What is free cash flow or FCF? How Free Cash Flow is Different from Operating Profit? What is Ideal Value of Free Cash Flow? What I Prefer in companies cash flow?

What is Free Cash Flow?

Free cash flow or FCF is the cash a company generates through its operations.

There are many different formulas for free cash flow or FCF. The one I prefer is a simpler one used by screener.in ( which is one of my favorite sites to keep a watch on company news without wasting too much time).

The formula is – The total sales generated by a company less the total expenses for generating the sale, working capital requirement of the company and the taxes company needs to pay.

In mathematical terms:

FCF = Cash Generated from Sales – ( Operating expense + Working Capital + Taxes )

How Free Cash Flow is Different from Operating Profit?

One may get confused about Free Cash Flow with operating profit margin but let me clarify a difference between FCF and operating profit.

Sales done by a company in profit and loss statement may not be real sales to the customers. It may also include some sales which aren’t sales but sent to the distribution channel.

Let me explain this with an example of a company which manufactures a product called X.

So the company pushes the products to its distributor, it will be shown as sales generated in the books of the company. In reality, the sales actually did not happen and no customer bought X. It is the distributor who stocked the product X.

The sales in the operating profit are sales generated from the stocking of the product by its distributor but when it comes to free cash flow or FCF, the sales are actual sales to the customer based on the cash received by the company.

So OPM is an important aspect of the companies operations efficiency but it can be misleading without cash flow consideration.

Another example of higher sales and lower free cash flow can be for companies that accept payments after few days of making sales. Typically it happens mainly for B2B (business to business) companies and not B2C (business to customer) companies.

As an example, company M manufactures a product P for its regular customer C.

So the payment from customer C may not come as soon as it receives the product P. Both manufacturer M and customer C may have agreed to payment terms of making a payment of the delivery in a few days time.

The more delay in the days of the payment can mean the company M will need more money to keep producing the product P. On top of that, as customer C needs more of the product P, the company M will need more money to keep the production going.

The sales of the company M will increase but the free cash flow will increase with a delay. Very fast growth for such a company can mean a higher requirement of cash.

What is Ideal Value of Free Cash Flow?

Free Cash Flow or FCF can be a double-edged sword. It can vary from business to business and from sector to sector.

A lower FCF doesn’t mean the company isn’t doing good or doesn’t care for its shareholder.

The cash flow varies from sector to sector.

An infrastructure company can have a negative cash flows for a few years whereas a B2C company may not.

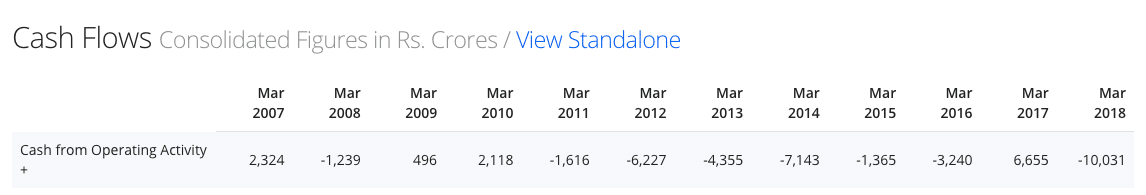

The biggest example is Larsen & Toubro or L&T. As per the screener data, we see a negative cash flow for the company for an elongated period of time:

The fact that the payment comes from projects in phases and each project can span a few years, a volatile working capital needs can’t be ruled out.

If you look at the FCF of Punj Lloyd, it doesn’t have such negative FCF but isn’t able to make profits.

What I Prefer?

As a passive investor investing predominantly in small and midcap companies, I find it tough to invest in such a sector with a very high requirement of cash.

So, I generally tend to avoid such capital-intensive sectors as a whole for very long-term investments and only consider sectors which generate cash on a continuous basis.

Generally, sectors or companies which generates a lot of cash are B2C companies.

Again, in the same sector, a small-cap company can have negative cash flow in its early stages when they are setting up its supply and distribution channel.

Final Thoughts

Everything for a company or an investment ultimately boils down to profits and cash.

If a company is able to generate cash or if a business can sustain its growth from the cash generated out of its operations, that is the best company to invest for a very long-term. Scaling up and continue on the growth track isn’t very tough.

As an investment philosophy, I prefer to invest in companies that have a very good cash flow and are low on the CAPEX (capital expenditure) needs. These companies will have high ROCE and ROE and reward its shareholders are rewarded with dividends and buybacks.

So looking to invest in a business which has less capital requirement will be better. This is my way to invest. Everyone may not agree to it but do you?

Great article explained in a layman terms! But dear shabbirji, what is the role of depreciation in cash flow that I can’t able to grasp. I read somewhere that a cash flow can be manipulated by considering depreciation. What to do in such scenario ? Also is CCC important parameters in days ?

Ur thankfully

Manipulators will try to manipulate. There is very little one can do about it. But then cash flow near the Operating profit level is a good to judge things.

Thank will keep in OPM & Cash Flow relation in mind

(Y)

One way is to check auditors track record. Any of big 4 auditors in company is safer one as manipulation chance is nearly nil

That is a very good point to consider as well.

Thanks Shabbir for the article!! As we discussed before, the only point which bothers me is that it’s hard to find MOAT companies or lesser competition companies in low capex but true that you get rewarded (dividend/buyback) time to time. Do u know any company which APPROX. satisfies both the points (+ve FCF and med. to high capex) ?

Thanks for sharing your knowledge and experience.

Livog, I don’t track such high capex sectors and so won’t be able to give you names directly but you can look at some infra companies like Siemens and others and they may fall into those companies.

shabbirbhimani already