Tax is a very significant portion of our total expense. What if your profit or return on your investments can be tax free or significantly lower in tax?

What is: ebitda – Very simple explanation of EBITDA

ebitda stands for Earnings Before Interest, Tax, Depreciation and Amortization. In simple terms ebitda is earnings capacity of the company with pure operations factors only.

How Can One Remain Safe in this Era of ATM and Online Banking Fraud?

With each new security process being introduced also opens more ways for fraudster to get access to your information and so here are few tips to keep it safe.

What is the difference between EMI & pre-EMI & How pre-EMI differs from EMI?

When it comes to home loan, there is one more jargon that we need to understand and it is pre-EMI. So let me explain what is pre-EMI, how it is different from EMI?

What is The Biggest Lesson of Investing We Can Learn From Pepsi IPL 2015?

Investing lesson from IPL 2015 and it is not about buying an IPL team. You can learn investing from every event and IPL2015 is no different.

Volatile Equities, Unstable Gold & Saturated Real Estate Market – Where Should One Look To Invest In Current Scenario?

When you have more than one investment choice, you are more likely to be paralyzed by the paradox of choice of investing.

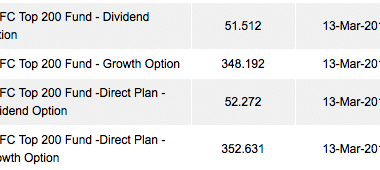

Mutual Fund Plans – Direct Vs Regular Plans

Indian retail Investors are not able to differentiate between regular and direct plan for investing in a mutual fund and so let me explain what it means and when you should be using which one.

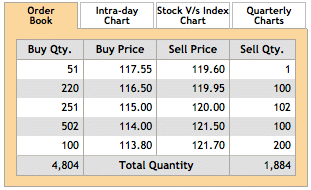

What is: Paper Trading – How to Paper Trade the Right Way

Paper trading is trading with no real money and just with live market price. Let us understand how to paper trade the right way.

Which is The Best Mutual Fund to Invest in 2015?

Let me answer what I think is the best possible investment opportunity in equity mutual fund for 2015.

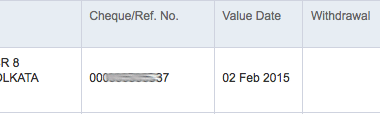

CTS Cheque Clearance – Has Indian Banking Moved Ahead or Behind?

Has CTS Cheque Clearance made Indian Banking Moved Ahead or Behind? Is this a planned strategy to make use of non paper based transaction by banks?

- « Previous Page

- 1

- …

- 30

- 31

- 32

- 33

- 34

- …

- 56

- Next Page »