Stocks added in Jan 2016 to my portfolio and plans for Feb 2016 with details of why I added Ashok Leyland heavily and how to capitalize the shocks Mr. Trump can give to Indian equity market.

A report I share each month on the progress of my portfolio of stocks and mutual funds with reasons of each and every stock that I own along with contract notes of trades executed in the current month and share plan for the coming month.

Note: This is not my complete portfolio in the market and I may have open trading positions as well as some previous investments prior to Jan 2016 and other riskier small and micro cap investments.

The major part of demonetization is behind us and the quarterly results that I have seen till now look good as well. Still, I have a keen eye on the upcoming results of companies in my portfolio and will add positions only when I get a clear picture of the impact of demonetization.

Ashok Leyland

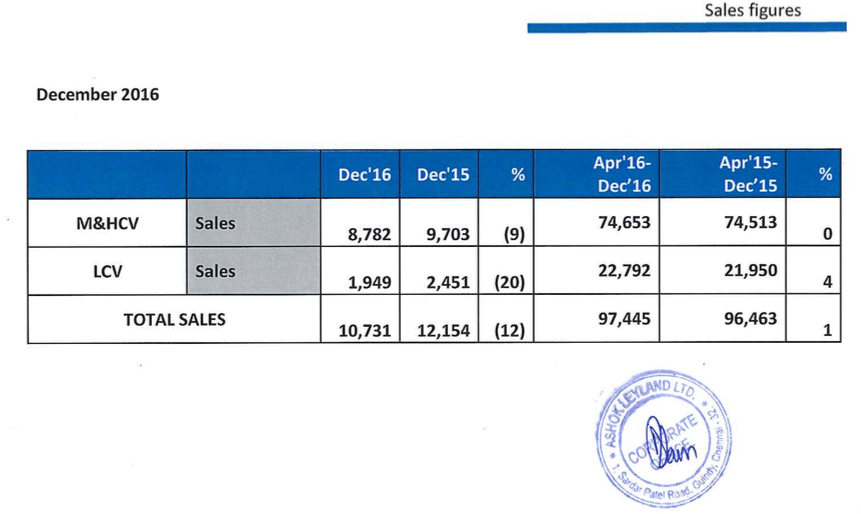

Ashok Leyland is my first investment of 2017. Added a position just after I saw the December sales number for the company which had very less impact of demonetization.

You can check out the same report on the BSE website.

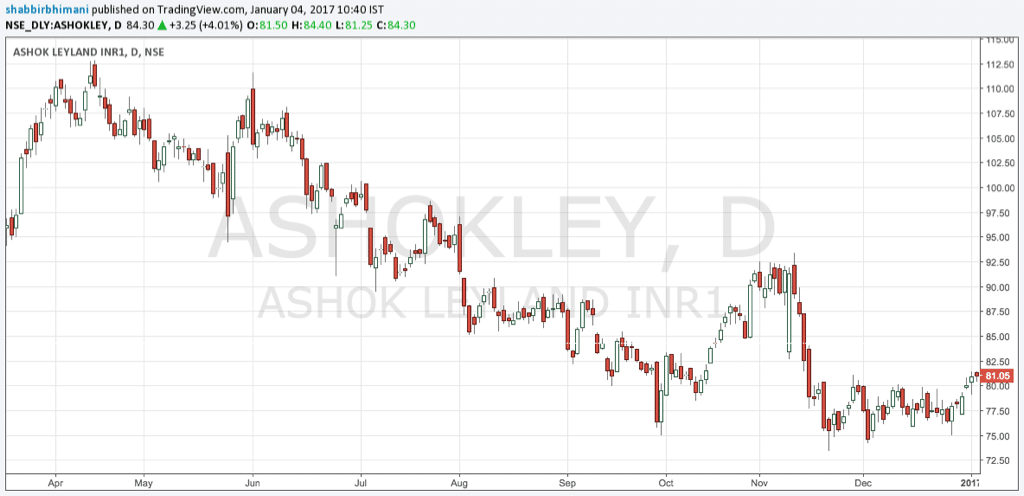

Technically the stock has also formed a solid bottom around the ₹75ish level.

Charts by TradingView

My position was based on December sales number and good bottom being formed. Contract notes of Zerodha attached.

Later I analyzed quarterly results and my views are result was awesome. I focus on sales growth which can lead to other numbers and figures falling in place in the long run. The market did not take numbers that positively but positive management commentary took the stock price higher. Will wait for a significant correction to add more position.

Pidilite Industries

In my last month’s report I expected a recovery and that is exactly what happened. Though I did not expect such a sharp recovery but it made my portfolio look much better. Still, I want to see quarterly results which are coming out today (1st Feb 2017) along with the budget.

