Is the Nifty PE ratio above 25 overvaluation? Let’s see the argument and counter argument to judge when one should be investing

There is enough argument that Nifty is overbought when its price to earnings ratio or PE ratio is above 25 and is expected to correct. However, when the Nifty P/E ratio goes below 14 is considered to be undervalued.

Let’s understand the Nifty P/E ratio and a good enough indicator to estimate the market correction.

Nifty and its Earnings

Nifty is an index formed by selecting the 50 companies listed on a national stock exchange or NSE India from various sectors.

I want to clarify that Nifty 50 is not the index that comprises the largest 50 companies of India.

The top companies are chosen from different sectors. So it can so happen that a company with a higher market cap may not be part of the Nifty because other companies in the Nifty represent the sector or other sectors that need representation in the Nifty.

For example, as of 1st August 2021, Avenue supermart or Pidilite Industries are not part of Nifty 50, but Hero Moto Corp is. However, the market cap of the Avenue supermart is more than 200k Cr, or for Pidilite, it is more than 100k Cr, but the market cap of Hero Moto Corp is around 50k Cr.

So Nifty covers the majority of the sectors in India. Further, the calculation of earnings for the Nifty 50 is based on the sum of the companies’ weighted average within the Nifty 50 index.

I will not get into the details of the earnings calculation for Nifty as that is not the main topic of the article. However, we can get Nifty’s EPS online. As it is calculated based on the current earnings, there isn’t much variation in it.

As of 1st Aug 2021, the Nifty’s EPS is ₹583.

So what is Nifty 50’s Price to Earnings or PE ratio?

Nifty’s Price to earnings ratio or PE ratio is calculated based on the current value of the index divided by its calculated earnings.

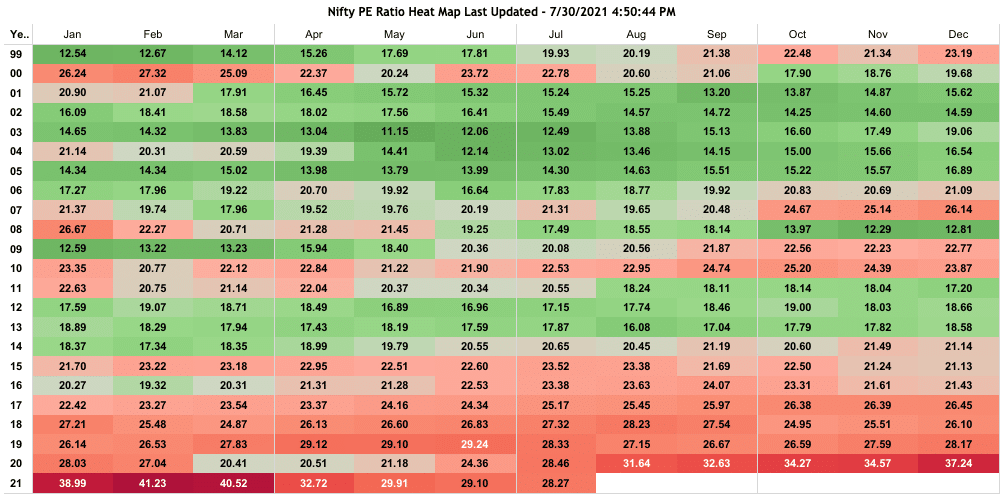

As of 1st Aug 2021, the Nifty’s closing price is 15,763 and the EPS ₹583. So Nifty PE ratio is 15,763/583, which is 27.

