Everything a retail investor needs to know about rights issue. Explaining everything from the recent rights issue example of Reliance Industries

Let me share everything an investor needs to know about the rights issue.

What is the Rights Issue?

The definition in simple terms is:

An issue of shares offered at a discount by the company to its existing shareholders in ratio to their holding of old shares.

The issues help in the company to raise capital that can be used to expand the business to fuel growth.

Ideally, companies use the profit to grow business. However, at times a significant investment in the business is needed. So they raise the money via the rights issue.

There are multiple ways to raise money, and QIP is one other way to raise money.

Examples of Reliance Industries

Reliance Industries has the record date for its rights issue as of May 15th. It will raise ₹53,125 crores will open for application on May 20th and the close on June 3rd, 2020.

It is the first rights issue by Reliance Industries in nearly three decades.

The company has fixed the issue price at ₹1,257 per share. The day the price was fixed was April 30th. On that day, the price of Reliance Industries trading in the market was around ~₹1,455.

So the company offered a discount of ~₹200 to its share price for existing shareholders to apply for the issue.

So anyone having Reliance Industries in their demat account on the closing day of May 15th, 2020, can apply for rights issues between May 20th and June 3rd, 2020.

As we have t+2 settlement, which means if you buy a share, it takes two trading days for the shares to get into your demat account.

So for shares of Reliance Industries to get into your demat account on May 15th, you needed to buy it on May 13th.

The ratio for application is for 15 shares in the demat account; one can apply for 1 share.

Some Common FAQ’s About Rights Issue

Let me answer some of the common FAQs about the rights issues. If you have more questions, feel free to ask them in the comments. I will be more than happy to add them here and answer them for you.

Are rights issues good or bad?

No one answer fits all. The rights issue is to raise money from the market. Companies need capital for many reasons, including an acquisition, set up a plant, and so on.

So how the company is going to use the fund will decide if it is good or bad for the company. Are they investing in the right direction or making a bad one.

How do I participate in rights issues?

Once you have the shares in your demat account on the record date, the day when the subscription for rights issue starts, you will have an online option in your demat account to apply.

However, you can also apply offline as well. The best is to contact your broker and ask for the details for the application for the rights issue.

Should I buy shares in a rights issue?

Again, it all depends on the price and the ratio at which it is being offered.

In the Reliance Industries example, the share price for the stock was ₹1455, and the rights issue was at a price of ₹1257. Moreover, you could apply for 1 share for holding 15 in the demat account.

Let’s assume you get 1 share for each of the 15 shares you hold. So your average purchase price of the 16 shares become:

= (1455*15+1257)/16 = ₹1442

If you are fine investing in the company at that price, you should be fine applying.

What are the advantages of the rights issue to Investors?

The discount is offered to the current price is the main advantage of the rights issue for the investors.

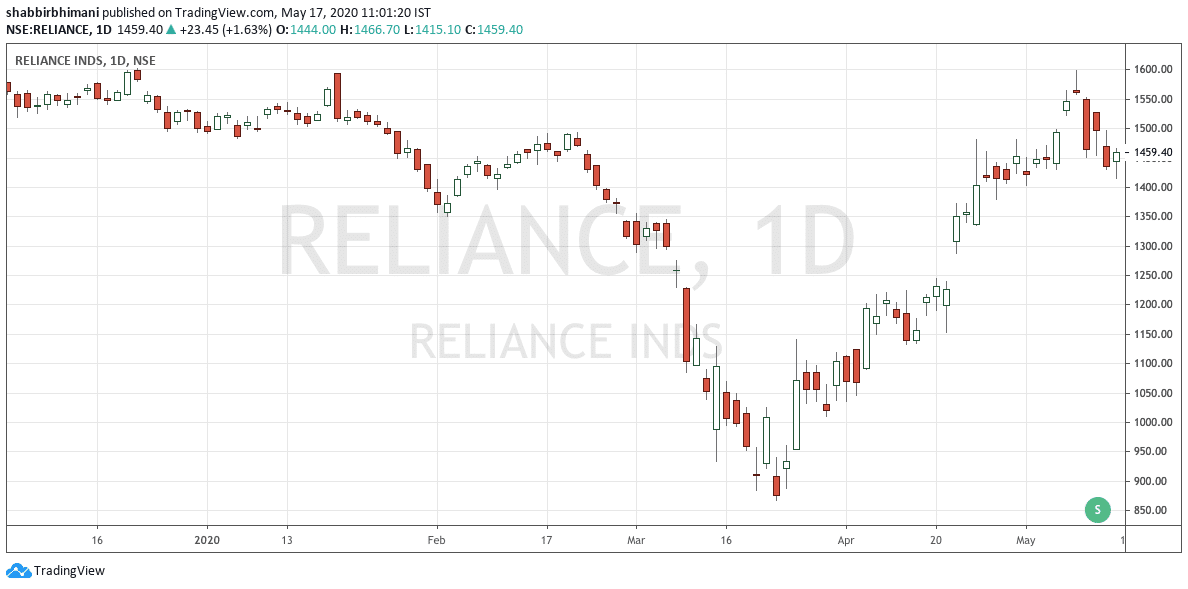

However, in the charts above, one can see, the share price started to rise from ₹950 levels to ₹1450 levels just before the announcement of the rights issue.

How do you sell the shares of rights issues?

After the rights issue end date, there will be a new date that the company will announce to allocate the extra shares to your demat account.

Once you have the shares, you can sell them like regular shares. However, remember it is the same day when everyone receives the shares. So it can mean there is a considerable selling pressure as well.

What kind of affect rights issues have on share price?

Depending on which day you are looking at the share price, there will be an impact. If the rights issue is offered at a significant discount and is lucrative for investors, the days before the record date, there will be a surge in demand to be able to apply for more shares.

Once the record date is done, the stock is an ex-rights issue, which means the demand will be sluggish, and stock price can come down.

The day the newly issued shares hit the market, there can be additional pressure on the price as investors pile up to sell their allocated shares.

Do rights issues increase market cap?

No, the rights issue directly doesn’t increase the market cap of the company. The issue of extra shares should ideally dampen the market cap of the company by the same amount. However, as the stock is being traded in the market, there can be an extra demand for the shares, which may increase the companies market cap.

In our example of Reliance Industries, pre-right issues, the stock price increased from ₹950 to ₹1450. It is an increase in more than 40%.

Then because rights issue was lucrative, the price went even further for an increase in demand for the shares.

Ex-Rights Issue the share price is back to ₹1450.

Does a rights issue reduce share price?

The share price does reduce on the Ex-Rights day as well as when the extra shares hit the market.

However, depending on how the company is going to use the capital, the growth may be around. Still, the most important aspect is the use of capital that will decide the share price and not the rights issue itself for the long-term investors.

Thanks for sharing the information in simple yet profound manner.

Could you please help understand if the preferential issue lock-in dates are just round the corner and the company opts for rights issue, what does it signifies ? And how it can impact price movement in both the scenarios comparatively.

Price movement is based on the market sentiments and how the market is viewing both the events. On a daily basis, they seldom follow the fundamentals. I have seen stock rallies based on the fact that they have declared stock split.

Excellent and simplistic information for the common layman without much of commercial jargon.Thanks.

The pleasure us all mine.