Understand Standard Deviation and what experts mean when they say one or two standard deviations away from the mean

If you follow the news channel, I am sure you may have heard the term Standard Deviation like “one standard deviation from the mean.”

What does it mean?

We will understand everything about the mean and standard deviation and what it means for the retail investor in an easy to understand form.

Let’s begin with the formula first, and then we will simplify it to apply it to markets.

What is Standard Deviation?

The standard deviation is a statistical formula to calculate the diversification of the dataset relative to its mean.

It is the formula to calculate the difference of the data relative to the mean in simple language.

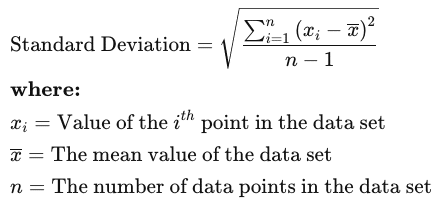

The mathematical formula for standard deviation is:

The mean is the value that one gets by adding the data set and dividing it by the specified number of elements.

Simple Example of Standard Deviation

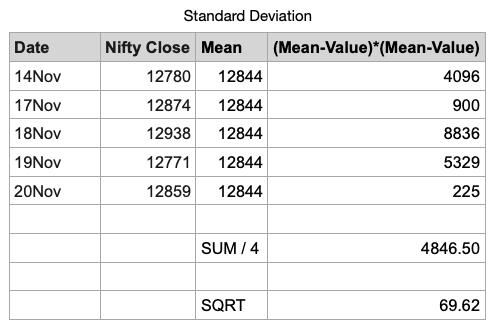

Let us do a simple calculation of standard deviation for the Nifty for the past week only. It is only for the sake of understanding.

| Date | Nifty Close |

|---|---|

| 14Nov | 12780 |

| 17Nov | 12874 |

| 18Nov | 12938 |

| 19Nov | 12771 |

| 20Nov | 12859 |

Now the mean is the sum of these closes and divides it by 5. The value is 12844. (I am not considering the amount beyond decimal to keep it simple)

Now we have to calculate the standard deviation from the mean for these five values.

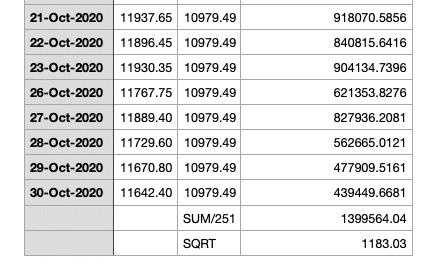

Here is the table to do it.

We subtract the mean from the value and square it. Then take the sum of the numbers and divide it by n-1, which is 5-1 or 4.

Then we take the square root of that number, which is now ~70.

The significance of 70 is that when Nifty is above 70 points from the mean of 12844 – it is termed as one standard deviation above the 5-day average.

When the Nifty is above 140 points from the mean, it is termed as two standard deviations above the 5-day average value.

Ideally, one should use a longer time frame, like 52 weeks or 12 or 24 months, and do the same calculation.

Use of Standard Deviation

Now we know how to calculate standard deviation but what is more important as an investor is to use it for investing.

A standard deviation is a useful tool in analyzing the risk as it measures the market’s volatility concerning the mean.

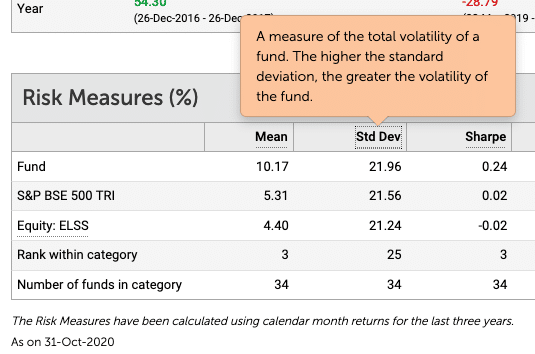

Typically, the standard deviation isn’t calculated for the stocks but the indices, ETF’s, and funds.

Here is the standard deviation calculated for Mirae Asset Tax Saver Fund – Direct Plan at ValueResearchOnline.

A massive difference shows how much the fund is deviating from the benchmark.

68–95–99.7 Rule

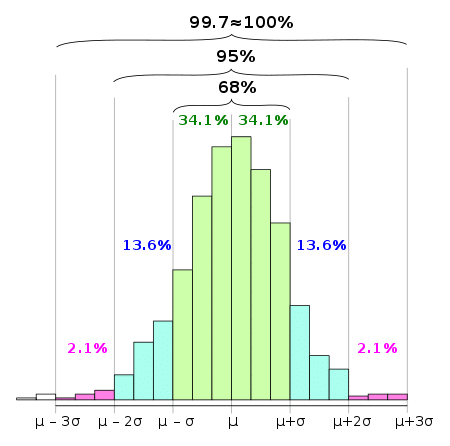

The 68–95–99.7 rule states that the value within one standard deviation of the mean account for about 68% of the set. In contrast, within two standard deviations account for about 95%, and within three standard deviations account for about 99.7%.

Read More about the rule from Wikipedia.

Applying the same to investing, one can assume there are 68% chances that the market will revert to one standard deviation.

The other way to look at it is, when the market is below the two standard deviations, there is a 95% probability that it will revert to the mean.

Similarly, if the market is above two standard deviations from the mean, there are 95% chances to revert to the mean.

When prices give a very high swing, the standard deviation is higher than usual, so it has a high probability of reverting to the mean.

Final Thoughts

One can download Nifty’s historical data from the official website and do the calculation in a spreadsheet.

You can copy my spreadsheet and paste the data for the past 365 days of NSE.

Nifty’s mean for the past 365 days is ~10980, and the standard deviation is ~1180.

So around 13k, the Nifty becomes two standard deviations away from the past one year mean. Now we know what it means.

Markets that move slowly are more likely to sustain because it means the mean moves higher as well.

They aren’t too away from the mean and are more likely to have very low volatility.

Hi Sabbir

I am Salim Kotadiya from Ahmedabad. I am NISM 8 certified derivatives traders. Do you have any tools to trade options.

Nope. I don’t trade in options and don’t recommend it either.