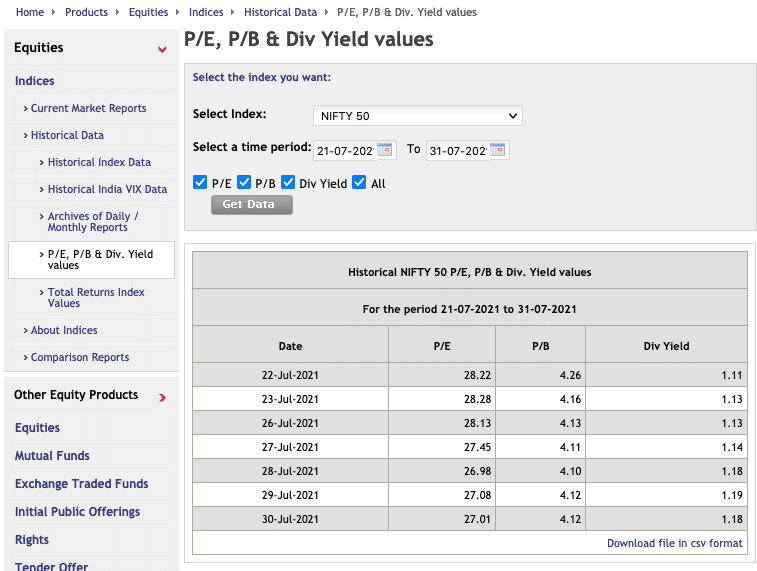

We don’t need to learn to calculate the Nifty earnings or PE ratio because it is available on the NSEIndia website.

Is Nifty’s P/E ratio good enough in the current scenario?

As an investor, the critical aspect to understand Nifty’s PE ratio is to be able to assess if it is the right time to invest in the market or not.

There are arguments on Nifty’s past performance when its PE ratio has gone above 25 or below 15.

Source: nifty-pe-ratio.com

The leftmost in white is the year, and Jan to Dec is the column that represents the average price to earnings ratio of the Nifty 50.

People who argue Nifty above 25 PE warrants for correction look at the above chart before 2014. We see whenever Nifty has gone past a PE multiple of 25, and there has been a significant correction.

The above scenario repeats in the year 2000, 2008 and then finally in 2010-11.

So there are reasons to believe that Nifty above 25PE is vulnerable.

However, since 2015, Nifty only once in February 2016 has gone below the PE multiple of 20.

Even after the crash in March 2020, the Nifty PE was above 20 because the earnings fell.

Furthermore, there is an interesting observation from Feb 2021 to Jul 2021. The Nifty has gone up from 14800 levels to 15800 levels in these six months.

But the PE ratio has moved from above 40 to below 30 despite the fact Nifty has gone up.

It signifies there has been a solid earnings growth in the quarterly earnings.

So if the earnings are expected to be good, the PE ratio at the moment may look high, but without a significant correction, the Nifty can still lower its PE ratio.

Why not use Nifty’s Price to Book or P/B Ratio?

The price to earnings ratio is a good indicator when you have a linear growth in earnings. However, in Covid times, the earnings have seen an impact. So the market is assuming there will be a significant improvement in earnings.

However, the book value doesn’t vary as much as earnings.