Britannia Industries

I am upbeat on Britannia Industries but still, prefer to wait till 13th Feb 2017 for quarterly results to get a clear picture of the impact of demonetization.

Jubilant Foodworks

Jubilant Foodworks is one of those stocks which has not performed as I would like to but again this is a company that is expanding in sales but at the cost of margins which is not taken positively by the market and rightly so for a stock trading at 50+ PE.

I will look at the quarterly results on 6th Feb 2017 and want to analyze the impact of demonetization and then decide next line of action for this stock.

Portfolio Update

Capital investment increased from ₹15,51,729 to ₹16,32,676, an increase of ₹80,947 in the month of January. The performance of the portfolio built so far is as follows:

Profits Realized

- Infosys: 780 (60)

- Average Buy: 1165

- Average Sold: 1178

- Tata Steel: 9,200 (400)

- Average Buy: 280

- Average Sold: 303

- Larsen & Toubro: 2,080 (20)

- Average Buy: 1241

- Average Sold: 1345

Total Profit Realized: 12,060

Dividends

- Zydus Wellness: 325

- Larsen & Toubro: 365

- Jubilant FoodWorks: 250

- Britannia Inds.: 900

- Birla SL Tax Plan: 8,581

- DSPBR Tax Saver: 1,460

Total Dividend Received: 11,881

Stocks

Stocks I am holding in my portfolio along with the link to why I have invested in them.

- Ashok Leyland 1,81,500 (2000) [Why]

- Invested: 1,60,192

- Profit: +21,308

- Britannia Inds. 1,40,870 (45) [Why]

- Invested: 1,18,731

- Profit+Dividend: +23,039

- Jubilant FoodWorks 87,615 (100) [Why]

- Invested: 1,09,503

- Loss+Dividends: -21,638

- Jubilant Life Sciences 2,01,420 (300) [Why]

- Invested: 1,34,636

- Profit: +66,784

- Pidilite Industries 6,73,500 (1000) [Why]

- Invested: 7,18,864

- Loss: -45,364

- Zydus Wellness 2,16,800 (250) [Why]

- Invested: 2,04,690

- Profit+Dividends: +12,435

- Total Stocks: 15,01,705

- Invested: 14,46,617

- Profit+Dividends: +56,564

Mutual Funds

- Birla SL Tax Plan-D: 1,12,305

- Invested: 1,05,000

- Profit+Dividend: +15,786

- DSPBR Tax Saver-D: 1,07,498

- Invested: 1,05,000

- Profit+Dividend:+3,958

- Total Mutual Funds: 2,19,803

- Invested: 2,10,000

- Profit+Dividend: +19,744

Overall

- Total Portfolio Valuation: 17,21,509

- Capital Invested: 16,32,676 (Total Investment in stocks & mutual funds less dividends receieved and realized profits)

- Unrealized Profit: +88,833

- Dividend: +11,881

- Realized Profit: +12,060

Big sigh of relief as my stock portfolio and overall portfolio both turned positive.

Plans Ahead

The large part of demonetization is behind us but Mr. Donald Trump and FED can give some shocks to Indian equity market.

I am very hopeful the shocks will come sooner than later and I would like to capitalize such opportunities.

Also, will have an eye on the outcome of budget and see if I can spot any good investment opportunity.

Over to you

If you have any questions or comments share them in comments below and I love to respond to them.

I have MMTC at 68, what do you foresee for this stock? I have been very patient,but I am losing other opportunites to invest my money.As of now it is in deep loss.

The company is not able to operate profitably ( https://www.screener.in/company/MMTC/ ) and only because of other income is manage to stay profitable is not something that I would invest in. Trading is fine.

Their profit increased by a lot as per last quarter (dec 2016). Even though demonetization happened.There is still no change in price.

If you are tracking this company, thats the best part and I don’t track it but just make sure the profits are not one off.

I have NHPC bought at 32, can we expect it will move upwards from now. Since there is a buyback.

Those news based upward movement are best captured in technicals and not fundamental. Technically 32 is a strong resistance and so it looks like unlikely as of now.

I have about 43.64% in IT now getting beaten, nice to see a portfolio with nice profit.

I also had IT in my portfolio but in August 2016 had let it go and not because I could foresee what is happening today but had doubt on the growth – https://shabbir.in/portfolio-aug-2016/

From -66,048 to +88,833 and that is jump of 1,54,881 which is like 10% increase. That’s awesome. Keep going.

Ohh I never looked at it from that point and thanks for letting me know that.