Everything An Investor Needs to Know About Expense Ratio Before Investing In any equity Mutual Funds in Indian Markets in an easy Question and Answer Format.

What is the Expense Ratio?

The expense ratio of a mutual fund in India is the total expense a mutual fund has to manage it. It includes the salary of the fund manager, the expense of the fund house including the administrative costs, advertising expenses, distribution cost paid as commissions to channel partners, and any other type of fee.

An expense ratio of 1% means each year 1% of the fund’s total assets will cover all its expenses so if the fund has an asset under management or AUM of ₹10,000 Crores and an expense ratio of 1%. It has a yearly cost of ₹100 Crores.

Let us take a real fund example and understand it better.

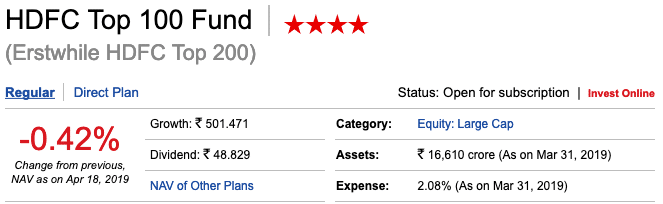

As per ValueResearchOnline, HDFC Top 100 Equity Large Cap Fund which manages ₹16,610 Crores of Asset.

In the regular fund, the expense ratio is 2.08%. So the fund in the past year had a total expense of 2.08% off ₹16,610 Crores which is ₹345.48 Crores.

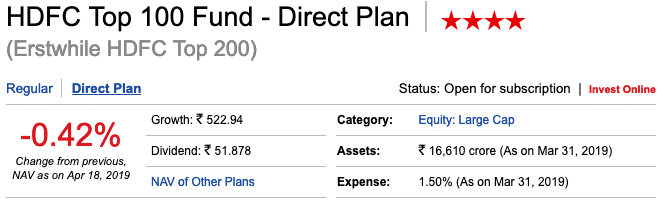

Now considering the direct fund, the expense ratio is 1.5%. So, the fund in the past year had a total expense of 1.5% off ₹16,610 Crores which is ₹249.15 Crores.

There is no bifurcation of how much asset is under direct fund management and how much is under the regular funds, but direct plans exclude the distribution cost which lowers the total expense.

Read: How to Invest in Direct Mutual Funds – A Step by Step Guide and How To Switch From Regular Funds To Direct Plan?

What is Good Expense Ratio for a Mutual Fund?

There is no good or bad expense ratio. The lower, the better.

So, if you find a fund where the past performance of them is at par, invest in the fund with the lower expense ratio.

Is Expense Ratio Charged Every Year?

No, the calculation is daily.

The NAV is adjusted for the expense daily. It is charged daily because, in most funds, there is no lock-in period. One can invest for from few days to weeks. So in that case, the asset under management may rise or fall daily.

So funds also charge expenses on a pro-rata basis daily. Otherwise, the investor holding the fund’s unit at the end of the year may have to bear all the charges which may not be ideal.

The calculation for lock-in period funds or closed funds may not be daily, but all open-ended fund charge expense ratio daily.

The final NAV adjusts after deducting the expenses.

Does ETF Have Expense Ratio?

Yes, they do have an expense ratio as well, but it is very nominal.

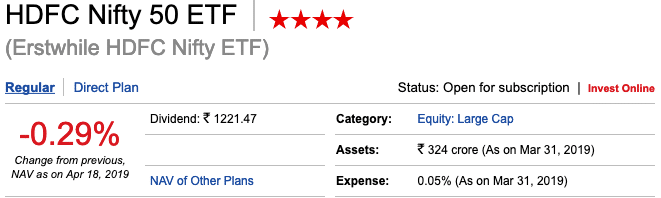

As an example, HDFC Nifty 50 ETF has an expense ratio of only 0.05%.

The reason for such a low expense ratio is, there is no need for a fund manager to manage the allocation of the fund. It is entirely on the constitution of the Nifty 50 Index. It is also one of the main reason why Warren Buffett recommends an ETF over a mutual fund.

Again, when the funds have a benchmark differently than the index, it is better to invest in a fund. For benchmark funds, it is better to invest in the ETF if it is available more so because SEBI has strict guidelines to stick to the benchmarking and minimal a fund manager can do to invest beyond the benchmark.

Does Expense Ratio Include all Fees for Mutual Funds?

Typically yes but it excludes the exit load which an investor may incur if he doesn’t remain invested for a certain period in the mutual funds.

As an example, HDFC Top 100 fund has an exit load of 1% for investors redeeming within 365 days of investing in the fund.

ETF’s don’t have any exit loads but as they are traded on the exchanges like stocks so they may incur the brokerage charged by the broker. Read What is: Exchange Traded Fund – ETF Vs. Mutual Fund

Is the Expense Ratio Excluded from the Total Returns?

Yes. The calculation of total returns is from NAV. As NAV excludes the expenses, the performance, of the funds exclude the expense ratio.

One must see things with a pinch of salt. When we are calculating the total returns, we see the past data. The past performance is from the not so stricter guidelines from SEBI for funds to invest.

So for example past 1-year performance of a large cap was much better than the performance of NIFTY but it may mean the fund was allowed to invest in stocks beyond Nifty as well.

It may not be the case anymore, and so the future performance of a large-cap fund may not beat the NIFTY returns by a significant margin. They now predominantly need to invest in the Nifty stocks only.

The only tool in the hands of the fund manager is to change the allocation in the sectors differently based on their study of what will lead the next market move.

How Expense Ratio Effect the Overall Mutual Fund Returns?

They dampen by the percentage of the total expense. If a mutual fund has an expense ratio of 2% and if another fund has an expense ratio of 1.5%, typically it means the return of the investor will vary by 0.5%.

In case of HDFC Direct and regular funds, as we saw, the total return from the direct plan will be 0.58% (2.08-1.5) higher.

Is there a Limit a Fund can Charge as Expense Ratio?

Yes certainly. Otherwise, the expense ration may have been even in double-digit like insurance.

The maximum total expense ratio or TER allowed is 2.5%.

As the amount of asset under management or AUM increases, the expense ratio keeps decreasing.

For the first ₹100 crore of average weekly total net asset under management the expense ratio can be 2.5%, it reduces to 2.25% for the next Rs 300 crore, then to 2% for the next Rs 300 crore and finally reduces to 1.75% for the rest.

So we don’t find fund’s with an expense ratio of more than 2.5%

Final Thoughts

If you have any questions on expense ratio, please ask them in comments below, and I will be more than happy to answer them for you.

Does it means HDFC Top 100 Fund pays Rs95 Crores as distribution cost?

I don’t think so though I am not sure either. The reason I don’t think it is that way because the amount under management as direct and regular will decide what is the commission being paid. That is how it should be.