ROCE stands for return on capital employed, which helps us understand the financial efficiency of the business and the management.

What is ROCE?

ROCE stands for return on capital employed; in other words, the return promoters can generate from the cash or capital deployed in the business. It is a way to measure the efficiency of the management, which deploys the cash at a better than money market rate for an elongated period.

Higher ROCE means better efficient management, which means better profitability for the business and the company in the long run.

The Formula

The textbook formula for ROCE is

ROCE = Earnings Before Interest and Tax (EBIT) / Capital Employed

Though the textbook formula for ROCE has EBIT and Capital Employed in the business, the formula can vary from industry to industry and depends on what is considered as the capital employed or part of EBIT.

Some websites use the capital work in progress or CWIP for calculation, whereas others use only the working capital. Some consider EBIT, whereas others may also remove the tax from EBIT. Read about EBITDA here.

There is no right or wrong in using either of them, but the more important is to be consistent in the calculation.

For example, the ROCE of Page Industries, as per ValueResearchOnline for March 2018, is 64% and over 60% for the past six years.

Whereas it is 59% as per the MoneyControl and has a lot of variations as well.

Neither of them is wrong as long as they do the calculation consistently.

As an investor, you must follow anyone consistently. I use these seven sites, and for ROCE, the value of Screener and ValueResearchOnline are consistent, and I like to use ROCE right at the first step of my stock selection. So I use Screener’s value. Feel free to use any one of the values of your choice.

Why is ROCE important?

ROCE helps investors understand the profit a company will generate based on its invested capital. So the most crucial aspect of any business is generating returns rather than keeping the money in the debt market.

If a business takes a debt at 9% interest, it should be able to generate returns better than 9%. ROCE is a way to measure precisely that, and this is the sole reason return on capital employed is one of the essential aspects of measuring the efficiency of the business and, more importantly, the management.

So it is one of the most important factors to consider doing business in the first place because if the company can’t generate returns better than other avenues of investments, there is no point in doing business.

Similarly, for an investor, investing is critical to generate returns. If the business cannot generate returns, investors can never make money in the long run. So it is a vital aspect to consider when investing. The same has been emphasized in The UnUsual Billionaires and The Little Book That Still Beats the Market.

Good, Average and Ugly ROCE

There are some companies where you won’t see good ROCE value, which should be avoided. There is no general rule as to what level of ROCE is better than others, but the consensus of 15%+ is a good ROCE level for a business based on the long-term average interest rates in India.

I like to see ROCE be at least in the double-digit to be considered for investment because if the value is in the single digit, it is better to keep the cash invested in the debt market than to invest in a business.

So for me, the good ROCE is above 15%. In all my investments, I like to have a ROCE of above 15% mark.

Note: In the early stages of any business, ROCE may not be very high, or in some cases where a company has made fresh investments, ROCE may drop significantly. So it is always better to see ROCE for an elongated period.

The average ROCE is between 10 to 15%, but I like to see it inching higher. (Force Motors and Lupin are a couple of companies in my portfolio where ROCE is below 15%. Lupin only in the last fiscal had a ROCE of under 15%. Force motors had an increasing ROCE when I first invested, but as of now, it has taken a nose dive).

The ugly ROCE is when it comes in single digits. This is because the average return on the capital deployed in the business is under the average return the cash can generate from the debt market. One of the examples is Bharti Airtel, which, per Screener, has only a ROCE of 7.5%.

Examples

Businesses need money to grow. Looking at the ROCE or Return on capital employed can help us understand the financial efficiency of the management. When a company uses capital efficiently, the ROCE can increase exponentially.

Let me share an example of why ROCE is essential to the company and how a company can have the same or similar profits and yet require much more capital or much less capital.

