Categorize the mutual funds and invest into as many category of mutual funds as possible to make mutual fund portfolio well diversified.

Indian retail investors invest in different funds and think that it is diversification of portfolio but that is completely wrong. Diversification of investment means investing in the different asset class to negate the fluctuation in any particular investment vehicle. There is a common saying that Doesn’t put all of your eggs in one basket which is the basic principle behind investments with diversification.

Categorize the mutual funds and invest into as many categories of mutual funds as possible to make mutual fund portfolio well diversified.

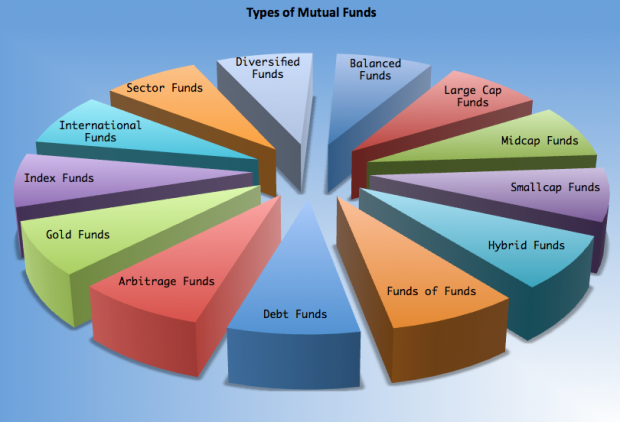

So let us categorize the types of Mutual Funds

Balanced Funds

Mutual funds that invest in equity, as well as debt and money market instruments, are termed as balanced funds. Normally equity instruments are the major portion of the investment profile ranging from 60 to 80% and rest in debt and money market instruments. The fund house with a variation percentage predetermines the equity to debt investment ratio that they can use to switch the majority of the investment into debt at any given point of time.

Taking an example of HDFC Balance fund we see asset allocation of 60% in equity with a deviation of 20%. Similarly, in debt they have an asset allocation of 40% with a deviation of 30% and so this fund at any given point of time can go major equity to major debt asset allocation.

Large-cap funds

Funds that invest in companies with large market capitalization are known as large-cap funds. The definition of large-cap stocks are defined by each fund differently and so understanding the fund investment style helps to understand what kind of diversification one can achieve investing in the fund.

- HDFC Top 200, its investment objective is to invest in BSE 200 Index scrip’s, which will always be large-cap companies, and so this fund is a large-cap fund for sure.

- HDFC Focused Large-Cap fund may invest in those companies with a market capitalization greater than or equal to that of the company with the lowest market capitalization in the CNX Nifty Index.

- Franklin India Blue-chip Fund does not define the size of the company for investment but only invests in large-cap companies with strong financials and market leaders.

Blue-chip, Top 100, Top 200, Equity funds are some of the common names used for large-cap funds but investing in each of those funds from same or different fund house does not diversify mutual fund investments.

Mid Cap & Small Cap Funds

Funds that invest primarily in medium-sized companies or medium market capitalization companies are termed as mid-cap funds and funds that invest in small size companies or small market capitalization are termed as small-cap funds. Ideally mid and small-cap companies are clubbed together into one group by fund houses to name the fund as mid and small cap funds. The idea is to invest in small and medium companies without too much segmentation.

Small and mid-cap category of funds tend to avoid the market leader and try to invest in future leaders and have higher returns but at the price of higher risk.

Arbitrage Funds

Arbitrage funds are funds that remain in cash or debt investments and look for arbitrage opportunities in various market segments like the difference in pricing between cash and derivatives segment.

Index Funds

An index fund has benchmarked an index for investment. Some of the popular indexes for mutual funds are Nifty, Sensex, Nifty Junior, Nomura MF Index, and CNX 500, etc.

Investing in Index funds along with a large-cap fund may not provide the needed diversification and it may just lead to investing in the same companies through different funds.

Tax-saving ELSS Funds

Funds that have 3 years of locking period and provide tax benefit under the section 80C are termed as tax saving ELSS funds. Every fund house has one tax saving scheme and normally this fund invest in large-cap stocks. Check fund specific investments if you prefer to diversify your assets with tax saving funds.

Remember investing in an ELSS fund with a large-cap fund may not provide the needed diversification.

