In a large-cap company, lower promoter holding can be acceptable to an extent but for a midcap and more so for small cap, I don’t prefer low promoter holding. So let me share what I consider an ideal promoter holding for a particular size of the company before investing.

In a large-cap company, lower promoter holding can be acceptable to an extent but for a midcap and more so for small cap, I don’t prefer low promoter holding.

So let me clarify everything one needs to know about promoter holding before investing in any company.

What is Promoter Holding?

In a very simple language, promoter holding is the percentage of the total company held by the promoter.

The promoter holding is expressed in terms of percentage. So companies total number of shares is 100% then what percentage of it is still held by the promoters or owners of the company.

How to check Promoter Holding?

It is important to check the most recent promoter holding in a company as well as the number of shares pledged by the promoter.

Once you are comfortable with the current ratio of promoter holding, one can move to investment checklist then do the fundamental analysis and finally check out the business and operations before investing.

I use ValueResearchOnline, Investello and BSE website to check the promoter holdings.

ValueResearchOnline

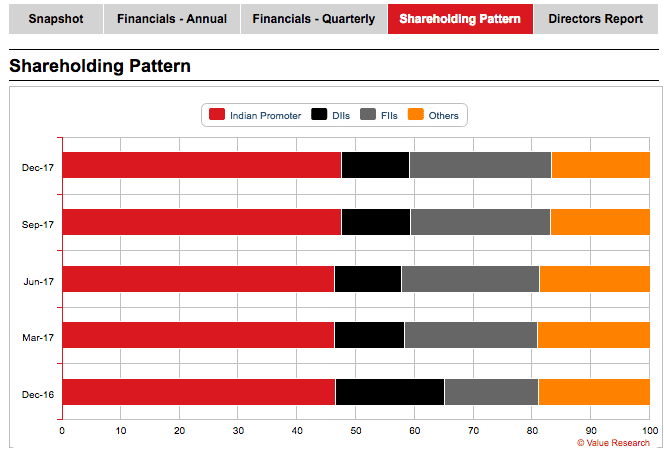

ValueResearchOnline has a ShareHolding tab for each company that shows how the shareholding pattern has been shaping up for a company in the last 5 quarters.

Investello

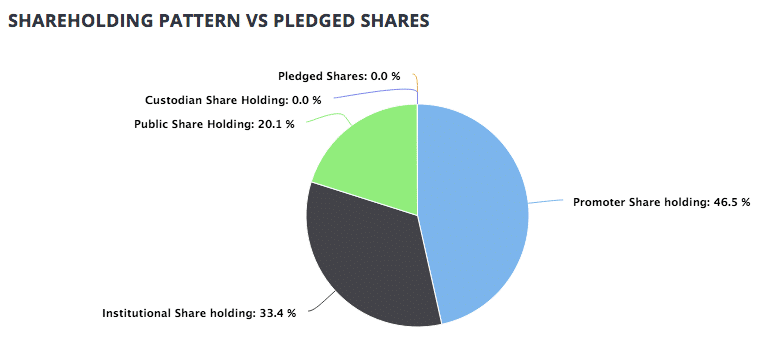

Investello not only have the shareholding pattern but also the pledged shares of the stock. The shareholding pattern is at the very bottom of the safety tab.

