Let me answer what I think is the best possible investment opportunity in equity mutual fund for 2015.

Diversifying Your Portfolio – Everything You Need to Know About Diversification

Understand diversification and see why Indians crave for portfolio diversification and help you diversify your portfolio even if you know very little about the market.

NFO – Everything you need to Know About Investing in an NFO

Answering Why fund house come up with NFOs? Why fund house don’t come up with new funds often? and When you should avoid investing in NFO?

How to Achieve Capital Protection And Still Remain Invested in Market?

The fear of loosing capital in market is one of the major reasons for Indian retail investors to keep themselves away from market. Let me share a step-by-step process to remain invested in market with 100% capital protection.

7 Most Ignored Mutual Fund Criteria For Smarter Mutual Fund Investments

Mutual fund investment is making Indian retail investors life simpler but knowing these 7 ignored criteria about mutual funds can help investing in mutual fund even simpler.

How to Save Tax On Short Term Investment With Profits

How profit from short term investment i.e. investment for under 1 year in equity market can still save lot of tax that may need to be paid otherwise.

Best Strategy To Save Tax Under Section 80C

The best strategy for saving tax is to invest with minimum locked in period and save maximum tax with minimum possible to zero investment.

What Is The Right Age and Right Way To Save Money?

Saving a huge amount of money in the long run will help you to live a cozy life. There arises a question demanding the right age to start saving money. What do you think? Is it ok to start saving from the age of 30 or late 30’s?

What Are Direct Plan For Mutual Funds?

SEBI has mandated Mutual Fund Houses to come out with two varying options for all their schemes, namely Standard and Direct. The standard version of all mutual fund schemes will incur a charge which will be treated as an agent fee or commission and the direct plan is free from any charges.

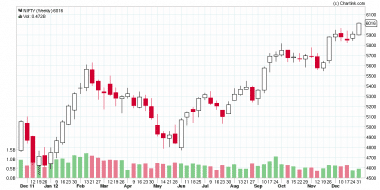

3 Lessons To Every Indian Investor Willing to Invest in 2013

Year 2012 was full of surprises for the Indian investors. Looking at the weekly charts for Nifty in 2012 we clearly see it had something for every body be it trader or investor. Nifty has shown good support in 2012 around 4500, 4800, 5000, 5200, 5550, 5850 and so it does look like 2013 will be a year where there will be lot of support for market and so if you are keen to invest your money in 2013, there are three things that you need to know.

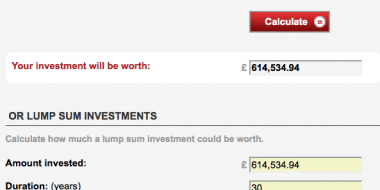

Why It Is REALLY Very Important to Start Investing Early?

Two individuals, one of them invested ₹3000 for 10 years and yet he made ₹1.43 Crore more than the person who invested the same amount for 30 years in the same asset class with same average return on investment.

Technical Analysis of Indian Mutual Funds

There is no Open, High, Low, Close values for mutual fund NAV and so you cannot have candle sticks but still can apply the price action chart patterns on mutual fund NAV for technical analysis.

Invest in Mutual Funds – Can Ads Substitute Entry Load?

AMFI India has come up with ads – it is wiser decision to invest whatever little you can every month in Mutual funds. Can this Ads act be substitute to Entry load?

How to Invest In Mutual Funds Online?

There are many ways you can invest in mutual funds online. I will share the one that I use myself as well as other methods of investing in mutual funds online.

Where to Start Investing and by How Much?

Let me answer the question. I am N years old and earn few thousands a month and have no investments so far. How much should I invest and where?