

I am not sure but you are asking the same question in different language and first try to do it with few stocks and see it in working. It is not humanly possible and you have to be using the automated software.

ok. thanks sir.

can you suggest me some books for learning intraday equity share trading specifying techinical analysis???????

Yes. Check out http://shabbir.in/technical-analysis-books/

sir,

i have read your article very carefully.one question arise in my mind is that is possible

suppose i have rs.1,00,000 in my trading account, if i buy 100 shares of reliance at

rs.1,000. On t+2 days shares come to my dp account. now the price of reliance is rs900in nse and 930 in bse. Is i can do buy and sell of shares from nse to bse same day, a no of times to create profit. Is it legal, safe and profitable????????????? Is this action cause penalty??

Yes if you can execute such trades, it is completely safe profit but then you will not find such a difference manually.

thanks sir

one thing i also want to ask that it is necessary to have shares in dp account to do intra day buy and sell from one exchange to another???

YES and that is what I have answered in the article itself?

Im 17 m I practice In market

Sir Nice Article !!

I didnt understand the trades between NSE and BSE.

How is it possible to buy in one exchange and sell in another ?

Eg: If I buy at Rs. 50 in BSE and sell at Rs. 54 in NSE, wont I have to cover my position in NSE ?

Rushabh, you cannot do the trade the same day but otherwise you don’t need to cover your position. The sold quantity will be adjusted from your depository account.

sir,

i agree with your comments

i was a speculator for 5 years then i quit because of high pressure.

for the past 5 years i have become arbitragor and not a speculator

i am a full time trader.

one who have vast speculation knowledge and less brokerage and high speed connection alone can do arbitration.

typing speed. research atleast for 5 hours (after market hours)

limits. non auto squaring. money power for taking deliveries are essential

you can send me email for knowing some strategies.

we can also share our toughts.

if you send email to my address relianceccc@gmail.com

computers are just machine.

if we have brain and experience in speculation we can win computers.

small investors,part time traders,connection slow broker accounts and less money ppl should avoid arbitration.

if you have a good typing speed you can earn Rs20,000 but arbitration can only give you rs10,000 for the first 2 or 3 years.

play it as a game and not for money.

try to win game and never focus on making money.

age factor is also very crucial for arbitration.

sorry to tell this

if you crossed the age 40 brain power slows down in stocks.

i have seen millions of traders loose money because of the age factor

regards

desikan

Im 17 m I practice In market

Hi Shabbir,

I read through your above article on arbitrage. The thingy that caught my eye was the penalty you said about, that we have to pay it to the Stock exchange where we do the sell transaction. Now, having said that, could you give me a fair idea on how that penalty is computed. Requested info is to understand if it is possible to make few bucks even after paying penalty in such transaction.

Thanking you in anticipation.

Sentil

No you cannot make more than 20% on any day and paying such a high penalty does mean you can only make money if the stock hits lower circuit on further trading sessions

Sir

I use to do arbitrage 2 years ago but left that job because of some reason. I m thinking to rejoin arbitrage again

Do u think this is right time to enter again in arbitrage .

if yes sir plzz do suggest any of the companies name so I can approach them fo this job . I use to have a great typing speed in no.s

Thanking you

Chirag

Chirag, I am not aware of any such jobs.

we have vacancy for arbitrageurs

contact 9717501076

hi I am Having a team of more than 20 dealers, all having experience of more than 10 years, we have already worked with JM Finance, Religare, Active finstock, Quant, Etc,

We are dealing in Cash-Fo and Cash-to-Cash on Fund and Stock basis respectively.

contact me if you have any Business for me and my team as we are interested in Algo trading (GREEK) on CO-LO or TBT.

regards,

Prem

09887464369

Dear Mr. Bhimani,

I want to know the rule and regulation about the get yourself appointed as Arbitrager. Is that any exam one has to undergo taken by SEBI ? Please also clarify whether any certificate is required for an individual before acting / performing s an Arbitrager ?

this is urgent as I want to defend my client in a case please.

Prashant Pandit

I am not aware of any such thing as being appointed as Arbitrager

Sir, I would like to know that is it possible to arbitrage trading for any individual.If yes, then plzzzz recommend name of some broking house…..!

Theoretically yes but practically NO.

means……please elaborate

Thats what I have explained in the article.

Hi Shabbir,

As per point one; Arbitrage in only possible with shares in Account.

Let’s say

“Stock ABC” is at 235 on NSE

And

“Stock ABC” is at 200 on BSE

Price Diff 35

And

I do not have “Stock ABC” in my account;

I would need to buy the stock

And

stock will come in my account only after T+2 days;

by this time the price could square off between the exchanges.

In this case Arbitrage is opportunity is lost.

One more thing :

What is Stocks to Futures arbitrage?

Best regards,

Maandhar

Stocks to futures arbitrage is not arbitrage and is hedging where you buy a stock as well as sell it in futures the same amount and so up or down movement in stock makes you profit in one and sell in other but then depending on what how your square off gives you profit.

I am retail buyer (small investor ). I dont do any any kind Arbitrage. I always buy in NSE. i never compared in BSE (before buying in NSE). How I should select a stock to buy between NSE (or) BSE?

The option to select the exchange should be there in the application that you use when buying

Sir can i leave my mail address and we cant talk over mail coz i wana know much about stock exchange if u can pls help and guide me in right direction.

Sure. Check http://shabbir.in/contact/

So what i understand from your article is that doing a manual arbitrage trading is not advisable. So can you suggest which software you suggest for this?