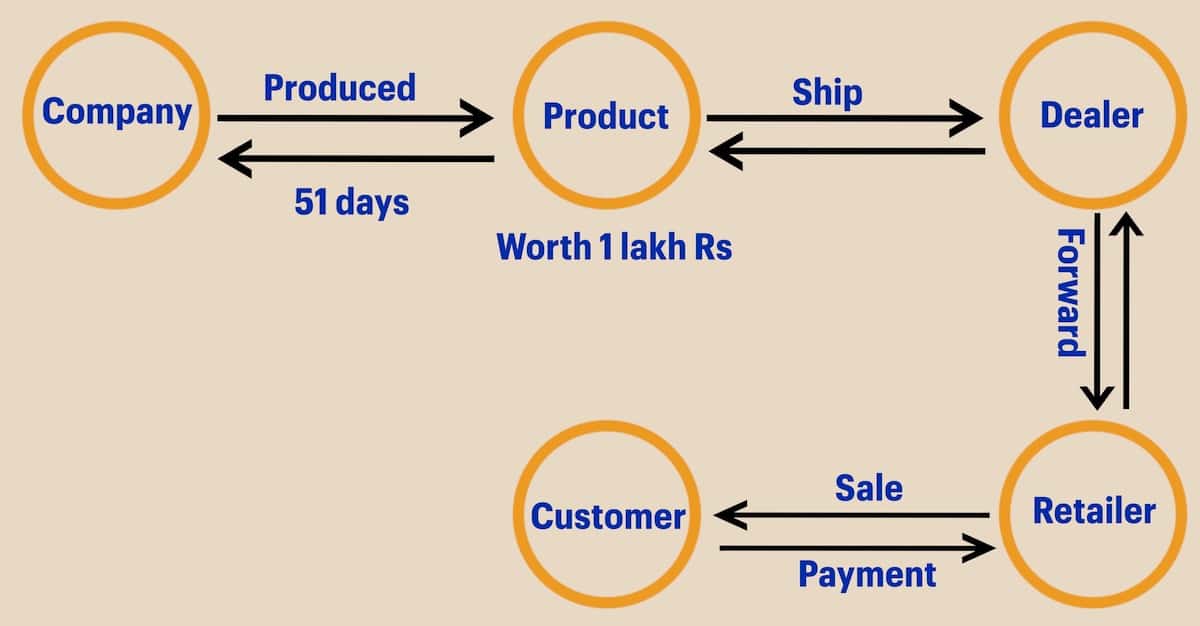

Let’s say the company is producing 1 Lakh Rupees worth of products X daily.

Now, it will require the product to be shipped and delivered to the distributors, and then they will deliver it further to its retailers, who will ultimately sell it to the customers.

Then, the distributor will receive it, verify it, and move it forward to pay the company after 40 days.

So a product that started in production on the 1st of Jan took ten days for transportation. It then gives a window of 40 days for the distributor to reach the retailer, and the retailer will sell and pay the distributor, who then pays the company.

The product worth 1L is sold for 1.10L and gives a margin of 10%.

However, the company is receiving the money back after almost two months. (10 days of transportation and then 40-day payment terms).

Further, we may have to take into account the holidays. Still, for calculation’s sake, if we don’t, then after 50 days company gets the money into the bank account to do the production again for the product. So theoretically, the company requires a capital of 50L to keep producing till the money returns.

Profit will be 10k daily, so quarterly, the company will generate a profit of 9lakhs.

What if the company asks its distributor to pay the amount in 10 days and complete the whole cycle in 25 days instead of 50 days? The capital requirement will reduce to half, and the company can profit similarly.

This is the beauty of ROCE and helps us judge how well the management is operating.

You are making the same profit but now require capital, much less than earlier.

Same sales and same profit, but ROCE is a lot different in both cases. So again, companies use tricks like giving an extra 1% if the distributor pays on the 10th day so they can get more distributors without requiring additional capital.

Ways to Sky Rocket ROCE?

Debtor days are the average days for a company to receive customer payments.

So we discussed debtor days and how if the company reduces it, the better ROCE becomes.

Similarly, a company needs raw materials to produce its final products. So a company has to pay its suppliers.

Days Payable is the average number of days a company takes to pay invoices for goods obtained on credit.

If the company pays after a long time for its raw materials, it will be able to produce its items with less and less capital going forward.

