What critical information to look in the annual reports before investing in any company and how to judge the management and the future outlook of the company.

ROCE – Understand Financial Efficiency of Management

ROCE stands for return on capital employed, which helps us understand the financial efficiency of the business and the management.

What is PE Ratio & Why It Is An Important Factor in Valuing a Stock?

Understanding the PE ratio and how to calculate forward PE ratio. Why the growth outlook doesn’t help even the long-term investors make money from the market?

The Type of Stocks I Avoid Investing Now and Why?

Understanding the current market correction, the stocks and sectors to avoid now but more importantly where to look for next market leaders and multi-baggers

Is It Ok To Give PoA (Power of Attorney) To Stock Brokers?

Giving PoA doesn’t mean all your wealth is now with the stockbroker and he can kick you out from where you live. It only happens in movies or tv serials.

How I Use these 7 Sites For All My Fundamental & Technical Analysis

How I use these 7 websites Screener, Investello, ValueResearchOnline, MoneyControl, BSEIndia, ChartInk, TradingView to quickly reject not so good investment opportunities

The Little Book That Still Beats the Market

The screener query to the Joel Greenblatt’s magical formula from the book “The Little Book That Still Beats the Market” along with my view on the magical formula.

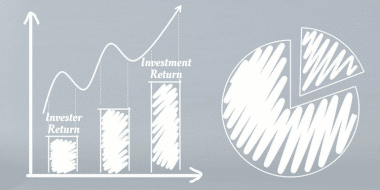

Investment Return Vs Investor Return – Why Investors Earn Below Average Returns?

The average retail investor isn’t able to create wealth in the market despite markets doing so well. Why there is so much gap between investment return and investor return?

How to Know if A Stock is Overvalued or Undervalued?

Is there any process to judge if the company is overvalued or undervalued? The answer is yes. I share my complete process to find out if the company is overvalued or undervalued.

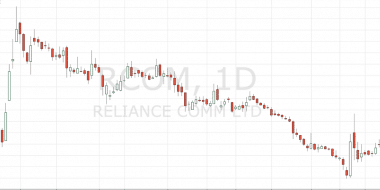

Circuit Filters or Circuit Limits – Why Some Stocks Can Rise or Fall More Than 20%?

Answering reader question: Why some stocks like RCOM can rise more than 30% but stocks like Vakrangee or Manpasand Beverages stop trading after 5% change in price? Why few stocks have the circuit limits?

- « Previous Page

- 1

- …

- 16

- 17

- 18

- 19

- 20

- …

- 56

- Next Page »