I have not used any software and so will not be able to suggest you something concrete but then if you plan to use softwares, you should be trading in the direct NSE window and not through brokers to avoid the brokerage. To trade in direct exchange, you need to have a trading portfolio of atleast 5 crore and after hearing about that amount, I was sure it is not for retail investors by any chance.

So that means a retail investor cannot do arbitrage??

Almost 😀

Sir,

I work in GKN securities as an arbitrager..for the past 2 months..i work in NSE & BSE,i m confused,tht i used stand in BSE leg Or Nse leg…it wil be grt if u help me as i m new..

* tht i should stand in Bse Or Nse leg..

Amitesh, I am not able to understand your question.

We have this software name “Greek G.A.T.S.”,What Base i should kept while trading, NSE Base OR BSE Base?

Amitesh, I would suggest NSE but then even if you select BSE should not be a lot different. I am suggesting not based on software because I don’t use it but I think NSE has more trading stocks then BSE

Sir what if First i buy at BSE & sell at NSE & then reverse the deal on the same day is it possible or I still have to pay penalty of short selling.

If you reverse your shorts in any one exchange but keep your buy position open in the other exchange, you don’t need to pay the Penalty

So sir now for doing arbitrage one has to see the difference which can recover his 4 transaction cost and when book it then when prices are at common level reverse the deal nd get the desired profit without holdin any shares we can do that?

And that cannot be done manually. Never even try that

Sir one more question pls… I have seen in some shares that there has to happen a difference of 2 or 3 rs bt that price level do not come at par though the share price is around 150-200 why is that so

Because the difference and the brokerage does not lead to arbitrage or else there are many big players who have softwares keeping track of such opportunities and punch auto trades

k thnx a lot sir

The pleasure is all mine Rakesh.

sir i wanna know about arbitrage bse and ase stocks.can u tell me how can i earn with arbitrage stocks.is it easy.thanx

No it is not at all easy and that is what I have explained in the article.

sir me arbitrege me kam karana chahta hu kya karu tell me plz email.send

What details should I email you?

sir, I have read ur articles on MFs…U advice to select best fund from each category, from midcap segment u recommend dspbr mid & small cap fund..but I want to know your opinion on the other categories..like large cap, large and midcap, multi cap…I want to select 5 funds and want to have some exposure to value oriented funds, I am going to invest in DSPBR midcap fund, but can you please help me to choose 4 funds from the below:-

1. franklin india bluechip

2. hdfc equity

3.quantum long term equity

4. DSPBR equity

5. Templeton india growth

6. Templeton india equity income

7. ICICI pru discovery

8.sundaram select midcap

9. franklin india prima

Ajinkya, I prefer not to spoon feed my readers and make their choices themselve because there is no rocket science in selecting the mutual funds.

Just follow one simple rule Choose couple of best fund in each category through ValueResearchOnline and select the one that you think would perform better in upcoming time based on their stock portfolio.

If I do them for you, you will be stuck yet again when re-evaluating them in few months time again.

thanx for your reply..I will do it myself…dont worry i will not held u responsible for any under performing funds…and according to me, if fund performs below its benchmark for 3 consecutive years then only we should replace it….I will select funds myself..just tell me whether I am on right track

1. large cap – franklin India Bluechip (excellent long term returns)

2. large and midcap – Quantum long term equity (very less churning raito, growth oriented, large cap bias)

3. Multicap – Hdfc equity

4. Midcap &small cap – DSPBR mid cap & small cap (investment approach – blend + ur recommendation!)

5. Multicap – Templeton india Equity income (value based approach with foreign equity exposure)

Perfect selection but also consider HDFC Top 200 fund as well.

thanx a lot! I preferred hdfc equity over hdfc top 200…just to avoid repetition of AMC, i have selected templeton india equity income and franklin india because though they are from same AMC, they are different in every aspect..R u suggesting that i should have hdfc equity and hdfc top 200 both in my portfolio?

Fund names or same fund house does not matter. Only thing that matters is past performance and future outlook.

what should be the minimum no of funds we should invest in? i think more than 5 funds is too much for SIP investment..what are ur views?

Minimum is 1 and Max of as many as they help in diversification. I prefer 3 – Large Cap, Mid and Small Cap, Commodities fund and if I had to add one more it would be gold related fund.

Hi Shabbir.

Thanks for the nice article. What do u suggest for a retial participant to make some profit thru arbitrage ?

Alex

Avoid is the best way Alex.

I had read this article before also. However, thank you for reminding the matter again.

Regards

B.Rajendra Babu

The pleasure is all mine.

dear sir,

its a valuable information.was there a possibility of arbitrge trading in REL.media works in recent past. Thank u

Ambika Mishra, it is impossible to check and verify that.

TO OPEN AN DEMAT ACCOUNT WHICH BANK IS GOOD PLS HELP ME OUT.

See http://shabbir.in/stock-brokers-review/ I prefer and recommend ShareKhan Online account but make sure you negotiate the brokerage for 2 paise, 20 paise or else it does not make much sense to go with them.

Shabbirji,

Thanks a ton for this article, In fact I was the one who had asked you for help.

Nagabhushan, the pleasure is all mine. 😀

what does DP means??? Detailed porfolio???

No. It means Depository Participant where you can hold your shares in Digital form.

Check out http://www.sebi.gov.in/cms/sebi_data/attachdocs/1315461854747.pdf

oh acha.. That DP… Thnk u..

DP –> Depository Participant, with whom your Demat Account is hold.