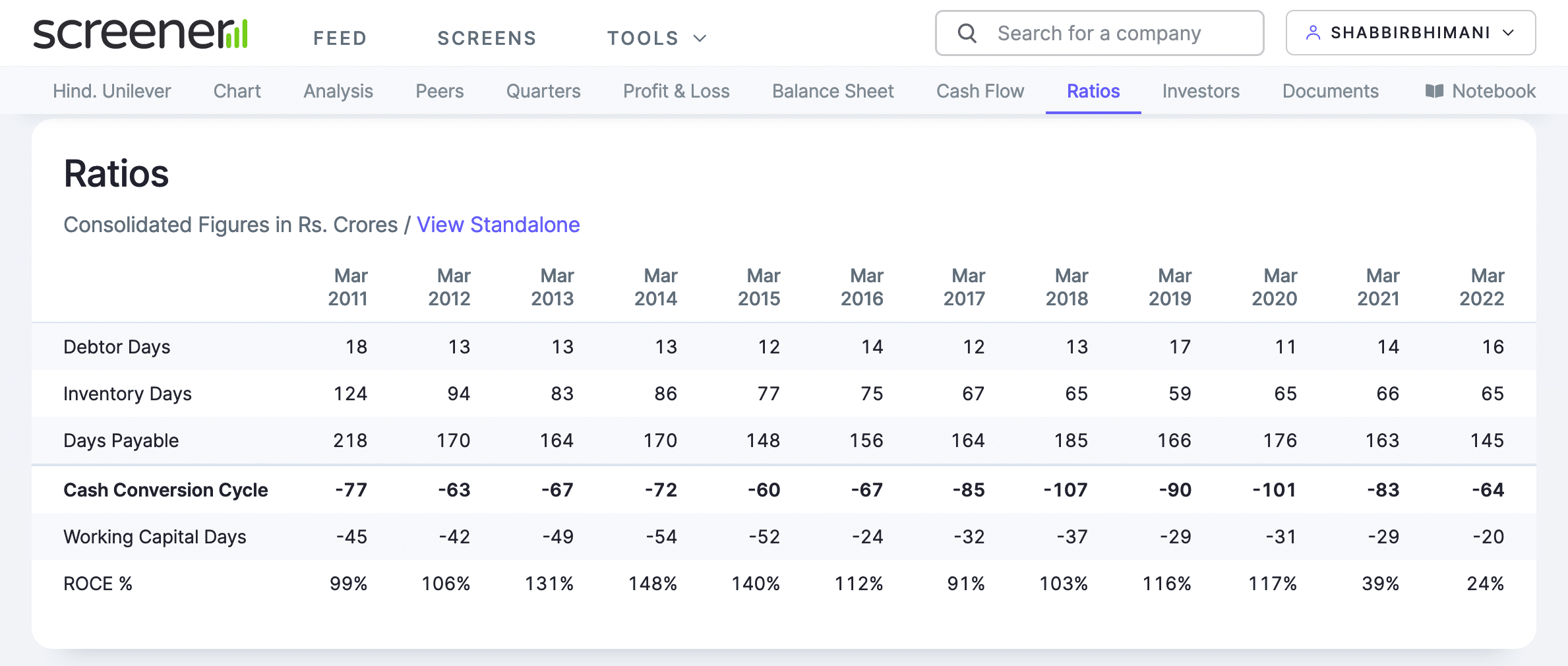

Hindustan Unilever

Asks for payment from its distributor in a few days but pays the suppliers after five months. So ROCE is sky high in the triple-digit.