International Funds

As the name suggests, funds that invest in opportunities outside India. Some of the funds in this category include L&T Indo Asia Fund, Birla Sun Life Intl. Equity Fund, and DSPBR World Gold Fund. Investing in international fund can provide a great deal of diversification. Remember that there are quite a few international funds but all the international funds are not same and some invest in International Equities, whereas other invest in international commodities like gold or oil internationally and some international fund are specific to some countries like China, Brazil…

Sector Specific Funds

Funds that invest in particular sectors like infrastructure, banking, Information technology, FMCG, power, etc. are call sector funds. Like International funds, sector-specific funds provide better diversification but unless you want to be diversifying the complete portfolio yourself, it is better to be investing in diversified funds.

Diversified Funds

Funds that neither invest in any particular sector nor invest in any particular sized companies are termed as diversified funds. Diversified funds can be a large cap, mid cap, small cap or even an international fund but normally if a fund is in those categories we tend to name them with those categories and not name them as diversified fund but any fund that does not invest in any given sector is ideally a diversified fund.

Funds of Funds

Funds of Funds or FoF is a mutual fund which invests in different mutual fund schemes instead of stocks and the biggest advantage of investing in funds of funds is you get access to high end closed-ended funds and schemes which a retail investor may not be able to invest because of minimum investment limits.

There are 2 kinds of funds of funds i.e. equity oriented and debt oriented. Equity-oriented fund of fund invests majorly in equity funds and debt oriented fund of fund majorly invests in debt funds.

Gold Funds

Gold funds primarily invest in Gold ETFs. I prefer to be investing in Gold ETF’s directly than investing in Gold funds.

Debt Funds

Debt funds invest in short-term or long-term bonds, Central Government Loan, State Development Loan, NCDs or Non-Convertible Debentures or any other money market instruments. There can be lock-in periods for investments in such Government instruments but you can invest in those instruments through debt funds without any lock-in period.

Apart from lock-in periods, you are also able to invest in good schemes at any given point of time that may not available when you want to be investing in a debt fund. As an example, if I want to invest in LIC Housing Finance Bonds or Power Finance Bonds in 2014, I have no choice but to use a debt fund only.

Hybrid Funds

Most of the Balance funds invest majorly in equity to be treated as an equity fund for taxation (needs 65% of investment in equity) but funds that do not have equity major investment profile and invest in equity, debt, as well as any other money market investment instruments, are known as hybrid funds. Few examples of hybrid funds are:

- L&T India Equity and Gold Fund – Fund that invests in the equity market as well as in Gold ETF.

- Kotak Multi Asset Allocation Fund – Fund that invests in bonds, gold as well as very small portion in equity.

Time-Based Classifications

- Close Ended

- Close ended funds are funds where investors can subscribe only during the New Fund Offer (NFO) period only.

- Open Ended

- Investors can purchase and sell units even after the New Fund Offer (NFO) period.

Asset Based Classifications

- Equity

- As the Name suggest these type of funds invest mainly into the equity market.

- Debt / Income

- These types of funds mainly invest in bonds and money market instruments.

- Hybrid

- These are the type of funds which invest some percentage into equity and some percentage into debt. Generally speaking, these types of funds invest at least 65% in equities and roughly 35% in debt.

- Real Asset Based

- These funds invest in physical assets such as gold, platinum, silver, oil, commodities and real estate. The famous one is Gold Exchange Traded Funds (ETFs)

Investment-Based Classifications

- Equity Diversified Funds

- These type funds diversify the equity component of their Asset across various sectors like oil & gas, technology, construction, metals, etc. They diversify investment to reduce their overall portfolio risk.

- Sector Funds

- Sector funds are those type of funds which are expected to invest predominantly (Generally, 65%) in a specific sector.

- Index Funds

- These funds take a position which replicates the index, say BSE Sensex, NSE Nifty, BSE top 200.

- Exchange Traded Funds (ETFs)

- An exchange-traded fund (or ETF) is an investment fund traded on stock exchanges, like stocks. An ETF holds assets such as stocks or bonds and trades at approximately the same price as the net asset value of its underlying assets over the course of the trading day.

- Fund of Funds (FOF)

- Funds investing in other funds. They may invest in the same fund house or other fund houses.

- Fixed Maturity Plans (FMPs)

- These funds are debt/income funds which invest in Bonds, Debentures and Money market instruments. They give a fixed return over a period of time and are mainly close-ended funds.

Regional Funds Classification

- Country / Regions

- These types of funds invest in securities (equity and/or debt) of a specific country or region. The returns for regional funds are affected not only by the performance of the market but also by changes in the currency exchange rates. In India, we hardly see any such fund which interests Indian investors but in the more developed countries, such funds are more popular because they invest in developing countries to generate much better returns for investors.

