Why DSPBR Tax Saver mutual fund added to my portfolio along with plans for November. My portfolio crosses a major milestone of 15 lakhs in October 2016.

A report I share each month on the progress of my portfolio of stocks and mutual funds with reasons of each and every stock that I own along with contract notes of trades executed in the current month and share plan for the coming month.

Note: This is not my complete portfolio in the market and I may have open trading positions as well as some previous investments prior to Jan 2016 and other riskier small and micro cap investments.

The plan for October was to keep away from investing in stocks and focus only on tax saving option. As planned, I invested in DSPBR Tax Saver fund.

DSPBR Tax Saver

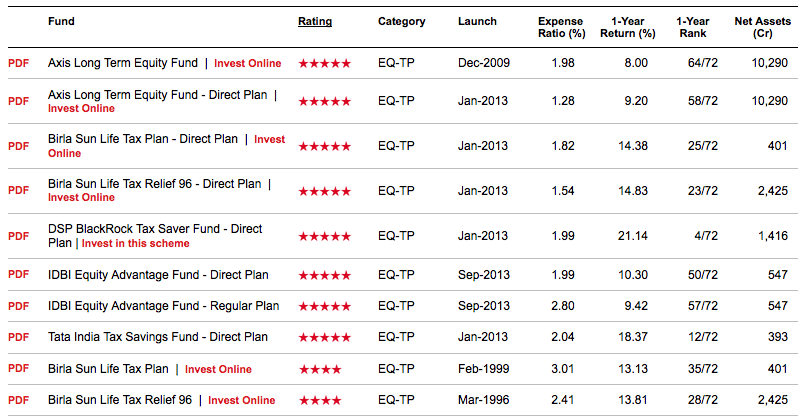

I selected DSPBR Tax Saver Fund for tax savings this year. The process I followed to select the fund was to choose from all 5 star rated funds at ValueResearchOnline and go with the fund that has midcap as benchmark Index.

- Axis Long Term Equity Fund has benchmark of BSE 200

- Birla Sun Life Tax Plan has benchmark of BSE Sensex

- Birla Sun Life Tax Relief 96 has benchmark of BSE 200

- IDBI Equity Advantage Fund has benchmark of BSE 200

- Tata India Tax Savings Fund has benchmark of BSE Sensex

Whereas DSPBR Tax Saving has benchmark Nifty 500 which in my opinion will outperform BSE 100 / BSE 200 and Sensex for the next 3 years or so.

I have invested 30k (Transaction details) as of now and have plans to continue at the current rate for 5 months.

As always I selected the dividend option so I get full tax saving benefit and get back dividend that I can deploy into stocks.

Pidilite Industries

My portfolio is very biased towards Pidilite Industries but I have no intention to rebalance it anytime soon and will let it remain as it is for the next few months. As investment increases, the balance will naturally establish itself.

On top of that Pidilite is more of a safe bet in my portfolio and I don’t expect it to outperform other investments. So it can make portfolio automatically balance itself.

Jubilant Foodworks

The day Jubilant Foodworks announced it results, it was down almost 15% in two days. I am still positive on this stock because the result was in line with my expectation.

My expectation was the company is trying to increase market share with promotional offers and they have managed to achieve it. An increase in YoY sale by 14%.

Stock trading at 70PE means market expectation has to be an increase in profit and profit margins all the time. It did not happen and so stock was hammered.

According to me 900 to 1000 is accumulation zone for this stock but if less than expected profit margins with an increase in sales hammer the stock price in next quarterly results as well, we may get a good entry in the stock at much cheaper valuations.

It will be a great learning experience if I am proved wrong in JFL.

Portfolio Update

Increase in investment from ₹13,53,094 to ₹13,83,094. An increase of ₹30,000 in the month of October. Let’s see the performance of the portfolio I have so far.

Profits Realized

- Infosys: 780 (60)

- Average Buy: 1165

- Average Sold: 1178

- Tata Steel: 9,200 (400)

- Average Buy: 280

- Average Sold: 303

Total Profit Realized: 9,980

Dividends

- Zydus Wellness: 325

- Larsen & Toubro: 365

- Jubilant FoodWorks: 250

- Britannia Inds.: 900

- Birla SL Tax Plan: 8,581

Total Dividend Received: 10,421

Stocks

Stocks that I hold in my portfolio along with the link to why I have invested in them.