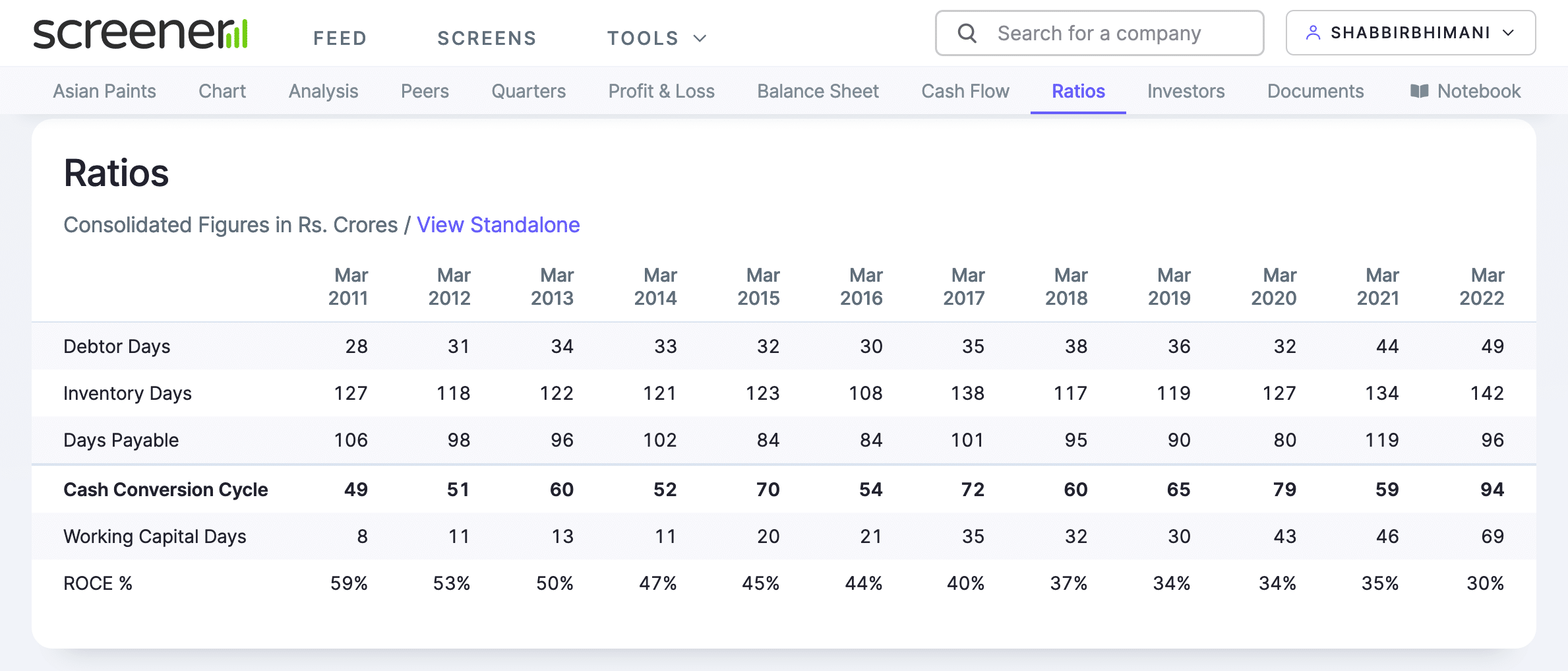

Asian Paints

Asks for payment from its distributor in a month or so and pays the suppliers in three months. So ROCE is around 30%.

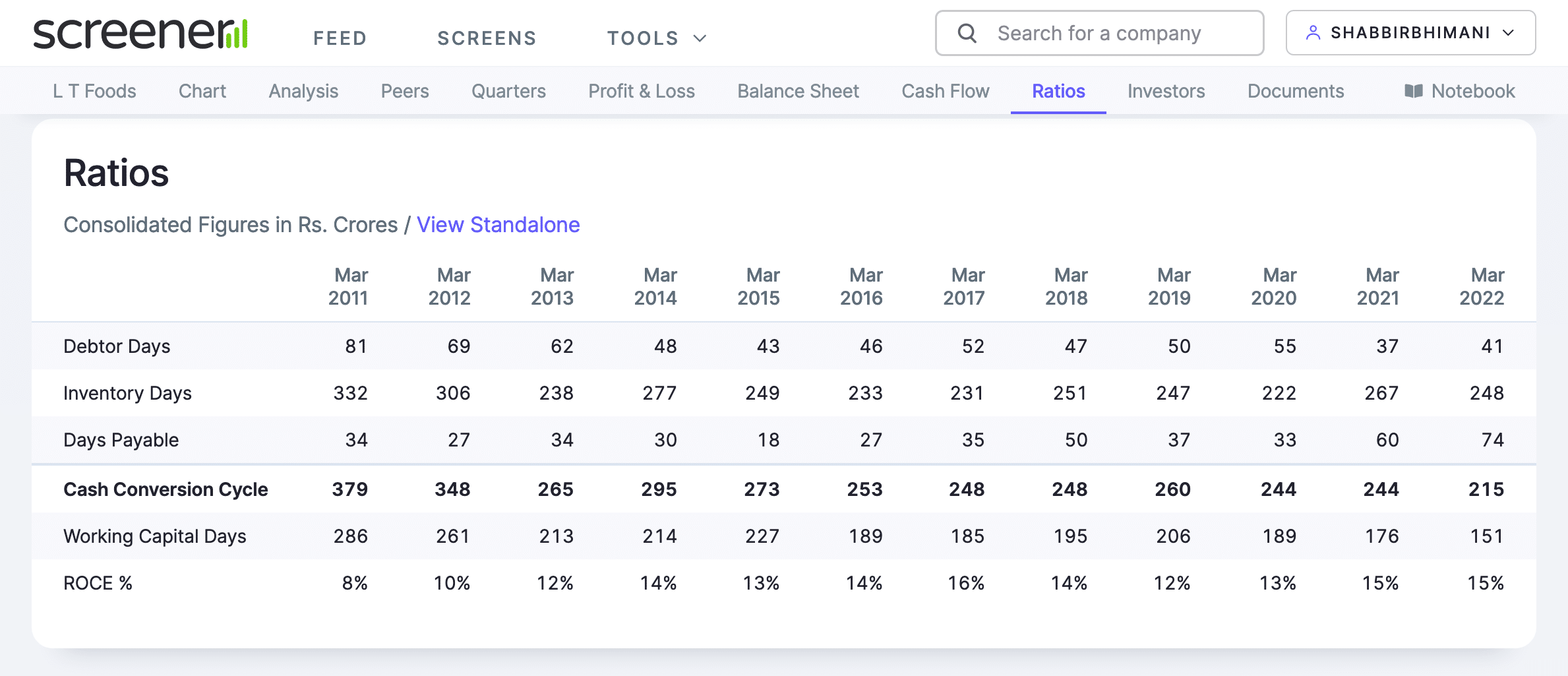

L T Foods

It asks for its distributor payment in a month but pays the suppliers after two months. But because the Rice it produces needs to be aged, it has a lot of inventory days. So return on capital employed is around 15%.

Thanks for the concise analysis of ROCE. I also agree that people should stay away from a single-digit ROCE as it means that the expected returns are very low.