Investing lesson from IPL 2015 and it is not about buying an IPL team. You can learn investing from every event and IPL2015 is no different.

Volatile Equities, Unstable Gold & Saturated Real Estate Market – Where Should One Look To Invest In Current Scenario?

When you have more than one investment choice, you are more likely to be paralyzed by the paradox of choice of investing.

Diversifying Your Portfolio – Everything You Need to Know About Diversification

Understand diversification and see why Indians crave for portfolio diversification and help you diversify your portfolio even if you know very little about the market.

Do you have the mindset of a trader or an investor?

Let us see what is needed to be a trader or an investor and judge for yourself if you have the mindset of a trader or investor.

Are you expecting too much out of your Investment in market?

A jaw dropping question in my AMA which read something like this. I have removed all the identifiable information from the email because I am getting lot of such emails on regular basis where people are looking for being a full time trading and most of the time the investment amount is such that they […]

NFO – Everything you need to Know About Investing in an NFO

Answering Why fund house come up with NFOs? Why fund house don’t come up with new funds often? and When you should avoid investing in NFO?

User Question: Invested in Reputed Companies for 7-8 Years & Still A Loss

Answer to User Question: I have 4 to 5 reputed company shares for last 7-8 years but it has not increased rather decreased with losses, but all preach for long term investment to get 15-20%?

How to Achieve Capital Protection And Still Remain Invested in Market?

The fear of loosing capital in market is one of the major reasons for Indian retail investors to keep themselves away from market. Let me share a step-by-step process to remain invested in market with 100% capital protection.

7 Most Ignored Mutual Fund Criteria For Smarter Mutual Fund Investments

Mutual fund investment is making Indian retail investors life simpler but knowing these 7 ignored criteria about mutual funds can help investing in mutual fund even simpler.

Understanding Investment Psychology When Investing in Market

What if a stock you invested into is a wrong investment and you know for sure it is a mistake but are not comfortable booking a loss? Answer lies in understanding the investment psychology.

How to Control Greed in Stock Market

Learn how to control greed in market because greed and fear are emotions that do not allow executing your strategies even though you know what is right and what is not.

Unknowingly I have been Forcing My Readers to The Biggest Mistake to Managing Personal Finance

The worst investment tend to happen in the month of February and March for saving tax and I realized I have been preaching the same on my blog.

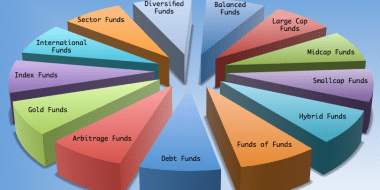

Mutual Funds Types – How to Really Diversify Investment Portfolio

Categorize the mutual funds and invest into as many category of mutual funds as possible to make mutual fund portfolio well diversified.

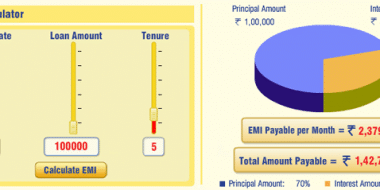

How to Choose the Right Investment Oppurtunities To Building Wealth

Answer to question – I can make X% in FD and am able to grab a loan at much lower interest rate. Should I Opt for it?

How to Be Your Own Financial Planner Book Review

This is review of the book I have just completed reading How to be Your Own Financial Planner in 10 Steps: Master Your Financial Life 2 by Manish Chauhan of JagoInvestor.

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- 6

- …

- 8

- Next Page »