What is no-trade zone, and how can a retail trader calculate the target levels based on stop loss, support, and resistance. Understand with a live example of Marico India.

Last week we saw Stop Loss, and today we will consider its counterpart the target. The right calculation for the target levels is crucial for trading success, and I will show it with a live example.

So much ado let us directly dive into it.

How to Calculate Target Levels?

The most critical aspect of trading is to be able to calculate the stop loss and target levels in seconds. When you are trading, the stop loss and target levels should be right in front of you. Otherwise, it is impossible if one needs to follow a mathematical process to get them.

So how can we easily calculate the target levels?

The formula to calculate the target is At least 1.5 times the stop loss amount.

Each word in the statement is essential. The first word is “at least.” So the target can be two times the stop loss amount or even 2.5 times the stop loss amount, but it is never one time the stop loss amount.

Next is 1.5 times the stop loss amount. So, let us understand the word 1.5 times in the above equation as well as the word stop loss amount.

In trade, if your stop-loss is of ₹10k, the target should be a minimum of ₹15k or is 1.5 times the stop loss amount.

The 1.5 times isn’t any random number. There is a science behind it as well. Let me explain the science behind the 1.5 with the success ratio.

What is Success Ratio and Why it Matters?

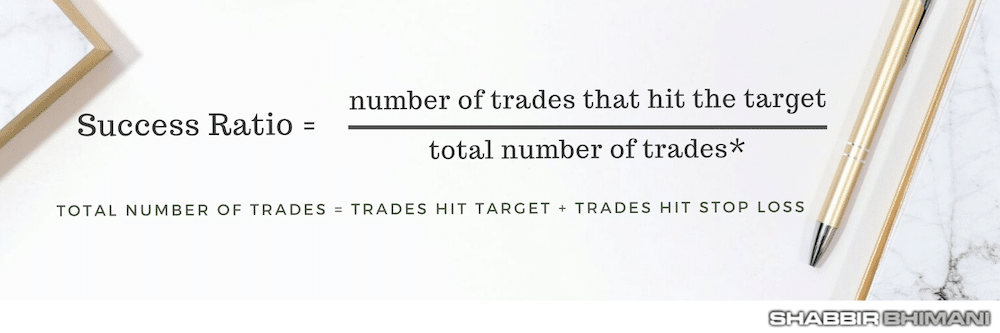

In trading terms, the success ratio is the ratio of a number of trades that are successful or hit the target to the total number of trades. It is represented in percentage.

Mathematically the Success Ratio is represented as:

For calculation sake, let us assume the stop loss amount for each trade is 5%. So when a trader is ready to lose 5%, his target level is a minimum of 7.5%.

So on a price of ₹100, stop loss becomes ₹95 and a target of ₹107.5.

So, if a trader executes 20 such trades in a month with 50% as success ratio, he will lose in 10 trades and win in 10. So a loss of ₹50 (₹5 x 10 trades) and a gain of ₹75 (₹7.5 x 10 trades) will ultimately result in a gain of ₹25.

With 20 trades of ₹100, each means the capital of ₹2000 (₹100 X 20), and he makes a profit of ₹25 or ~1% per month.

So, 1.5 times, the target is the bare minimum one should aim for.

I agree 50% success ratio is slightly on the lower side, and typically one can have a success ratio of anywhere between 60 to 75%.

- With a 60% success ratio, the loss is ₹40, and the gain of ₹90 makes a profit of ₹50 or a return of ~2.5%.

- With a 70% success ratio, the loss is ₹30, and the gain of ₹105 makes a profit of ₹75 or a return of ~3.5%.

Understand the Return on Investments?

The return on investment for a trader is a factor of success ratio.

From the above calculation, it is easy to conclude that to make returns between 2 to 3% per month; a trader has to have a success ratio between 60 and 70% with a stop loss to a target ratio of 1.5 times.

Again, a success ratio of above 70% is challenging to achieve for a consistently long period.

However, a target of more than 1.5x is possible.

So to make a better return on investment consistently, one has to keep higher than 1.5 times target to stop loss level.

When The Trade Becomes a No Trade Zone?

I am sure it is now clear why you should have a target that at least 1.5 times the stop loss amount.

