What is the difference between Close-Ended Funds and Open-Ended Funds and should retail Investor consider a Close-Ended Fund or an Open-Ended Fund?

What is an Open-Ended Fund?

An Open-ended mutual fund is where you buy the units of mutual funds directly from the fund house at an NAV price set by them.

Similarly, when one wants to sell, the fund house purchases the units back from the investor at a NAV price and returns the money to the investors.

Typically the funds that we invest in as large-cap, mid-cap, or small-cap funds in the market are all open-ended schemes. You are free to buy them from the fund house as and when you prefer investing, and they will be more than happy to redeem your units upon request.

What is the Close-Ended Fund?

Close-ended funds are funds where investors can subscribe only during the New Fund Offer (NFO).

If an investor wants to invest after the NFO period, the only option one has is to buy the units from the secondary market. It is much like shares where the number of shares is pre-decided, and depending on the demand, the fund manager’s past performance, and futuristic approach to investing, it may receive an application for NFO.

Once investors subscribe to the units in an NFO, the new investments aren’t accepted or offer a lottery system, like an IPO.

Why we Need a Close-Ended Fund

Unlike in open-ended funds, investors cannot buy the units of a closed-ended fund after its NFO period is over.

So new investors can’t enter the fund nor existing investors exit. However, the closed-ended schemes are available for trading like shares. It enables investors to buy and sell units like the shares of a company.

So once we have an actively traded funds, the price of units may not always be equal to the fund’s net asset value or NAV. It may be higher or lower, depending on the expectations of the fund’s performance.

Similar to shares, closed-ended funds can also have dividends and buybacks.

So, to provide an option to trade on exchanges, close-ended funds are needed.

What are the examples of open-ended funds?

The mutual funds suggested in the best mutual funds for the 2020 series are all open-ended schemes. It means when an investor invests, the fund house issues a new unit to them. Similarly, at the time of redemption, the fund house buybacks the units.

Some example of open-ended schemes include:

- Mirae Asset Tax Saver

- Axis Midcap

- Axis Bluechip

- Kotak Standard Multicap

What are the examples of closed-ended funds?

The closed-ended mutual funds are not very common among Indian retail investors. Much like ETFs, they make a trade, but the volume in them is meager.

The three funds that have a sizeable amount of asset under management within the closed-ended fund are

- HDFC Hsng Opp 1 1140D Nov 2017 (1)

- UTI MEPUS

- ICICI Pru Value Fund-19

Again, because they aren’t traded actively, nor investors are allowed to invest and exit in them and so aren’t very popular funds.

Can I redeem closed-ended funds?

No. One can’t redeem the closed-end funds. However, if the funds are traded in the exchange, one can sell them, or if the fund comes up with a buyback, one can surrender the units. The closed-ended funds typically have an end date, whereas, on the given day, the fund house buys back all the fund units.

So in our above example of funds HDFC Hsng Opp 1 1140D Nov 2017, the fund house came up with the fund in Nov 2017 for 1140Days after which the fund house will buy back all the units, and each investor will redeem the units.

Do closed-end funds pay dividends?

Yes, they do.

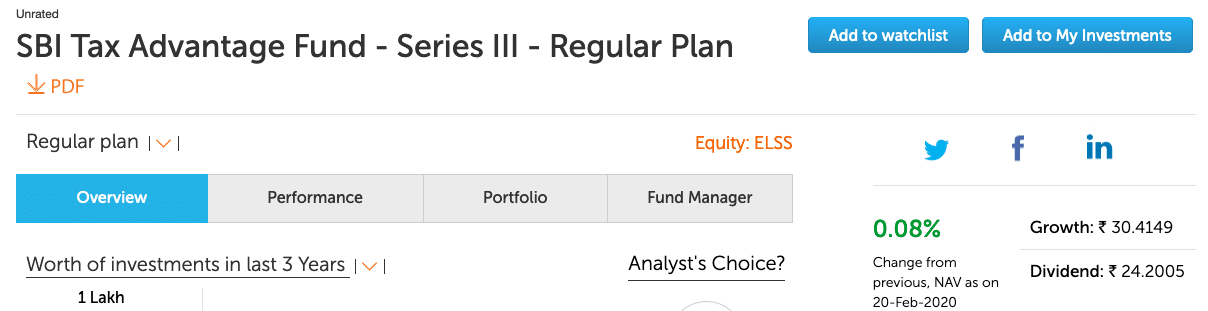

The fund SBI Tax Advantage Fund – Series II or Series III are closed-ended funds, and as we see the NAV, they have offered Dividend as well.

Are closed-ended funds the right choice of investment?

The answer may vary from investor to investor. My personal choice is NO when you have an option to enter and exit fund as and when you want, why one should opt for a fund that has more restrictions unless the performance of the fund is way better than the open-ended scheme.

So no, I don’t think closed-ended funds the right choice of investment.

What are the risks of closed-end funds?

Pretty much the same as the open-ended funds. Investment in equities is subject to market conditions, and closed-ended funds aren’t immune to market fluctuations.

What are the advantages of closed-ended funds?

The fund manager is not worried about inflows and outflows of money. They purely focus on investing the amount in the market and let the profit rides.

So typically, the performance of a closed-ended fund should be better than an open-ended fund.

However, my view is, the restrictions on not able to withdraw at any given point in time outweigh the incremental return from the fund.

How to Buy a closed-ended fund?

The best time to buy into a closed-ended fund is at the time of the NFO period. Later on, if one tries to buy from the secondary market, may end up paying a lot of premium.

Similarly, the best time to sell is when the tenure of the fund ends. Otherwise, one may end up selling at a discount.

Final Thoughts

Closed-end funds aren’t a smart choice of investment in the market for retail investors. Still, it is better to know about them. Over time, they may become better, and as and when an opportunity comes, one may consider investing in it.

Leave a Reply