Final Thoughts

Diversifying portfolios with investments in different areas always helps but keep in mind that you should always keep track of your Investments and from time to time switch the investment vehicle that may not be able to make most for you.

Hi Shabbir…great article.

But want to understand an ideal ratio to maintain while investing into mutual funds. Like how much percent to invest in LC, Small-Mid cap, Hybrid funds, Tax planning funds, Multicap funds and Gold funds.

Delnaz, Glad you like the article and thanks for sharing your feedback.

Coming back to your question about how much should one invest in which fund and ideally it would depend on person to person and his risk appetite as well as his timeline.

If you can take more risk, I suggest 100% in midcaps and I know this can sound foolish but then if you want to gain more, you should be ready to take risk. If you see my portfolio ( https://shabbir.in/portfolio ) I do invest mostly in midcaps and that too on the back that I don’t share my smallcaps openly as it is more risky.

If you want to reduce your risk, increase exposure to large caps. If you want to reduce risk even further, you can opt for balanced fund.

I invest in tax planning to the extent I can and also try to find small cap funds which are limited as well. You can read here – https://shabbir.in/best-elss-fund-2017/

I hope I have answered your question.

Hi Shabbir,

Thank you very much for providing such a brief explanation for almost all type of MF’s. I am very much interested in starting SIP in MF as I have seen my friends relative getting much benefit from there SIP’s. But I am not sure which kind of funds are good to invest in and they are unable to explain me as they say they are taking help of some agent. From your explanation I am able to figure out the meaning of these funds but still in confusion in which one I should invest. I have also read your other article in which you have listed top performing MF’s to invest in. Should I invest on those ?

Secondly I would like to start SIP online with a minimum of 1000 or 2000/- monthly i.e. without the hassle of paper/form filling/submission etc. Just like we do a FD online through bank. Is there a way to do that ?

Thirdly if at some point of time I feel that I need to switch to other better MF how often can I do that in a year ? Can it be done online without paper work ?

I am sure there must be several people out there who have similar queries. Your help can do a world of good for us.

Hi Nitin,

I have seen people jump into stock market seeing others and thats the first step to failure but I am also glad you are not jumping into the market just like that but prefer to be going the SIP route which is the best route to get started with market.

About your question like where you should invest depends on individual to individual and his ability to take risk and what kind of funds availability he has.

Top performing MF’s are good ones but then I prefer to invest in MF where I see more future growth in stocks than in past.

Yes you can do your SIP online and you can opt for your brokers online platform if you have an account with them or go with fundsindia.com to invest in major MFs online.

You can switch as many times as you want but remember there is an exit load if you switch too early and also know about the tax implications on the same.

Yes there will be lot of people who have similar queries and if you have more, just ask them and will be more than happy to help you get all of them solved.

Thanks

Shabbir

Thanks again Shabbir for suggesting such an awesome website for online investment service. Its really good and they also suggest good performing mutual funds for investment according to the SIP profile and provide other investment advisory services for free. But I want to understand how it benefits them when they are providing free service for online investment ?

Do they get fraction of our profits when we invest in any mutual funds through there service and in the end we get less amount of what actually we should get ?

Secondly which way is more beneficial for SIP investment ?

1. Through local investment agent which incurss paper work

2. Through online investment website like fundsindia.com

Thirdly I request you, if at all possible to post an article regarding early exit load and other tax implications related to SIP investment. Its really a great tool for systematic investment and I am sure several people wants to know about these secret charges on MF/SIP investments

Hi Nitin,

There are many benefits and some of them are my assumptions.

They can ask for some annual payments from fund houses for giving them XYZ part of business. No they cannot take profit from your invested amount unless letting you know because the Entry Load has been eradicated from mutual funds in India for quite sometime now. So if you invest 1000 Rs, they should be investing 1000 Rs only. Yes they can add some extra Rs as separately which ICICIDirect does.

I always prefer online investment through my broker or through fundsindia like services because it is less of a hassle. Other option is to invest directly through the fund house website which can even save on anything brokers may charge but then it comes with an extra option of managing too many accounts with so many fund houses.

This blog is not about taxation and is more focused about investment but yes I do share few things about taxation and surely will try to add it as and when possible.

About exit load it varies from funds to funds but normally it is in range of 1 to 2% when withdrawn before the timeline indicated in the funds document.

Thanks

Shabbir

You provided a comprehensive guide on different fund categories,Shabbir.Going to be quite helpful to new investors.

Glad you liked it Bikramjit.

You provided a comprehensive guide on different fund categories,Shabbir.Going to be quite helpful to new investors.

Glad you liked ti Bikramjit.