Why I added all my mutual fund position for tax saving in Feb 2017 to my portfolio and also share why this is the last and final portfolio report update.

The Best Multi-Cap Fund to Invest in 2017

The best multi-cap fund for 2017 with consistent outperformance history for a decade. If you had to invest only in one fund in 2017 it should be a multi-cap fund

The Best ELSS Tax Saving Fund To Invest In 2017

Investing in any top rated fund may not be enough & returns can vary from under 5% to above 18%. Let’s narrow down to the best fund that can outperform in future.

What is: Exchange Traded Fund – ETF Vs Mutual Fund

What’s the difference between exchange-traded funds or ETFs and mutual funds? Which is the right one for investor investing for the short, medium and long term?

Invest 10k Mutual Fund SIP For 25 Years, Need Any Other Retirement Plan?

Reader Question: I am 30, married and no kids. Without any savings, if I invest 10k monthly SIP in equity mutual funds for next 25 years, do I need any other retirement plans?

What one should do after the SIP term completes?

What all things should we consider to either redeem or renew SIP term or just stay put with our investment

If I Can Do All With Mutual Funds Why Do I Need to Invest in Stocks?

You don’t need to be investing in stocks if you can focus only on mutual funds provided you can avoid the following temptations to investing in stocks.

Why you should almost never invest in NFO?

Nothing new in yet another new fund being offered, 10 Rs NAV and many other reasons to avoid almost all new fund offers.

5 Common Mistakes When You Follow Warren Buffet Quotes On Social Media To Invest in Market

When share price goes down by 5% I buy and exit at profit of 20%. I am not seeing any profit in my portfolio and so can you tell me what the hell am I doing wrong.

How to Book Market Losses Without Having Sleepless Nights

Booking a loss is so difficult that at times it is easy to quit the market keeping the loss making stocks in the portfolio than to book losses. The process I follow makes booking a losses lot easier than it seems without averaging down the stock.

When is the Right Time to Sell Your Mutual Fund Investment?

Mutual funds are different from stocks and so buying and selling of mutual funds are not as impulsive as stocks but there are various reasons to sell off mutual fund investments.

When market crashes, mutual funds also crashes. So how mutual funds are safer?

Whenever there is a crash in the stock market, equity mutual funds also crashes and at times more than the market. So why everyone terms mutual funds safer?

Investment Roadmap to 1 Cr in 10 Years

User Question: I want to retire early and my financial goal is to have 1 Crore in my bank account. I am ready to invest 8 to 10 lakhs now and can I get 1 Cr in 10 years?

How to Judge Your Financial Advisor – 8 Signs To Fire Him Right Away

Every financial advisor has an objective of making a profit for himself or his company but just make sure they are not at the expense of your losses.

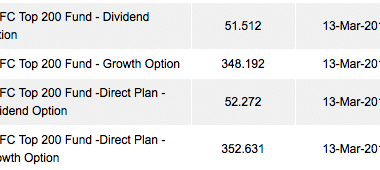

Mutual Fund Plans – Direct Vs Regular Plans

Indian retail Investors are not able to differentiate between regular and direct plan for investing in a mutual fund and so let me explain what it means and when you should be using which one.