- Britannia Inds. 1,49,206 (45) [Why]

- Invested: 1,18,731

- Profit+Dividend: +31,376

- Jubilant FoodWorks 1,00,895 (100) [Why]

- Invested: 1,09,503

- Loss+Dividends: -8,358

- Jubilant Life Sciences 2,06,160 (300) [Why]

- Invested: 1,34,636

- Profit:+71,524

- Larsen & Toubro 29,505 (20) [Why]

- Invested: 24,814

- Profit+Dividends +5,056

- Pidilite Industries 7,25,400 (1000) [Why]

- Invested: 7,18,864

- Profit: +6,536

- Zydus Wellness 1,75,580 (200) [Why]

- Invested: 1,61,847

- Profit+Dividends: +14,058

- Total Stocks: 13,86,746

- Invested: 12,68,396

- Profit: +1,20,191

Mutual Funds

- Birla SL Tax Plan-D: 1,16,125

- Invested: 1,05,000

- Profit+Dividend: +19,607

- DSPBR Tax Saver-D: 30,005

- Invested: 30,000

- Profit:+5

- Total Mutual Funds: 1,46,131

- Invested: 1,35,000

- Profit+Dividend:+19,612

Overall

- Portfolio: 15,32,877

- Capital Invested: 13,83,094

- Unrealized Profit: +1,29,382

- Dividend: +10,421

- Realized Profit: +9,980

October 2016 – portfolio crosses a magical figure of 15 lakhs.

Plans Ahead

I wanted to keep a month of not investing in stock and though October was the wrong choice of the month because there was a goodish bit of correction in some of the stocks I wanted to invest, I am proud to remain organized. I am sure the temptations of October will come through in November and I am up for it.

I am still undecided on Larsen & Toubro as it is under 2% of my overall portfolio and I am not able to add more position at current levels. Have plans to book profit in L&T in November.

Over to you

If you have any questions or comments share them in comments below and I love to respond to them.

Great work. Thanks for being so transparent and sharing your portfolio.

The pleasure is all mine Kritesh

Why don’t you invest in direct mutual fund (Details from your transaction ) ?

There are many reasons Parag why I don’t invest in mutual funds but the major reason is I beat the returns from mutual funds by a big margin and I prefer focus investing where my number of stocks are very limited and not like mutual funds where they invest in all the funds under the underlying index.

I like MOSL Focus 25 fund but again they have 25 stocks which is like too many for my liking as well. I like to keep things to 10 great stocks invested at great levels.

I’ve been reading some of your blogs since few days. Impressed with the transparency you keep with your readers. Keep going.

Glad you like it @sowmayjain:disqus and I do follow your blog as well and it is quite informative as well.

He clearly mentioned why he chose dividend, “get back dividend that I can deploy into stocks”

IMO one should choose dividend if he disciplined to reinvest it and won’t be tempted to buy new phone or furniture.

When you opt for dividend, you need to pay DDT. Do you know this? And if you pay DDT what is the use of getting back dividends? That doesnt make sense to me.

We don’t pay ddt directly it’s paid by fund. Means it’s already deducted from amount you get, you get cash to buy shares as he mentioned.

Exactly.

Dividend generate cash to buy stocks or anything.

He not suggesting all to chose dividend option, he is telling what he do, he use that dividend to buy stock, if you feel you can not make better use of dividend then then you should choose growth option, he feels he can use cash of dividend in better way.

Sir this is concentrated portfolio, will you suggest a novice concentrated or diversified portfolio ?

I prefer focused investing but if you want diversified, opt for a mutual fund. They do diversification for you.

Sir, investing in two jubilant increase risk ? Same promoter ?

Both are different companies but even if there is a risk, I am fine taking that risk

Great work…

Why do you choose dividend option in elss funds.

Because I prefer investing the dividend back in stocks and invest less in mutual funds.

Hello SIr, I have a question regarding Mutual fund. which is better option when investing in MF, growth or dividend? i am investing as growth option till now, but in your post above i have seen that u prefer dividend. so can u plz guide about this?

Hi Saifee, I had the same question like you. Actually it depends on what is your goal. Take a look at below post to determine where should you invest.

http://www.theinvestmentmania.com/growth-option-dividend-option-mutual-funds/

I opt for dividend option because I want to get cash back to invest in stocks and I outperform mutual funds by investing in stocks and so I prefer to invest as less as possible in mutual funds.