Ideally, the stop loss is never based on the percentage but is a level below the key support level.

Once we have the support, the target becomes known. So in a couple of circumstances, the trade setup becomes a no-trade zone:

- The support level is too deep, making the stop loss amount very high. So at a current market price of ₹100, if the stop loss is at ₹85, it becomes a no-trade zone as it can be a massive loss if one has to execute a stop.

- The target level is above the significant resistance level. So at a current market price of ₹100 with a stop loss is at ₹95 and a target of ₹107.5 becomes a no-trade zone if significant resistance is at ₹105.

Let us understand the stop loss and target level with a live example because often, the same trade setup may be a no-trade zone based on where one sees the support.

Live Chart Example for Stop Loss and Target Levels

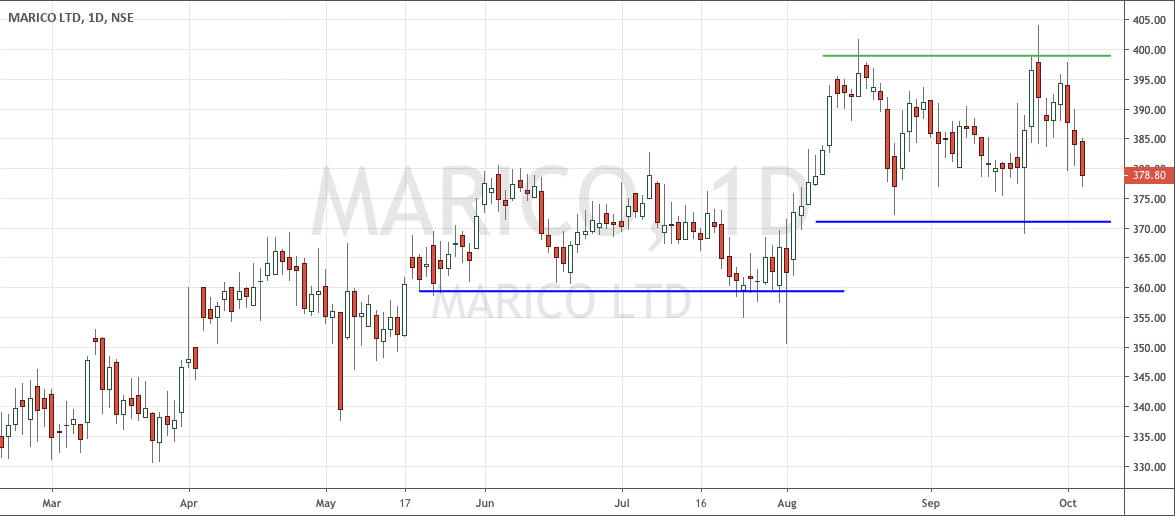

Let us now calculate stop loss and targets from the chart of Marico India.

Chart by TradingView

You can see two blue lines which are support trend lines at ₹370ish and ₹360ish.

The green line is a significant resistance level just below ₹400.

As a trader, the current market price or CMP is ₹379.

As a short term trader, if it is ok to take intermediate support of ₹370, the stop will be just under ₹370. For calculations, let us make it ₹369.

So our stop loss amount is ₹10. So the target should be at least ₹15 or ₹394, which is under ₹400, and so it is a good trade setup.

Now assume a positional trader who doesn’t consider intermediate support of ₹370 but want to go for a significant support level of ₹360. So his stop loss is ₹359.

So a stop loss amount is ₹20, the target should be at least ₹30 or ₹409 which is above the significant resistance level of ₹400 making it a no-trade zone for a positional trade.

For a positional call, the scenario of stock going past ₹400 may be a better trade setup because the stop loss of ₹40 (₹400 – ₹360) and a target of ₹460 seems reasonable as the stock will be in all-time high region with no significant resistance between the ₹400 and ₹460.

Trading is more about buying high selling higher.

Final Thoughts

I hope the article helps every Indian retail investor understand the calculation for target and trade based on return on investment.

Short and simple yet bang on! You made trading unbelievably easy within few sentences whereas people asking for thousands for few tips. Thank you.

The pleasure is all mine Sampat.