Everything you need to know about the Net Asset Value or NAV for mutual funds including the formula for calculation of NAV along with the cut-off time

The Net Asset Value or NAV is the net value of the total asset less than the total liabilities. In the context of Mutual Funds, the NAV or net asset value represents the per-unit price of the fund on a specific date or time.

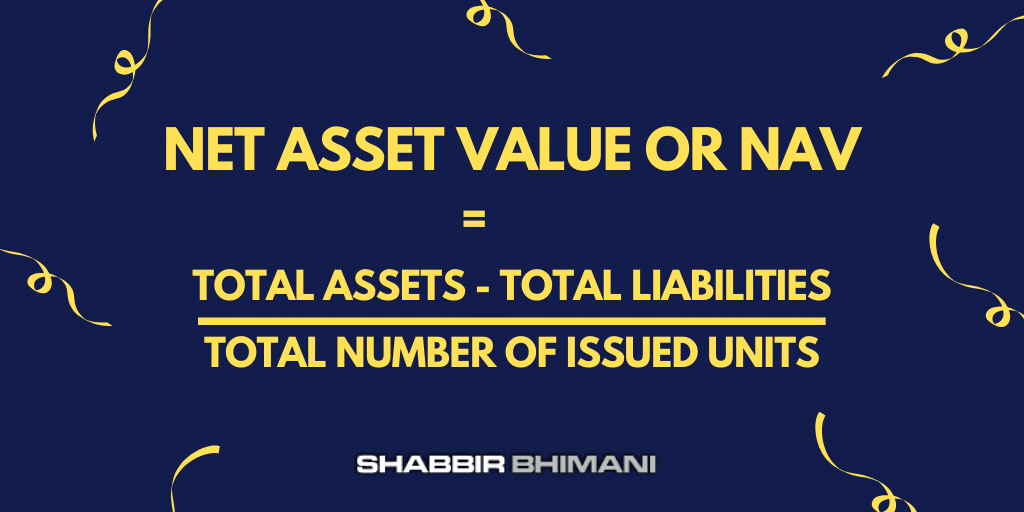

So the net asset value or NAV calculation on a given day for a mutual fund is for the total number of units it has issued for the total asset as an investment in various schemes (equity, debt, as well as cash) less the total liabilities.

Because there is a change in the assets of mutual funds for the difference in prices of the investment in the market, the NAV calculation is at the end of each trading day based on the close market price.

Ideally, the mutual funds’ NAV changes as the market trades. However, mutual funds don’t trade in real-time. Instead, they update the NAV at the end of the day. One of the main differences between mutual funds and ETF.

The fund’s NAV thereby represents a “per-unit” price of the fund to help in buying and selling them more manageable.

NAV Formula

The formula for a mutual fund’s NAV calculation:

However, the calculation of NAV for units in each plan of the scheme is in the manner provided in the offer document.

The difference between today’s closing net asset value (NAV) and the previous day’s closing net asset value (NAV) is known as the change in NAV. Ideally, it is in percentage terms.

Assets for Mutual Funds

The asset for a mutual fund is the investment by the mutual fund. It may include investment in the shares of the company, investment in the debt market, or even cash in the books, including the interest earned.

All investments by the funds are an asset.

Liabilities for Mutual Funds

The liabilities of a mutual fund typically include money that is pending. It can be the money they may have taken as loan from banks or NBFCs, pending payouts of the redemption units, pending dividend payment, and fees, including the salary.

All pending payments are liabilities that can be either long-term or in the short-term.

The importance of Cut-Off Time for NAV

As ordered by SEBI, the cut-off time for mutual funds NAV is typically 1:30 PM.

It means the buy and sells orders the fund receives before 1:30 PM will be executed at the NAV of the same day.

The orders mutual fund receives after the cut-off time are processed for the NAV of the next business day.

Hi

i am a student. I have a saving of around 25k. I want to invest in MF or Index as the current NAV is comparitively low. Can you please tell me where should i invest? Index fund or mutual fund. And in case of index fund which fund Nifty 50 or nfity next 50.

Index funds are a better choice. Read https://shabbir.in/index-funds/