ELSS tax saving funds have a lock-in period of 3 years which makes investors remain invested for the long-term. When new investors check the return for the funds, they are positively surprised. But it also makes them feel ELSS funds is the only route to building wealth.

The Best ELSS Tax Saving Fund To Invest In 2018

Let us take a top-down approach to the top-performing mutual funds for the past 1 year and come up with the best ELSS tax saving fund to invest in 2018.

How to Invest in Direct Mutual Funds – A Step by Step Guide

A step by step guide to investing in direct mutual funds with an example of my investment of Rs. 50,000 along with why Zerodha’s COIN interface is an avoid

The Best ELSS Tax Saving Fund To Invest In 2017

Investing in any top rated fund may not be enough & returns can vary from under 5% to above 18%. Let’s narrow down to the best fund that can outperform in future.

What Happens If I Miss Couple of Monthly SIPs to My ELSS Fund?

Will the invested amount be considered for tax deductions if I miss a couple of monthly SIPs?

When is the Right Time to Sell Your Mutual Fund Investment?

Mutual funds are different from stocks and so buying and selling of mutual funds are not as impulsive as stocks but there are various reasons to sell off mutual fund investments.

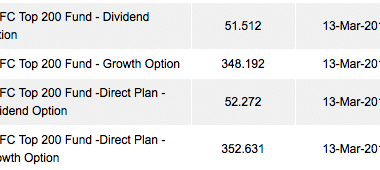

Mutual Fund Plans – Direct Vs Regular Plans

Indian retail Investors are not able to differentiate between regular and direct plan for investing in a mutual fund and so let me explain what it means and when you should be using which one.

Best Strategy To Save Tax Under Section 80C

The best strategy for saving tax is to invest with minimum locked in period and save maximum tax with minimum possible to zero investment.

Why You Should Invest in Mutual Funds?

An article by Vinay Kumar for making his friends understand why it is important to invest in mutual funds and how mutual funds delivers inflation beating returns that not only saves tax under 80C but returns are tax free as well.

Where to Start Investing and by How Much?

Let me answer the question. I am N years old and earn few thousands a month and have no investments so far. How much should I invest and where?

Best Rated HDFC Funds

I would start a series of posts where I would list few of the best rated equity funds from various fund houses and this is the first post in the series where I started with HDFC Mutual Funds.

Best Tax Saving Funds

List of some of the best Tax Saving mutual funds. The list of funds selected are based on criteria of consistent dividend for a long period of time.

Positive towards ELSS part of asset allocation

I am making this statement because ELSS comes with a mandatory lock-in period of three years. This happens to be the smallest lock-in period that is available in the 80C basket. You can compare this with PPF, which matures in 15 years, NSC in 6 years and FD requires five years to get the tax break.