BSE India

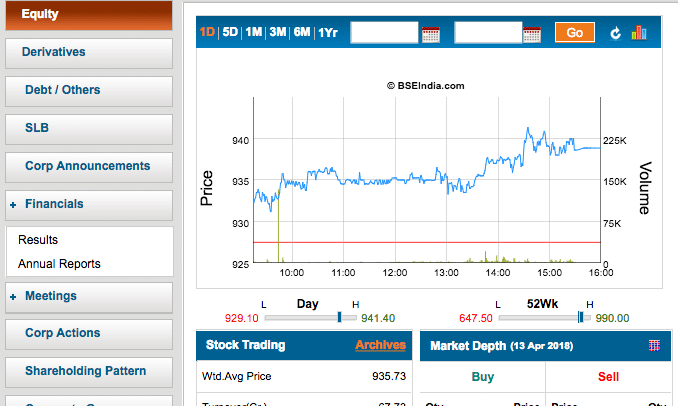

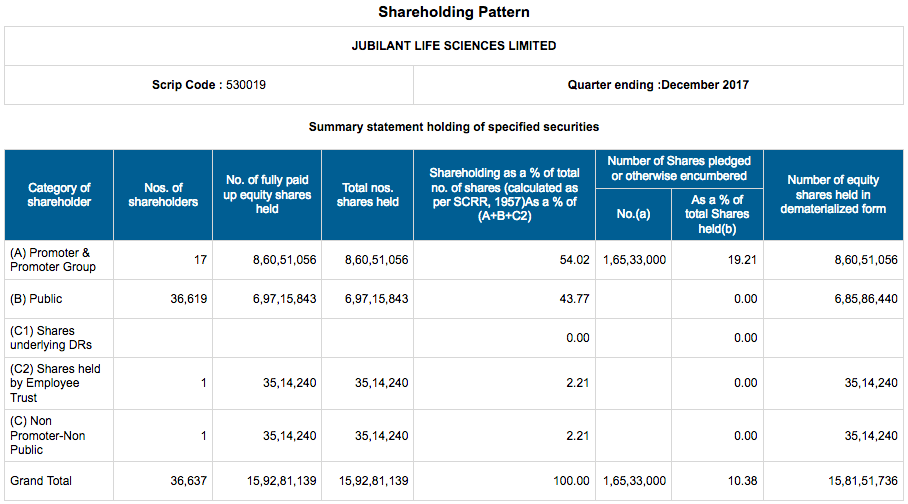

We have BSE India where everything is in textual format but in much more detail. The Shareholding pattern link for every stock is in the left sidebar.

And you can check the details of how many promoters holding has changed for each quarter as reported to the exchange.

We also get the shares pledged by the promoters. It is important to take a note of the shared being pledged by the promoters.

Why Promoters Reduce Holding?

Promoters want capital to grow the company and the business. So promoters float an IPO where they can get maximum value for their business and get the capital needed for the company to grow, expand, pay off the debt etc.

If the business is doing good, every company want to be expanding and will need more capital. So they sale stake in the company and thus reduce their holding.

At some point, better businesses run by awesome management don’t need more capital from investors. The business itself can self-grow.

Better capital utilization by the management is the key. These are the kind of business that can grow faster for a long period of time.

Why is Promoter Holding Important?

Some business is capex heavy and may need more capital for setup and operations whereas others aren’t a capital-intensive business. Getting listed on NSE and BSE is the first step to raising capital for a business willing to scale up but it isn’t the end of the need to raise capital.

When the company is small and need to grow further, it may raise more capital in the future thus reducing the promoters holding. If the promoters holding is already low, it will get lower in case the company needs more capital for future expansion.

So for a small cap company with a low promoter holding, and if they raise more capital, the promoters holding soon may reduce so low that they may lose interest in the company.

Once the company is already a midcap, slightly lower promoter holding is ok because it means the company has grown to a level where they may not need a lot of capital and the businesses cash flow can take care of the future expansion plans.

As the company becomes a large cap, the need for further capital may not be needed. The cash generated from the operation can be enough.

Let’s say a company wants to set up a new factory for expansion, the small-cap company may need to raise capital but for a midcap company the operations and loan can be enough but for a large-cap company, only retaining the income from operations may be enough. Again it depends from company to company and sector to sector but just a general viewpoint.

My Rule of Thumb for Promoter Holding

So my rule of thumb for the promoter holding

- Small Cap – I consider small-cap companies with market cap of ₹ 100 Cr to ₹5,000Cr and prefer a promoter holding around 70%.

- Midcaps – Companies with a market cap of ₹5000 Crore to ₹50,000 Crores and promoter holding between 50% and 70%.

- Large caps – I don’t give too much importance to promoter holdings though I don’t like companies with under 25% promoter holding.

* The above market cap is set by me as it helps me but feel free to change as you see helpful.

Often when promoter reduces it’s holding in the company, it is seen as negative by the shareholders and it isn’t true. What is important is to understand why the promoter’s are reducing their stake in the company and what will the money be used for.

Final Thoughts

There is no general rule that can apply to every company or even a set of companies as to what promoter holding is good and what isn’t. Within the same sector, we have diverse promoter holding. Infosys has under 15% as promoter holding and TCS has more than 70% promoter holding. HDFC Bank has 25% promoter holding and Kotak bank has 33% promoter holding.

HDFC Bank promoter holding is 25% as per the BSE website.

Thanks for pointing that out and it is now rectified.