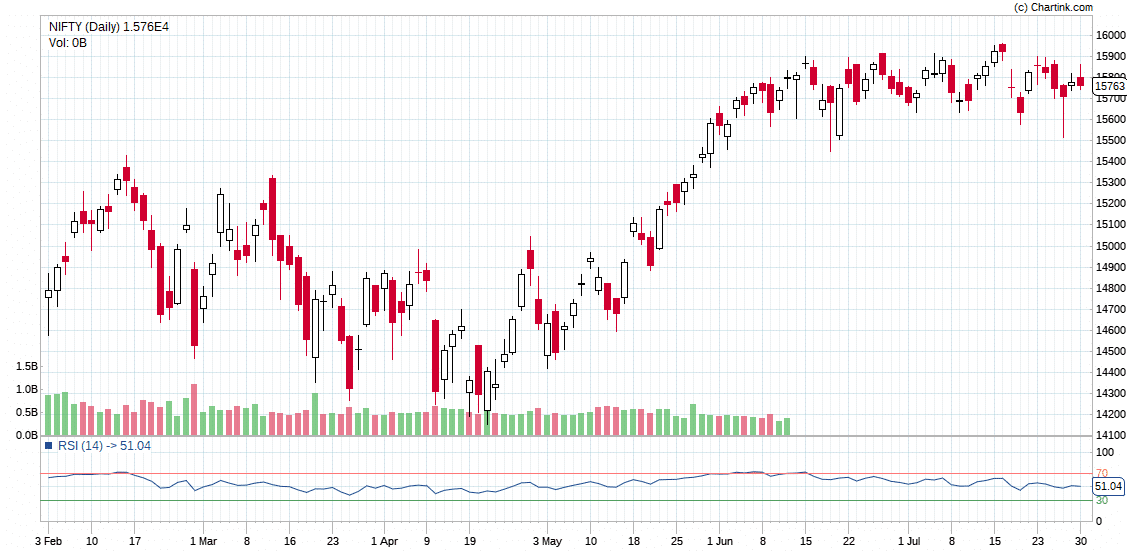

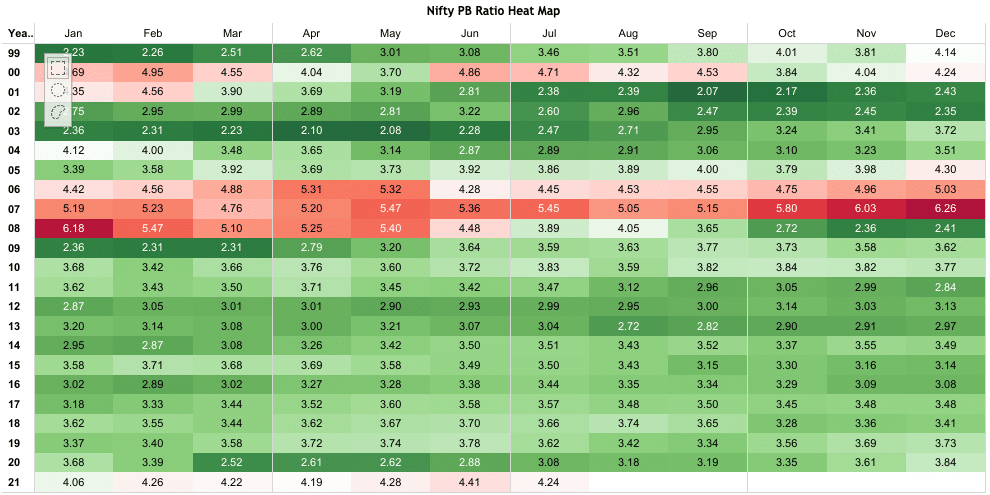

So now, let’s use the Nifty’s Price to Book or PB Ratio and do the same analysis that we did for the PE ratio.

Source: nifty-pe-ratio.com

The two significant corrections in the market in 2000 and 2008 happened when Nifty’s Price to book or PB ratio was above 4.5.

Further, when the Nifty’s PB ratio was around 2.5, there has been bull runs. We see it in Mid 2001, 2003, 2009 and finally in 2020.

Why is Nifty Price to Book Ratio a better Indicator?

Price to book perfectly predicts bull and the bear phase in Nifty for the past 20 years.

If you follow the PE ratio of Nifty to invest, you may have been waiting since 2015, and portfolios may have doubled during this time. Whereas, we have seen how the price to book ratio is a better indicator.

Based on the price to book value of Nifty, my view is, if the Nifty consolidates around the same level of 15700, the book value for Nifty has to increase by 20% in the next few quarters.

However, if the book value increases by only 10%, then Nifty is expected to correct by 10%.

Finally, if there is no growth in book value, we can see a correction of up to 20%.

Again, it doesn’t mean I will not continue investing. Let me explain why.

Final Thoughts

We conclude that the Nifty book value has to grow if the market has to sustain at the current levels.

Nifty’s book value is the weighted average of the sum of all the companies book value.

So if Asian Paints can grow its book value at 15%, there has to be a company that will grow the book value at 5% to keep the average around 10%.

So we have to invest in companies that can grow profits and book value significantly higher than the market average. Then, slowly, we have to keep accumulating them.

Finally, at some point, the market will offer a significant discount to invest in them.

good analysis. How do u look at free cashflows rather than earnings as substitute to PER? how do u look at impact of dollar index on the prices in emerging markets ?

Free cash flow is an excellent substitute to earnings. However, I don’t follow too much on the external factors like dollar index because in the long term, you make returns proportionate to the earnings.