Mutual funds are different from stocks and so buying and selling of mutual funds are not as impulsive as stocks but there are various reasons to sell off mutual fund investments.

When market crashes, mutual funds also crashes. So how mutual funds are safer?

Whenever there is a crash in the stock market, equity mutual funds also crashes and at times more than the market. So why everyone terms mutual funds safer?

Investment Roadmap to 1 Cr in 10 Years

User Question: I want to retire early and my financial goal is to have 1 Crore in my bank account. I am ready to invest 8 to 10 lakhs now and can I get 1 Cr in 10 years?

How to Handle the Regret of Missed Market Opportunities?

Do you regret the missed opportunities in stocks? Do you know how you can be completely fine even after missing the opportunity of a lifetime in stock market?

How to Judge Your Financial Advisor – 8 Signs To Fire Him Right Away

Every financial advisor has an objective of making a profit for himself or his company but just make sure they are not at the expense of your losses.

Is PPF or Public Provident Fund A Smart Choice of Investment?

NO Public Provident Fund or PPF is not a smart choice of investment option for any investor whatsoever.

3 Most Common Mistakes That Every Indian Investor Makes

First kind of mistake is the one that helps you realize you have gone wrong and try to learn from it and other one is you tend to live in the imaginary world with those mistakes.

What is The Biggest Lesson of Investing We Can Learn From Pepsi IPL 2015?

Investing lesson from IPL 2015 and it is not about buying an IPL team. You can learn investing from every event and IPL2015 is no different.

Diversifying Your Portfolio – Everything You Need to Know About Diversification

Understand diversification and see why Indians crave for portfolio diversification and help you diversify your portfolio even if you know very little about the market.

NFO – Everything you need to Know About Investing in an NFO

Answering Why fund house come up with NFOs? Why fund house don’t come up with new funds often? and When you should avoid investing in NFO?

User Question: Invested in Reputed Companies for 7-8 Years & Still A Loss

Answer to User Question: I have 4 to 5 reputed company shares for last 7-8 years but it has not increased rather decreased with losses, but all preach for long term investment to get 15-20%?

How to Achieve Capital Protection And Still Remain Invested in Market?

The fear of loosing capital in market is one of the major reasons for Indian retail investors to keep themselves away from market. Let me share a step-by-step process to remain invested in market with 100% capital protection.

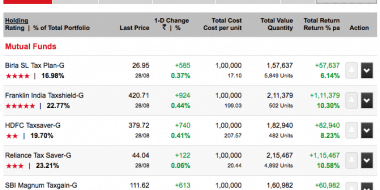

7 Most Ignored Mutual Fund Criteria For Smarter Mutual Fund Investments

Mutual fund investment is making Indian retail investors life simpler but knowing these 7 ignored criteria about mutual funds can help investing in mutual fund even simpler.

User Question: I have 5Lakh and want to invest for better than FD returns in 2 years

Planning to purchase a flat in a year or two and I have accumulated money for down payment and am very confused where can I invest it now for better than FD returns.

Understanding Investment Psychology When Investing in Market

What if a stock you invested into is a wrong investment and you know for sure it is a mistake but are not comfortable booking a loss? Answer lies in understanding the investment psychology.