With 2012 just over, it’s a great time to see the year in review. Let me share some of the most read articles of 2012 as well as some of my best articles of 2012.

Why You Should Invest in Mutual Funds?

An article by Vinay Kumar for making his friends understand why it is important to invest in mutual funds and how mutual funds delivers inflation beating returns that not only saves tax under 80C but returns are tax free as well.

Why It Is REALLY Very Important to Start Investing Early?

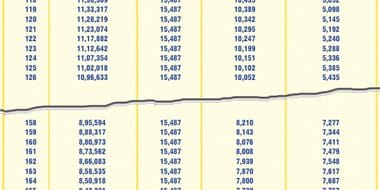

Two individuals, one of them invested ₹3000 for 10 years and yet he made ₹1.43 Crore more than the person who invested the same amount for 30 years in the same asset class with same average return on investment.

Home Loan Or House Rent – How to Make The Right Choice

Should opt for home loan or go for a rented house? Let me share what analysis should be used to make the right choice for yourself – Home Loan or House Rent.

How to Trade in Market With Breakout Chart Pattern?

Breakout Chart Pattern is my favorite pattern for trading in market and this time it was not only me who made tons of money with this pattern but forum members also took the most out of this pattern.

Technical Analysis of Indian Mutual Funds

There is no Open, High, Low, Close values for mutual fund NAV and so you cannot have candle sticks but still can apply the price action chart patterns on mutual fund NAV for technical analysis.

Making Most of Technical Analysis Indicators

Guest Post by Kotak securities where they shares some of the key takeaways for investors and traders when using technical indicators like MACD, RSI or Stochastic.

Technical Analysis Forum

Technical Analysis Forum to discuss stocks, technical’s, investments as well as ways to make forum a better place for everybody to learn and share the art of trading and investing in market.

When to Short A Stock – Intraday Shorting Strategy Revealed

My intraday shorting strategy to understand when to short a stock with Morning Panic and Afternoon Fade chart pattern using chart of Infosys on Friday the 13th

What is Technical Analysis – Why It Works?

What is technical analysis? Why technical analysis works? What is the theory behind technical analysis to work? What are principles of technical analysis? and lastly Why I think technical analysis may work for you as well?

- « Previous Page

- 1

- …

- 36

- 37

- 38

- 39

- 40

- …

- 56

- Next Page »